Arm IPO - Tough Situations, Priced To Perfection (Pt.1)

Summary

- Under Softbank control, Arm's fundamentals deteriorated dramatically, it didn't catch the AI tailwind, and its growth prospects were hampered.

- RISC-V will cap growth but the risk is overhyped. Arm's position in the core mobile market and growing PC/server market is still solid.

- At ~ 20x EV/S without clear traction to either grow the topline, or improve operating efficiency, Arm is clearly not a buy.

- If Arm is able to improve operating efficiency while driving more organic growth, with a dramatically moderated valuation, there may be opportunities ahead, but that's not for now.

- This Arm series is a four part series that will be released over the next two weeks.

Note: for subscribers who would like a 1-to-1 call to discuss Arm, feel free to book a 30 minute call with us to discuss.

Arm returns to the public market as its parent company Softbank has a strong demand for liquidity. As such, we are not surprised to see that Arm pushed for the IPO with some illusive narratives and a premium valuation that provides a negative margin of safety. Here we will discuss our insights on Arm and defy claims such as:

- Arm is the winner of AI.

- Arm will be able to grow at 20%+.

- Arm will change the licensing model to extract more value from clients.

As the vendor who sits on top of the semiconductor industry, Arm also impacts various key players' strategies, which we will also dive into further in the report. Related topics and companies include: AAPL, QCOM, NVDA, AMZN, Samsung, MediaTek, Hisilicon (Huawei), RISC-V & Tenstorrent, INTC, AMD, TSM, Ampere, and GOOG.

Story

In a nutshell, Softbank entered the $32bn Arm privatization deal with a plan to increase spend for higher growth and subsequent value creation. The plan failed with declining profitability, weakened customer relationships, complex corporate structure, and capped long-term potential. But at least Softbank did manage to sustain Arm's single-digit revenue growth.

Softbank tried to swap this inferior asset with NVDA in 2020, in a deal that was apparently impossible to go through.

Coming into 2023, with worsening performance, LP (Limited Partner) pressure, troubles in portfolio companies, and rising interest rates, Softbank had to find exits for its portfolio companies, including Arm. Though, the timing to sell Arm has not been ideal as the semiconductor industry is in a downcycle. As such, Softbank needed to explore every possible way to boost Arm's growth, margins, and narrative in order to sell it at high valuations on the public market.

Hence, it is no wonder that Arm is priced too high and pushed to bubble territory, as we witnessed something similar in 2019 when Softbank aggressively pushed WeWork toward an IPO, but investor scrutiny over the office-space startup's finances forced the IPO to be scrapped.

Arm's future is moderately attractive given its core mobile industry growth already peaked in 2016, and is now on a gradual decline similar to the PC industry. At ~19x EV/S, Arm has a terrible risk-reward profile for investors, but if its valuation can adjust to a moderate level post-lockup, then there may be value opportunities ahead.

History

In the 1970s, INTC created the x86 processor, which had an ISA (Instruction Set Architecture) called CISC (Complex Instruction Set Computer), and was designed to contain many instructions for a wider range of use cases and workloads.

