Updates: FTNT 2Q23 - More Attractive With Private SASE And SD-WAN Story

Summary

- FTNT appears more attractively valued after a substantial expectation reset following its latest earnings release.

- Short-term headwinds persist for the next four quarters due to higher comparables, supply-demand imbalances, and normal seasonality.

- FTNT's long-term growth areas, including SASE, SD-WAN, OT, and non-FortiGate products, strengthen its competitive positioning.

After a substantial expectation reset following its latest earnings release, Fortinet (FTNT) now appears more attractively valued compared to historical norms. However, near-term headwinds likely persist for at least the next four quarters due to tougher YoY growth comparisons, moderating imbalances between supply and demand, and normal seasonality effects coming back into play in the cybersecurity hardware industry.

While macroeconomic challenges have impacted the near-term outlook, FTNT's long-term growth thesis and competitive positioning appear to have strengthened, not weakened, according to our detailed analysis. FTNT is gaining share in several fast-growing markets including SASE, SD-WAN, OT security, and non-FortiGate products outside its core hardware firewall business. These segments continue to represent massive expansion opportunities over the next five years as enterprises modernize their network and security architectures.

Impression on Recent Price Action

The most successful tactical allocation strategy for tech stocks in 2023 has been to bet on momentum reversals each earnings season. Companies that reported disappointing quarters typically experienced expectations reset almost immediately with steep sell-offs, making it easier to deliver an upside surprise the next quarter, even if absolute results remained weak. On the flip side, companies that posted standout "beat and raise" quarters often witnessed expectations elevate to unsustainable levels, making it hard to satisfy the inflated growth assumptions in the next quarter.

This dynamic illustrates the market's current anxiety and lack of sophistication when it comes to fundamental-based analysis of tech stocks. Securities have been whipsawed based on an excessive investor focus on (often narrow) guidance beats/misses , while long-term positioning and growth prospects receive scarce attention.

For instance, Fortinet was irrationally punished even more than Cloudflare (NET) following Microsoft's announcement of its first network security product suite. This makes little sense given Fortinet's relatively limited exposure compared to Cloudflare, and its more differentiated, loyal customer base versus other rivals like Palo Alto Networks (PANW) thanks their impressive TCO (Total Cost of Ownership). The market failed to comprehend FTNT's competitive standing and product strategy compared to others in the space. Stocks today are predominantly driven by algorithms scanning for superficial insights rather than thoughtful forecasts.

Such inefficiencies were evident across previous NET and Snowflake (SNOW) earnings reactions over the past year as sentiment flipped drastically between quarters. FTNT proved no exception to this pattern - after being overlooked as a "legacy" vendor, investors uniformly flipped to praise every aspect of its business once growth and margins expanded. We grow cautious when sentiment skews too positively, given the inherent downside risks.

The sheer magnitude of FTNT's post-earnings gap down can be justified given the rosy expectations set by its significant beat-and-raise last quarter. Analysts extrapolated the upside surprise into future estimates, so the guidance cut this quarter represented an exaggerated expectation delta. This once again shows cybersecurity is not immune to macro uncertainty, and some cyclicality persists despite secular tailwinds.

With the stock declining approximately 25% intraday and surrendering all of its year-to-date gains, Fortinet's valuation now appears reasonably priced relative to historical levels. However, it is unclear whether the negativity is fully reflected, given Fortinet could potentially return to high-teens growth by 4Q23. We will delve deeper into the valuation and discounted cash flow analysis later in the report.

