Convequity's Valuation Update - Mid-Year Review 2024

Summary

- This is a mid-year valuation review covering cybersecurity, data, productivity, semiconductors, cloud, ecommerce, and consumer tech.

- Included is a DCF valuation spreadsheet consisting of 15 updated valuations.

- We also provide notes on the recent ERs and high-level commentary on 10 specific stocks from these valuations.

Overview

As our valued subscriber, you're familiar with our core research focus on cybersecurity, data, and productivity, along with our coverage of cloud and semiconductor sectors. Recently, our work with an institutional client has expanded our knowledge to various e-commerce and consumer tech companies. In light of this, we've decided to broaden the scope of our mid-year valuation review. This report will not only analyze our primary sectors but also incorporate these additional tech areas, offering you a more comprehensive view of relative value across the broader technology landscape.

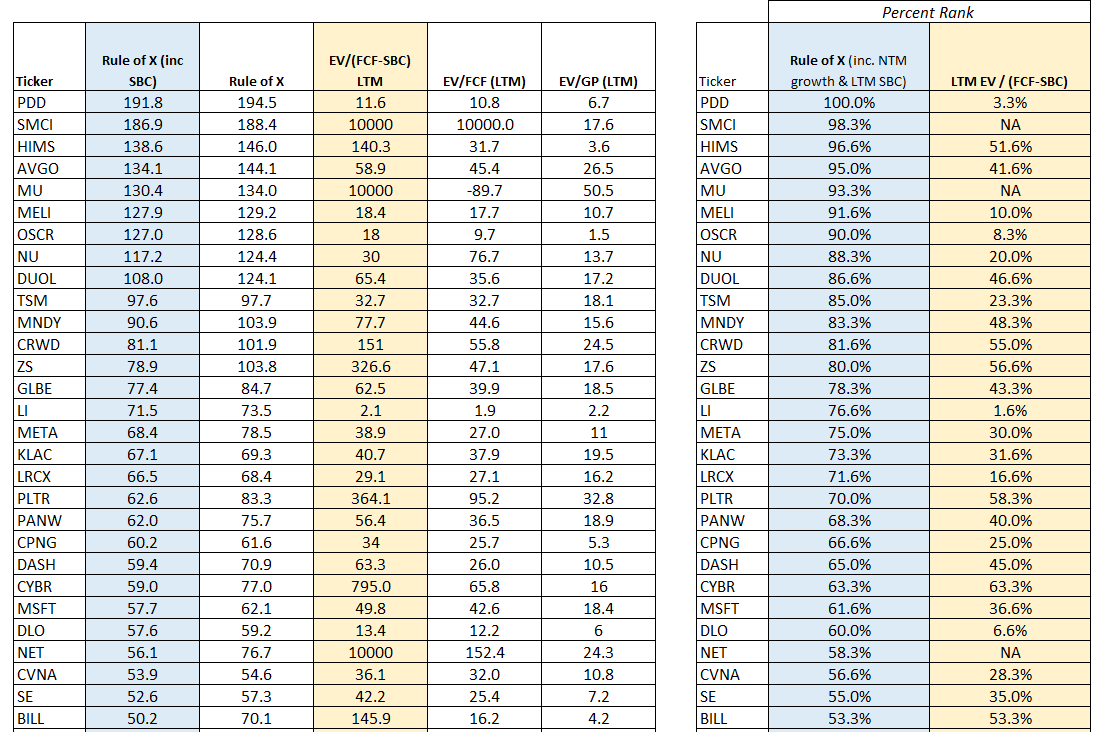

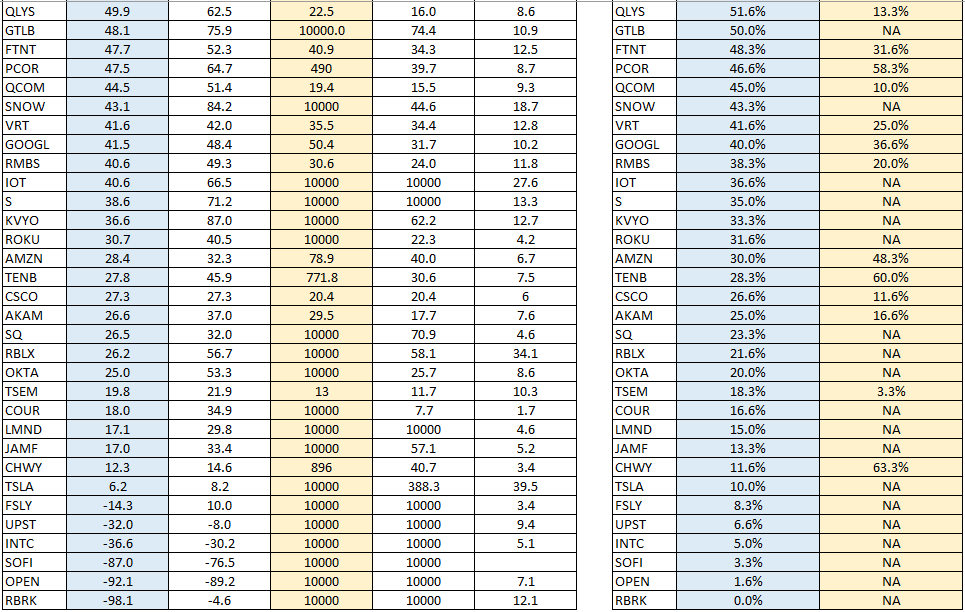

The two tables below present 61 stocks spanning cybersecurity, data, productivity, e-commerce, and consumer tech sectors. In the left table, stocks are sorted in descending order by the Rule of X (including SBC). As detailed in our previous valuation review, Bessemer Ventures introduced the Rule of X based on their observation that stock returns correlate more strongly with growth than FCF margin. Consequently, they modified the Rule of 40 by applying a growth multiplier. Their analysis found a median multiplier of 2.3 for public stocks, which we've adopted in our Rule of X calculations. Given the significant impact of stock-based compensation (SBC) on tech valuations — a factor we consistently include in our DCF models — we've further refined the Rule of X to incorporate this crucial parameter. The resulting Convequity-version of the Rule of X is as follows: Rule of X (inc. SBC) = (NTM growth * 2.3) + LTM FCF margin - LTM SBC

As you can see, in the left-hand table, we have included the Rule of X excluding SBC. We have also presented three multiples: EV/(FCF-SBC) which corresponds with the Rule of X (inc. SBC); EV/FCF which corresponds with Rule of X (exc. SBC); and EV/GP which does not correspond directly with a financial metric. The stocks with FCF multiples of 10,000 have negative multiples, meaning FCF-SBC or FCF is a negative number.

To make this relative valuation exercise more intuitive, on the right table we have percentile ranked the stocks in accordance to their Rule of X (inc. SBC). For example, Pinduoduo (PDD) has the highest Rule of X (inc. SBC) of 191.8, and therefore they have the highest percentile rank of 100%. In the second column of the right-hand table, we have put the stock's EV/(FCF-SBC) multiple percentile ranking. Stocks with a negative, or a 10,000 FCF-SBC multiple, do not have a ranking (as indicated by NA) but they are included for the ranking of the positive FCF-SBC stocks.