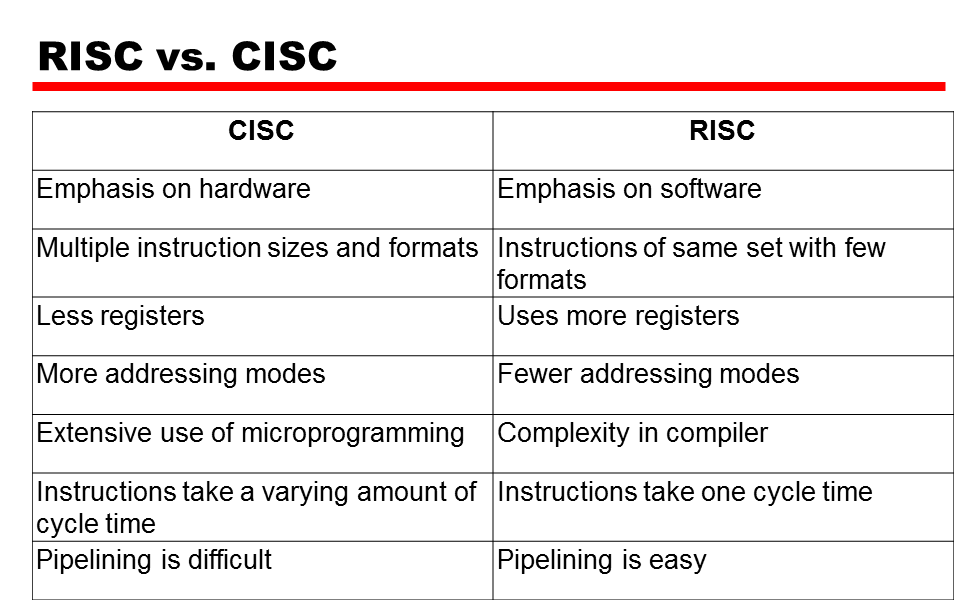

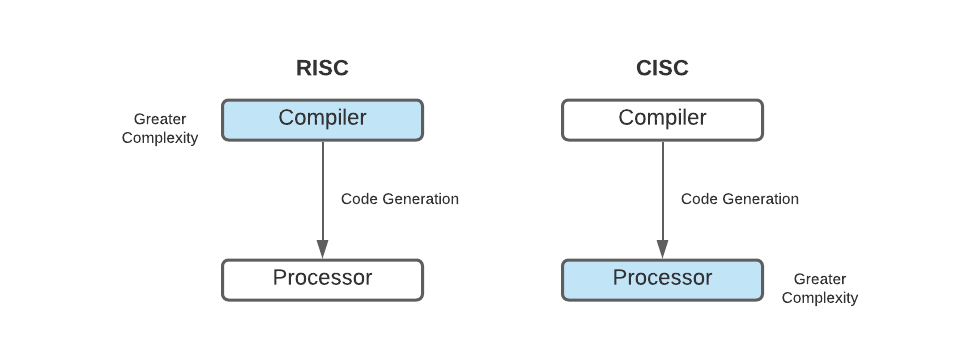

In 1980, David Patterson, a professor from UC Berkeley, found that in 80% of processing, only 20% of the instructions were being used. Hence, by reducing the number of instructions, you can make a processor that is more performant and power efficient than the incumbent x86 processor. From Patterson's insights emerged a new ISA called Reduced Instruction Set Computer, known as RISC, designed to be more performant and power efficient.

Arm was a joint venture founded in 1990 by Acorn Computers, Apple, and VLSI Technology, the semiconductor division spun out of Philips, to develop IP related to RISC. It created the Advanced RISC Machine (ARM being the acronym) ISA for Apple to meet its performance and power efficiency goals.

Difference between RISC and CISC

https://www.baeldung.com/cs/risc-vs-cisc

However, Arm didn't experience much commercial success throughout the 1990s and 2000s as the core PC market was already occupied by INTC's x86 32-bit ISA, and subsequently, by AMD's x86-64, the 64-bit extension designed by chip guru Jim Keller. It was impossible to push Arm or RISC processor to the PC market when all software applications are already created for x86. Moreover, the performance/cost gain was far off the 10x that the market generally wants if they are to endure the disruption and the high switching costs of moving to a newer architecture.

Furthermore, CISC processors do not remain stagnant either. With out-of-order execution and micro-operations and other features introduced, the difference between CISC and RISC becomes blurry, and in many ways, the modern x86 processors are not that far behind Arm in terms of power efficiency. The only caveat is that x86 maintains deep backward compatibility in that a new x86 process is still able to run applications developed four decades ago. This creates a problem because by being more backward compatible, the chip must contain a much higher number of instructions, many of which will be unused. As a consequence, the die area needs to be larger, leading to a lower IPC (# of Instructions Per Cycle) for those instructions that are actually needed. Furthermore, the larger chip creates more heat, so it is not power efficient. Technical debt ensues, making it even harder to achieve power efficiency; INTC is actively developing a new x86 that can get rid of this burden and unlock better PPAC (Performance, Power, Area, Cost) in the future.

Because of this, Arm was largely an auxiliary player, and it was mostly used in embedded systems like routers, controllers, and peripheral devices. These are devices that are more cost sensitive, slow-moving, and lower value-add compared to the PC.

Arm's explosive growth arrived in 2007, when Steve Jobs introduced the iPhone that ignited the parabolic growth of the mobile era, and smartphones replaced PCs as the most important personal compute platform. As we've mentioned, INTC & AMD's x86 wasn't far behind, but both companies' management vision was far behind. INTC's CEO outright rejected Steve Jobs' request for a specialized mobile phone chip. Meanwhile AMD was getting into trouble integrating ATI (the second biggest GPU vendor behind NVDA), and to salvage the M&A, AMD sold ATI's most growthy asset, the mobile GPU unit, to QCOM, who later renamed it Adreno.

As such, AAPL chose Arm-based ISA to build its processor, first designed and manufactured by Samsung, and later, in 2010, AAPL started to use its own custom-designed A4 chip. Arm's key differentiation here is that it is a clean ISA without backward compatibility concerns, and it is customizable for AAPL's unique mobile chip demand that requires ultra-low power consumption. It is also important to note that AAPL didn't use Arm for GPU because Arm didn't have a mature solution back then. So, AAPL used another UK IP licensing company, Imagination, for its PowerVR GPU to go in its mobile SoC (System-on-Chip). This partnership lasted until 2017 when AAPL started to use its own custom-designed GPU.

With the rise of the iPhone, GOOG pivoted its Android project from a mobile OS for keyboard phones to a mobile OS that supports touchscreen too. Early Android chipmakers, including QCOM, TXN, Samsung, MediaTek and NVDA, all chose Arm because none of them had great CPU knowhow. As a result, the entire mobile phone industry became completely reliant on Arm.

Then in 2011, INTC realized how big this market was going to be and quickly developed mobile x86 chips in partnership with MSFT's Windows Phone, with aggressive pricing strategies. However, it was way too late as the market had already standardized around Arm. Similar to the issue that Arm faced in the PC market, INTC found most applications were already built for Arm.