2Q23 Results

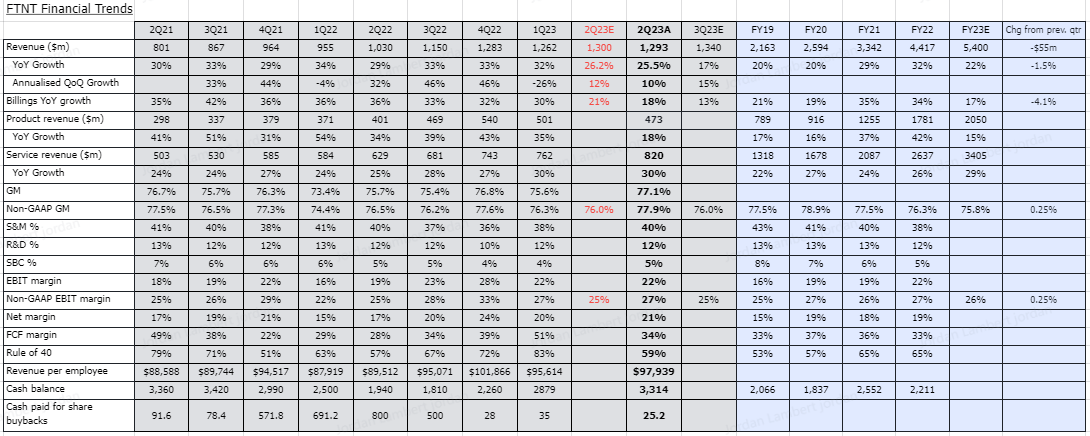

- Revenue of $1.29bn (+25.2% YoY) misses by $10m.

- Total billings were $1.54bn for the second quarter of 2023, an increase of 18.1% compared to $1.30bn for the same quarter of 2022.

- Added 6500 new logos in SMB

- Total deferred revenue was $5.13bn, an increase of 30.4% compared to $3.93bn for the same quarter in 2022.

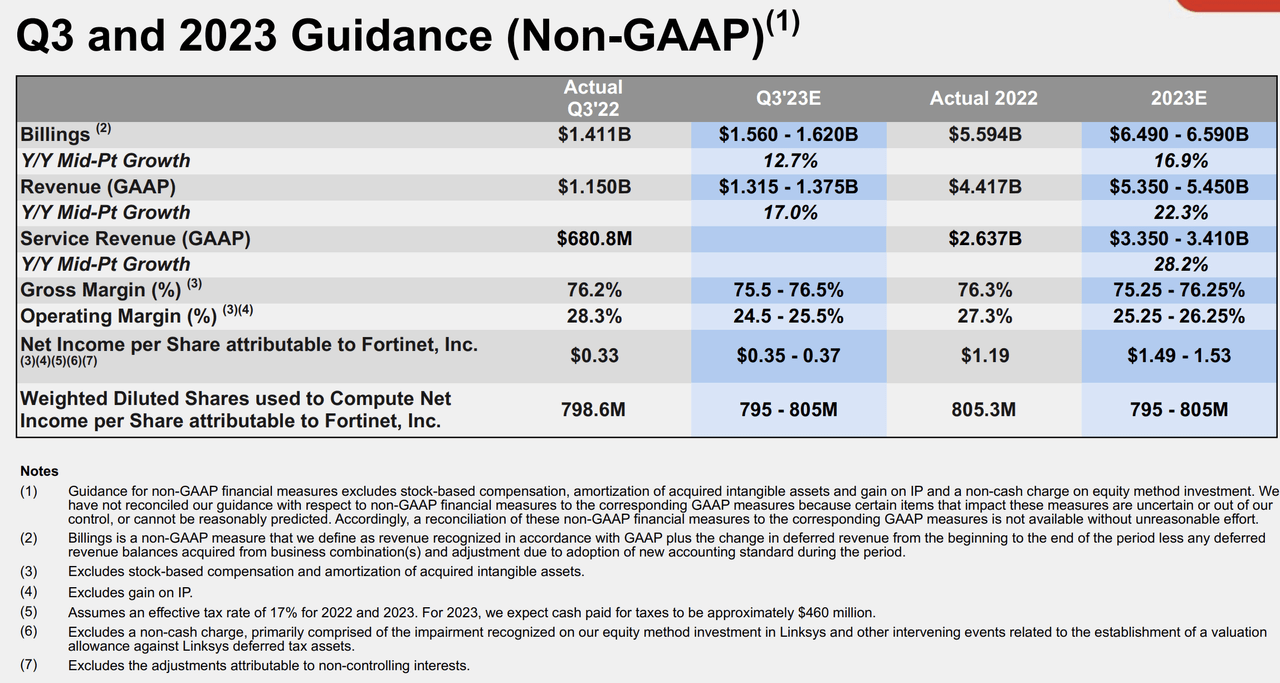

3Q23 guidance:

- Revenue in the range of $1.315 billion to $1.375 billion

- Billings in the range of $1.560 billion to $1.620 billion

- Non-GAAP gross margin in the range of 75.5% to 76.5%

- Non-GAAP operating margin in the range of 24.5% to 25.5%

- Diluted non-GAAP net income per share attributable to Fortinet, Inc. in the range of $0.35 to $0.37, assuming a non-GAAP effective tax rate of 17%. This assumes a diluted share count of 795 million to 805 million.

