Convequity Cybersecurity Taxonomy (Pt 2.2)

Summary

- In Part 2.2 we discuss the dynamics of the network security industry, which serves as a useful reference for public and private investors.

- We discuss why network security is slow-moving and favours the incumbents, and why some vendors get away with making exaggerated claims.

- We also discuss the emerging and future trends likely to dominate the innovation front.

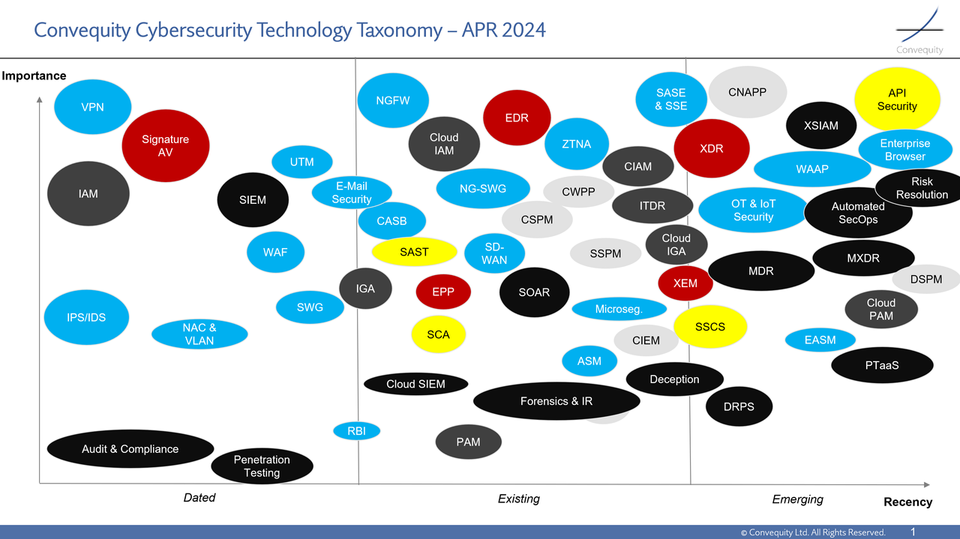

As a recap, Part 1 of the Convequity Cybersecurity Taxonomy provided an introduction to the broad trends of the industry. In Parts 2.X we are covering network security, aka NetSec. In Part 2.1 we discussed the key players and in Part 2.2 we're going to discuss the industry dynamics. In Parts 3.X, 4.X, and 5.X we'll be coming cloud security, SecOps, and identity.

Industry Dynamics

Scale & Operating Leverage

The NetSec industry favours the large players, and typically, the stronger players become even stronger due to their greater scale. In the on-prem, appliance-centric world, this means greater reach among VARs (Value Added Resellers), distributors, SIs (System Integrators), MSSPs (Managed Security Service Providers), service providers, and other channel partners. A larger player with a more substantial revenue and customer base will have significantly better economies of scale and can spread out its R&D and S&M costs more effectively than a smaller player can. This allows the larger player to lower end-user pricing while maintaining high operating margins. This dynamic is in sharp contrast to generic productivity SaaS, where a young startup with a few million dollars in venture capital funding can scale up fairly quickly within just a few quarters. For a startup to scale up in the NetSec space and reach escape velocity, it takes not months or quarters, but years. Even if the startup has great talent, vision, and execution, its Rule of 40 and overall economics won't look as attractive as established players before hitting the $1bn revenue mark.

Incumbency

In the past, primarily the customers of NetSec were dedicated NetSec teams. However, now these teams have mostly merged with the broader IT department responsible for a company's overall IT infrastructure, as NetSec has become an essential component within the networking infrastructure, rather than a nice-to-have. This type of customer is very cost-conscious, especially after the IT spending correction beginning in 2022. Most companies expect IT to keep their existing investments, particularly in hardware, running for 5-7 years or even longer, especially as the innovation cadence in this field has plateaued in recent years.

Furthermore, as NetSec is closely linked to networking infrastructure, no customer can accept a sudden networking failure, in which such risks rise when switching vendor. The consequences of such an event outweigh the additional performance or security benefits that a new vendor can provide. As new vendors often get started with SMB customers, large enterprises will only consider them after years of operation and proof of enterprise-grade quality.