Convequity's Bi-Annual Review (Pt.2)

Summary

- Klaviyo is evolving into an AI-native engagement platform, with recent churn and margin pressure masking strong long-term enterprise momentum.

- GitLab is delivering quiet leverage through agentic AI and enterprise expansion, though concerns around pricing model and platform depth persist.

- Meta is building full-stack AI infrastructure, but must close its model and silicon gap to fully realize its next-gen computing ambitions.

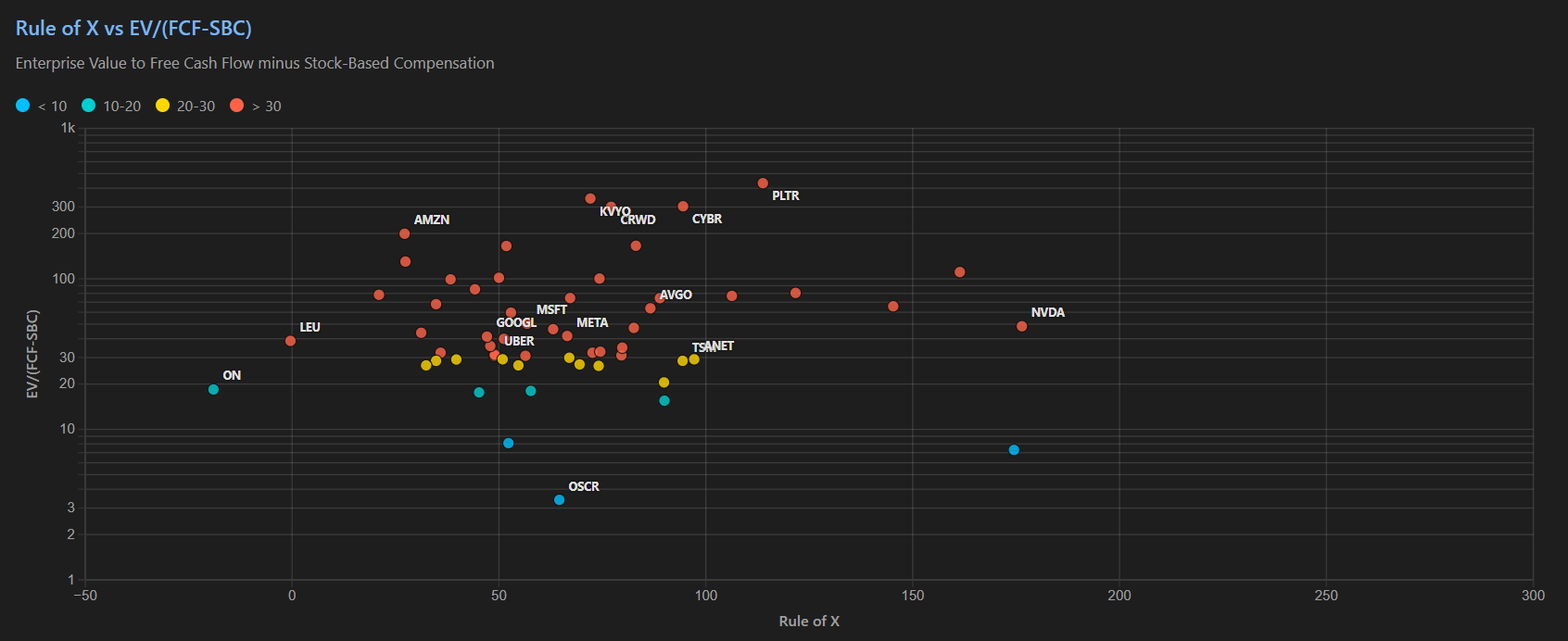

Valuation Overview

The table below is designed to highlight stocks with strong financial performance yet low valuation multiples, sorted by their Rule of X (inc. SBC) as a key indicator of financial health. We’ve percentile-ranked these stocks based on their Rule of X (inc. SBC) and paired this with their valuation percentiles to identify "low-hanging fruit" — stocks with a high Rule of X but undervalued multiples. Note that stocks with a negative EV/(FCF-SBC) have been assigned a multiple of 10,000, resulting in an "NA" percentile rank for valuation.

Open the Google sheets link to see the updated valuations for Klaviyo (KVYO), GitLab (GTLB), and Meta (META), along with the updated DCF valuations of FTNT, S, and PANW from Part 1.

Klaviyo (KVYO)

The Long-Term Playbook: Build the Unified Engagement Stack

At its core, KVYO is building a vertically integrated platform for e-commerce CRM, with its Customer Data Platform (CDP) as the foundation. This unified data layer allows merchants to precisely segment customers, build rich automation flows, and drive measurable revenue with minimal effort. It’s why KVYO’s workflows feel more like MNDY’s intuitive drag-and-drop templates — but with far more direct topline impact.

With recent expansions into SMS and mobile app push, Klaviyo is no longer just a marketing tool; it’s becoming the central nervous system for commerce-focused customer engagement. Moreover, it is becoming the vertical CRM database that is challenging HubSpot with greater flexibility, and even competing with Snowflake to a degree for ecommerce SMB and enterprises, offering better ecommerce-specific use cases.

Importantly, KVYO has moved away from relying solely on Twilio (TWLO) for SMS delivery. Its multi-carrier setup now includes providers like Sinch and Infobip, giving it better control over margins, deliverability, and performance — making SMS a true product moat, not just a channel add-on.

Why the Stock Is Down — And Why We Think It’s Overdone

1. Pricing Changes and Churn Concerns

Much of the recent selloff stems from KVYO enforcing compliance with profile-based pricing — that is, ensuring customers pay based on how many active customer profiles they store. Some customers who had been underpaying will now see price increases (capped at 25%), which management expects to drive some churn.