FY23 guidance:

- Revenue in the range of $5.350 billion to $5.450 billion

- Service revenue in the range of $3.350 billion to $3.410 billion

- Billings in the range of $6.490 billion to $6.590 billion

- Non-GAAP gross margin in the range of 75.25% to 76.25%

- Non-GAAP operating margin in the range of 25.25% to 26.25%

- Diluted non-GAAP net income per share attributable to Fortinet, Inc. in the range of $1.49 to $1.53, assuming a non-GAAP effective tax rate of 17%. This assumes a diluted share count of 795 million to 805 million.

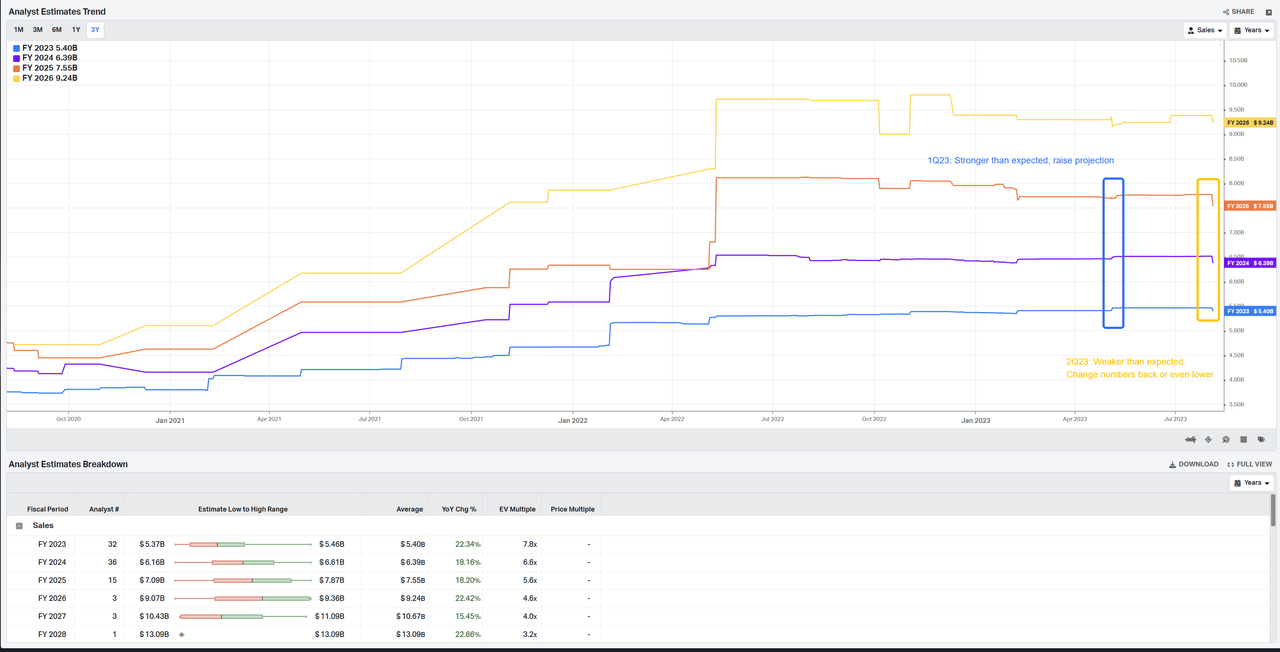

For the full year, FTNT now expects sales to fall within the range of $5.35bn to $5.45bn, down from a prior view of $5.43bn to $5.49bn. At the mid-point, that is a decline of $55m.

Management also expects billings to be between $6.49bn and $6.59bn, which, at the mid-point, is 4.1% lower than the previous guidance given in the 1Q23 ER.

For a better view of the following table click the link.

