Updates: FTNT 3Q23 - Is The Panic Justified?

Summary

- The slowdown continues but FTNT still outperforms industry peers. We don't see FTNT's competitiveness in decline, and expect the company to gain further market share over the long-term.

- After the expectation reset, FTNT's risk-reward looks way more favourable. Most of the downside seems priced-in, but we don't know when the company will reaccelerate growth again.

- In this update we revisit FTNT's prospects in SASE, and cover its architectural competitive advantages.

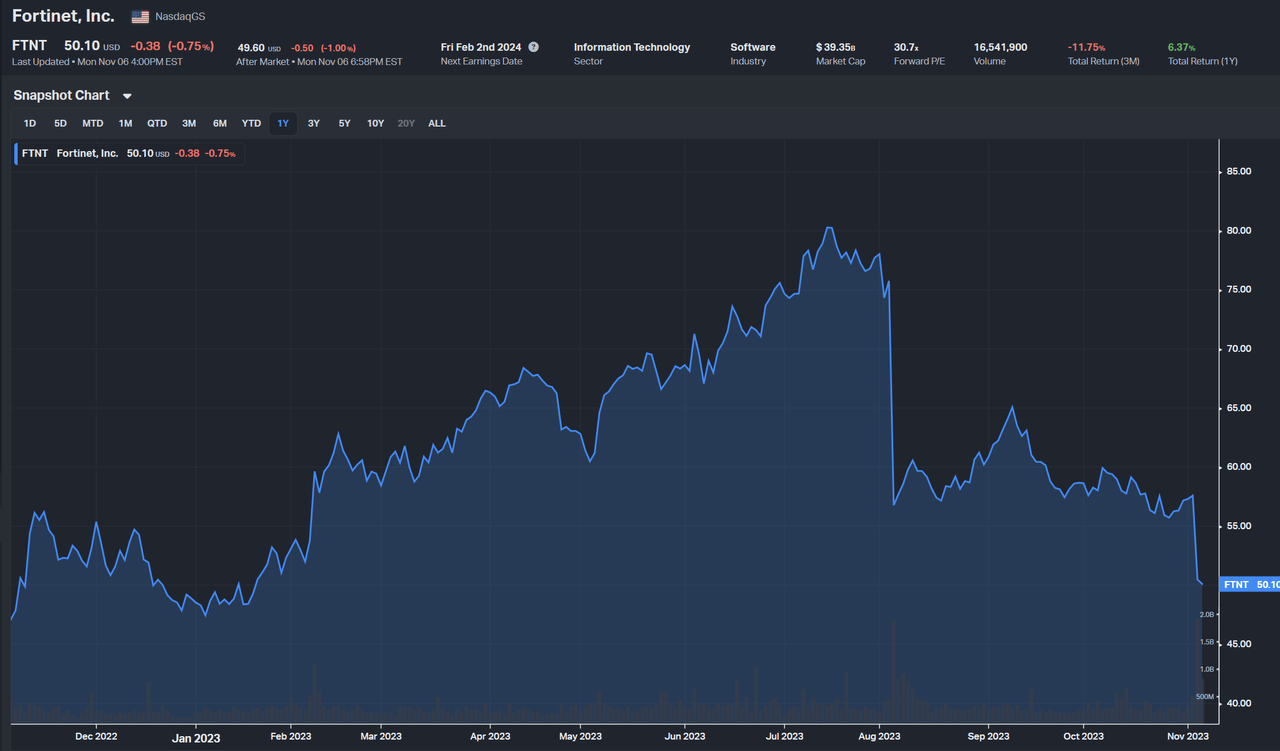

Price Action

FTNT continues to slide down further, wiping out most of the gains YTD. It is crucial to remind investors here that most of the gains earlier this year were driven by buoyant market sentiment and surprisingly positive momentum from the 1Q23 ER that turned all investors bullish. Most analysts without long-term fundamental analysis tend to rely on short-term results to justify the thesis. When they see great results, they congratulate the management, believe the company is working well, and thus upwardly adjust forward revenue and FCF and influence the stock into a rapid bull trend. When the results miss expectations, analysts quickly change their stance, and start to question everything about the company. They adjust their models to include a sudden decline in revenue growth that never reaccelerates, pushing down the valuation dramatically.

So, has anything really changed? Not so much with respect to FTNT fundamentals, but market expectations have altered a lot. Previously, the market expectation was a straight line consensus optimism, which is usually a bad place for investors to be as the margin of safety and risk-reward is unfavourable. Even if the company executes well, the upside surprise is low. But if the company has a misstep, the downside surprise is huge as those who chase the upswing will be quick to sell also.