But alongside this, KVYO introduced auto-downgrade: if a customer’s profile count drops, their plan automatically adjusts downward. This removes friction and makes pricing fairer — ensuring customers don’t overpay when demand fluctuates.

Yes, these changes might cause short-term revenue softness. But we see it as the right long-term move:

- It builds trust with customers.

- It aligns pricing with actual value usage.

- It prevents future disputes or overcharges.

- It creates long-term loyalty and retention upside.

The near-term revenue hit is modest, and we view the churn impact as more of a pricing hygiene reset than a signal of weakening demand. Actually, this reminds us of Amazon's approach, where in the past it has made pricing changes that hurt the company in the near-term but fostered greater long-term loyalty among its customer base. So, on the whole we think it's a good move by KVYO.

2. Employee Bonus Accounting Adjustment

Historically, KVYO recognized its full-year employee bonus expense in Q4. Starting in FY25, it will spread this expense across quarters. This will depress non-GAAP operating margin by mid-single digits in Q1–Q3 YoY, making comps look worse — even though there’s no real change in underlying expenses. SBC remains unaffected.

Q4 margins, conversely, will benefit YoY. This is purely an accounting shift, not a change in business quality.

3. Infrastructure Investment and Gross Margin Pressure

KVYO plans to invest more heavily in infrastructure to support larger customers and continued SMS expansion. Management expects Q1 gross margins to dip below FY24’s 77% due to these investments and seasonal load from the holidays.

But this is deliberate spend:

- To scale with the rising number of $50k+ ARR customers (up 46% YoY).

- To ensure quality of service and deliverability during peak events.

- To optimize SMS over time into a higher-margin channel.

Again, short-term compression for long-term strength.

4. Q1 Free Cash Flow Going Negative

The CFO flagged a seasonal reset of payroll taxes and employee bonus timing, which will push Q1 free cash flow into negative territory. This is a stark change from recent 15–20% FCF margins, and likely spooked investors. But we see it as seasonal and non-structural. Full-year FCF remains healthy.

5. Guidance Disappointment

KVYO guided to 23–24% revenue growth in FY25 (vs. 34% in FY24), with Q1 at 27% YoY. They also plan to increase S&M spend as a % of revenue to support go-to-market. This, combined with margin compression and accounting noise, created a perfect storm for the stock.

But these are measured investments, not signs of weakness.

Business Momentum Remains Strong

Despite the market reaction, KVYO is executing where it matters:

- $937m in FY24 revenue, up 34% YoY

- 12% non-GAAP operating margin and $160m in FCF, resulting in a 17% FCF margin.

- 167k customers, up 17% YoY

- 2,850 customers with >$50k in ARR, up 46%

- SMS attach rate now at 26% across SMB and mid-market

- EMEA revenue growth accelerating to 49% YoY

- Strong net new ARR of $140m, up 36% YoY.

- Annualized QoQ growth at 59.7% (but strong Q4 could make Q1 another seasonally weak quarter)

https://poe.com/preview/CmrWRFIsHnn0zo8YX9Og

More importantly, Klaviyo is positioning itself for the AI future. Its API-first architecture, deep customer data layer, and predictive ML models (like DLRMs for next-best-action) make it well suited to evolve into an agentic AI platform — one where flows build themselves and customer journeys are optimized autonomously. Like MNDY, it has launched copilot features; unlike MNDY, it has the data and infrastructure to personalize those experiences in real-time.

One concern is the weak DBNRR, of only 108%, and presumably this might dip lower in the coming quarters due to the price changes that will lead to both to a decline in revenue (for customers currently overpaying) and additional churn (for a portion of customers currently underpaying). We surmise this low DBNRR is due to KVYO being narrowly focused on marketing automation. However, as KVYO grows business in the adjacent products it has recently brought to market (Klaviyo Service & Klaviyo Analytics), DBNRR should rise.

Valuation: Structural Upside, Transient Noise

The market’s current reaction to KVYO reflects discomfort with accounting shifts, gross margin dips, and short-term revenue optics — not business fundamentals. We believe the stock’s selloff is a mispricing driven by backward-looking analysis.

KVYO is doing what great companies do: optimizing for long-term trust, value, and scalability, even if it means short-term pain. The profile pricing enforcement and auto-downgrade features enhance customer alignment. Infrastructure investments support future enterprise scale. And the foundation for AI-led automation is already in place.

We view this moment as an alpha opportunity for long-term investors. By manipulating the DCF valuation so that the intrinsic value per share equals the current share price, after the expectation of low-20s growth for FY25 and FY26, it seems the market is forecasting KVYO's growth will decline to low-teens. If this is what the market is expecting, then we see considerable upside surprise potential. It is very possible that investors view KVYO as an ecommerce-related vendor that will hit a growth plateau once the company approaches $1.5-3bn in revenue, similar to companies like Twilio, Wix, and Zendesk. This outcome is more likely should KVYO not be successful in greater expansion into the enterprise segment.

Our prediction is that, given the momentum in $50k accounts and the insight that the average spend from KVYO's top 10 customers is $1.5m, KVYO will be successful in its enterprise transition. Although for the larger, already established brands, they may not be willing to pay KVYO's gross margin and opt for alternative cheaper, DIY solutions where they can leverage their internal teams of developers.

In the near term, macro aside, it is unclear which way the stock will move. 1Q25 will be critical to monitor due to weak seasonal growth and margin compression. Though, at the same time, this feels largely priced in. So, for longer term investors, the key quarters will be 2Q25 onwards to better understand KVYO's positioning after the price changes have settled and its new products have had chance to boost DBNRR.