Generally, it seems as though the ~25% gap down is attributed to the combination of the $7m revenue miss, which equates to a 0.7% revenue growth miss, and the sharpish decline in YoY revenue growth expected for 3Q23 of just 17%. Either of these on their own might not have triggered the gap down, but together they have spooked those investors who had hyped FTNT too much since the last quarter. That being said, a 15% QoQ growth guidance for the next quarter is still healthy and better than most cybersecurity stocks, even those at a much lower revenue base. It is also likely that the billings miss, equating to a 3% growth miss, has played a significant part in investor disappointment, along with the fall to just 13% YoY billings growth for the next quarter.

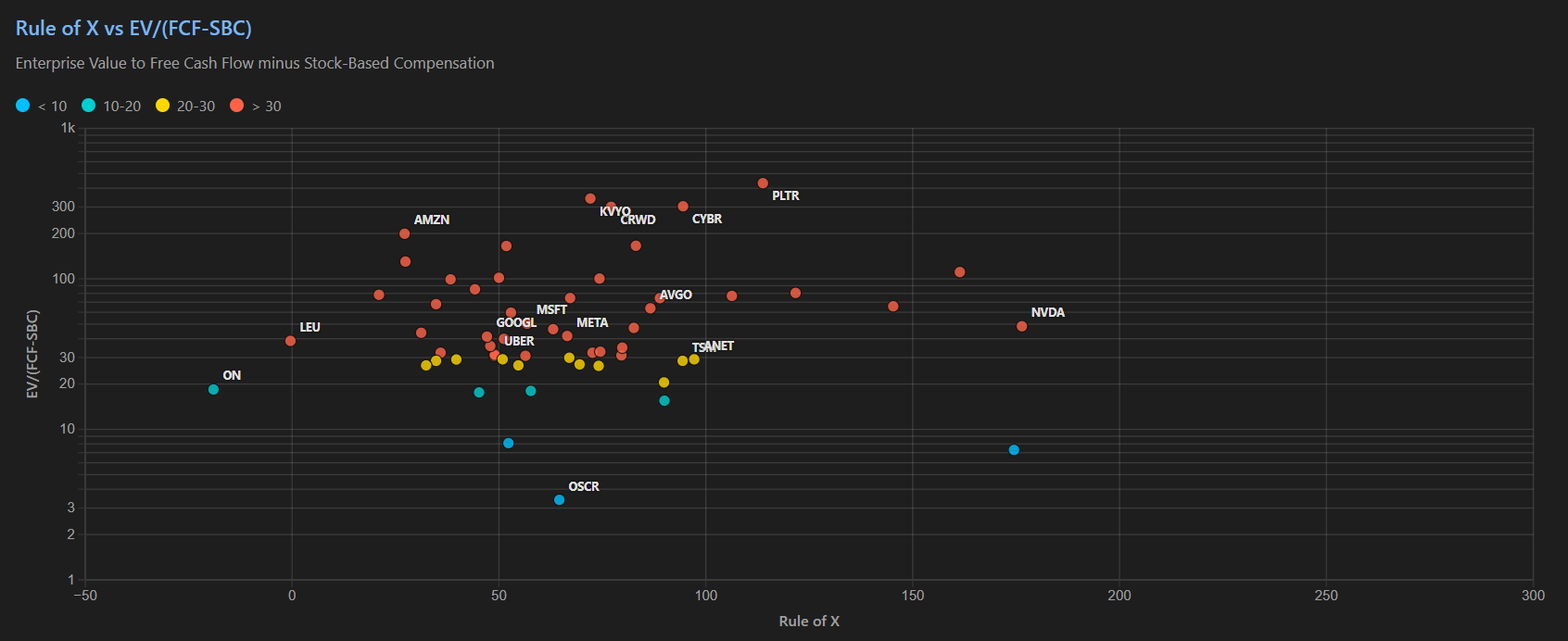

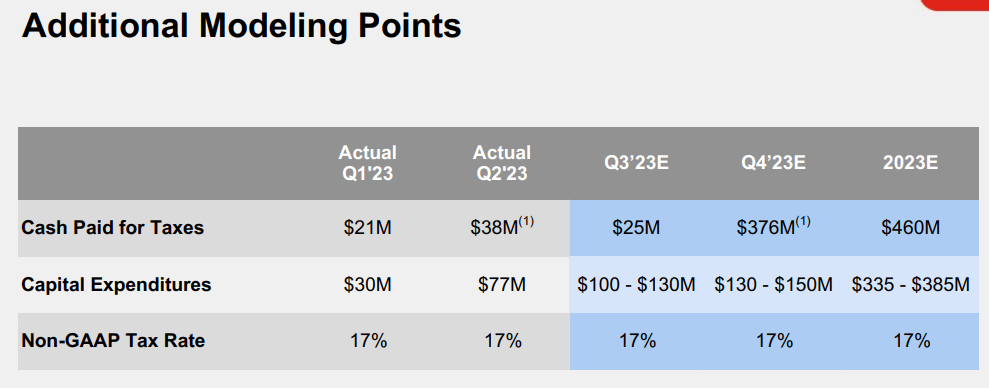