The idea is to quickly see some low hanging fruits by identifying stocks with high Rule of X (inc. SBC) and a low multiple. Many of the e-commerce and consumer tech stocks, such as PDD, OSCR (Oscar Health - founded by Palantir co-founder, Joe Lonsdale), MELI (Mercado Libre), LI (Li Auto), and DLO (DLocal), are some of these low hanging fruits. Compared to the enterprise software names we mostly cover, these stocks are in disfavor among investors generally because of their lower gross margins, or being non-US and/or Chinese, or being in the more volatile consumer facing businesses, or potentially for all of these factors.

Several enterprise software (i.e., cybersecurity, data, productivity, and adjacent sectors) stocks are generating a relatively high Rule of X but do not have relatively low FCF-SBC multiples. Though, if we focus solely within this sector for a moment, MNDY (monday.com | Your go-to work platform), CRWD (CrowdStrike), MSFT (Microsoft), and PANW (Palo Alto Networks) look more attractive than others in enterprise software. Looking further afield, within that top half of the percentile ranking, META (Meta Platforms), KLAC (KLA Corporation), and LRCX (Lam Research) are fairly attractive, boasting high Rule of X and low multiples.

However, investing is not always about identifying the low hanging fruit stocks that already have impressive financials. Often it is about finding stocks you expect will deliver a rate of change in financial performance, thus delivering a good Rule of X in the future. For us, stocks that fall into this category are the likes of GTLB (GitLab), S (SentinelOne), and JAMF (Jamf Holdings) - each of which we have extensive research available with your Premium subscription; just search with the ticker.

Below we present further valuation analysis, again led by the Rule of X. The stocks here are sorted in descending order by Rule of X, and we have incorporated a color scheme to categorize the level of Rule of X. Along with the FCF-SBC and GP multiples, we have added the stock's DCF valuation discount, 1-month, 3-month, and 6-month price changes, and the implied change in volatilities (implied vol has been obtained from the stocks' associated options), each of which has also been color formatted.

Ultimately, the DCF valuation is the most important form of valuation analysis, as it is the most forward-looking. In addition to the aforementioned e-commerce and consumer tech stocks, HIMS (Hims & Hers) and CPNG (Coupang, a South Korean ecommerce retailer) are two standout names with a high Rule of X combined with a deep DCF valuation discount. PCOR (Procore Technologies) and FSLY (Fastly) are two names here that have a poor Rule of X but a deep DCF valuation discount, implying that we believe their financial performance will improve substantially over time, attributed to them being leaders in their fields - construction technology and edge compute, respectively. These stocks have also had notable drawdowns combined with a drop in future volatility, as implied by their respective options, which supports a contrarian type of investment strategy.

We shall let you scrutinize the above table for yourself, and send us a comment at the end of this review or email us at service@convequity if you have any questions about this analysis or any specific stock.

The following link shows the DCF valuations for PANW, FTNT, NET, S, MNDY, JAMF, PLTR, SNOW, CFLT, KLAC, LRCX, QCOM, GTLB, META, and AVGO.