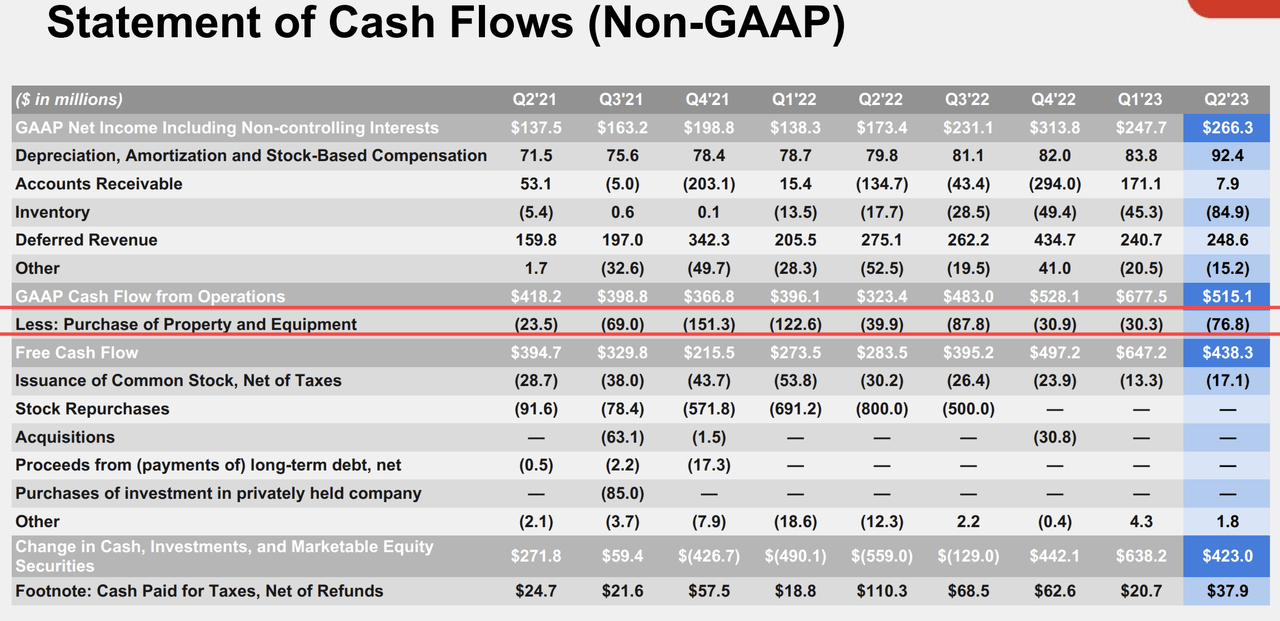

FTNT's GAAP and non-GAAP gross margin have bumped ~150 bps, presumably thanks to the ongoing momentum in the Fabric platform sales. S&M % remains high, on par with PANW's, but the R&D % remains very low thanks to FTNT's talent sourcing in cheaper locations such as Canada and India - this continues to be a notable source of its high FCFs. Given the drop in YoY growth to 17% for 3Q23, it will be interesting to observe the Rule of 40 in the next quarter. FTNT needs to maintain its S&M % in the near-term and the capex % guidance for 3Q23 is 8.6% (or $115m at the mid-point), which is 200-300 bps higher than normal (not shown in the above table). Hence, it's possible FTNT's consistently elite Rule of 40 may come down; however, even if it dropped to ~50%, it would still be better than the high majority of public cybersecurity rivals.

Similar to last quarter, the most surprising aspect of FTNT's latest earnings report was not the modest revenue miss itself, but the substantial reduction in full-year guidance for 2023. Specifically, management lowered total revenue outlook to a range of $5.35bn-$5.45bn, compared to the previous view of $5.43bn-$5.49bn. Billings projections for the year were also reduced to $6.49bn-$6.59bn, reflecting moderating growth expectations.

On the earnings call, management specifically guided to high-teen percentage billing growth in both 4Q23 and extending into 2024. This meaningful guidance cut follows the significant beat-and-raise results in the prior quarter, demonstrating the volatility and difficulty of forecasting growth amidst the current macroeconomic uncertainty.

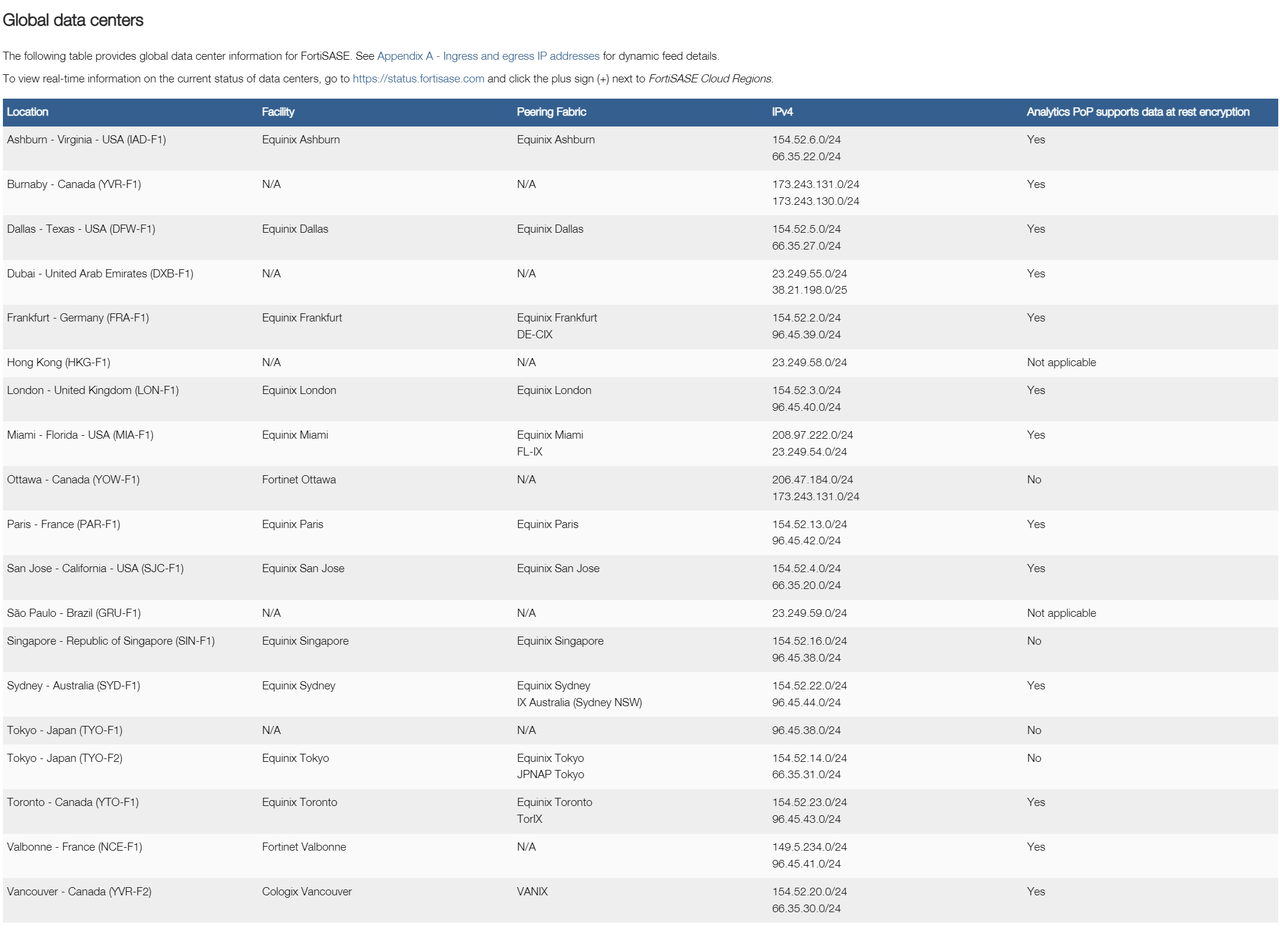

Some investors have also expressed dissatisfaction regarding the heightened capex budget approaching $350m. FTNT is investing heavily in expanding its own data centre infrastructure and cloud service capabilities, taking a "full stack" approach rather than renting third-party colocation space like ZS and NET. While requiring substantial upfront engineering efforts, building in-house should enable FTNT to offer highly cost-efficient security and networking-as-a-service (or NaaS) over the long run, especially for telco partners.

When analyzing the drivers behind FTNT's reduced outlook, product revenue weakness appears to be the key factor, as supply conditions normalize and customers temper purchasing after pandemic-fueled overbuying. However, service revenue has remained quite healthy, indicating a sustained solid demand for software and subscription offerings like FortiSASE, cloud-based security, threat intelligence, etc. These services aren't exposed to the same supply/demand fluctuations as hardware.

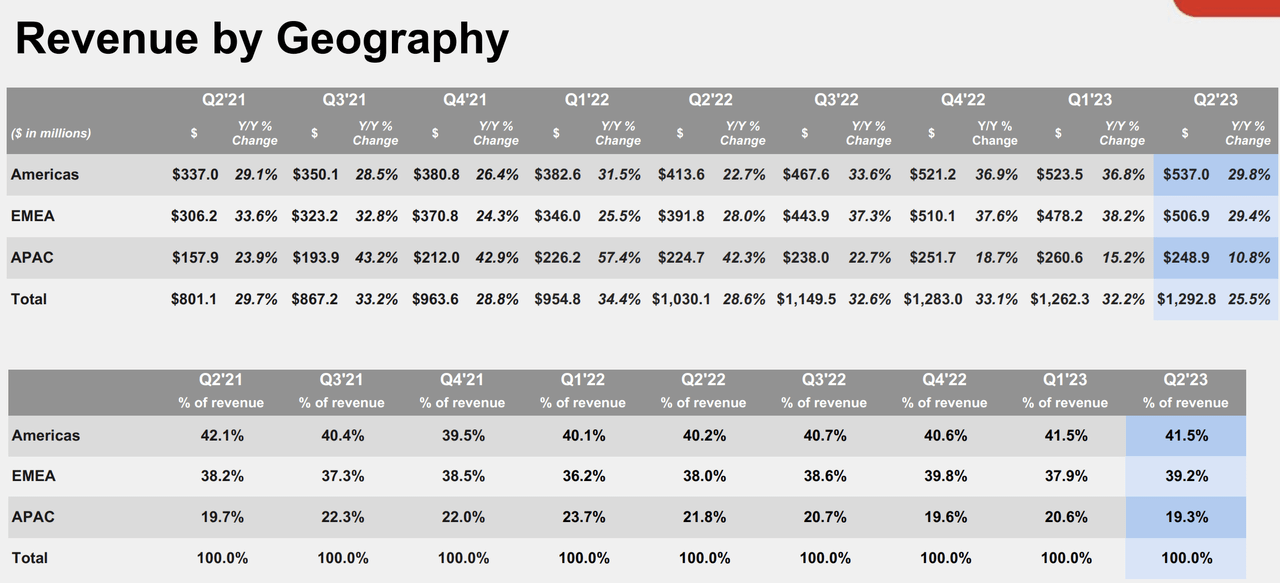

Geographically, FTNT saw considerable slowing in both the APAC and EMEA regions, similar to trends noted by other software vendors reporting this season. However, NET called out continued strength in EMEA driven by geopolitical security demand. It will be important to monitor whether this demand continues going forward or whether it shows contraction later on comparable to FTNT's trends.

In contrast, FTNT's U.S. large enterprise customer segment outperformed, given higher international and SMB exposure. Macro uncertainties appear to be expanding beyond tech into verticals like energy, retail, and finance, which represent a substantial portion of FTNT's customer landscape.

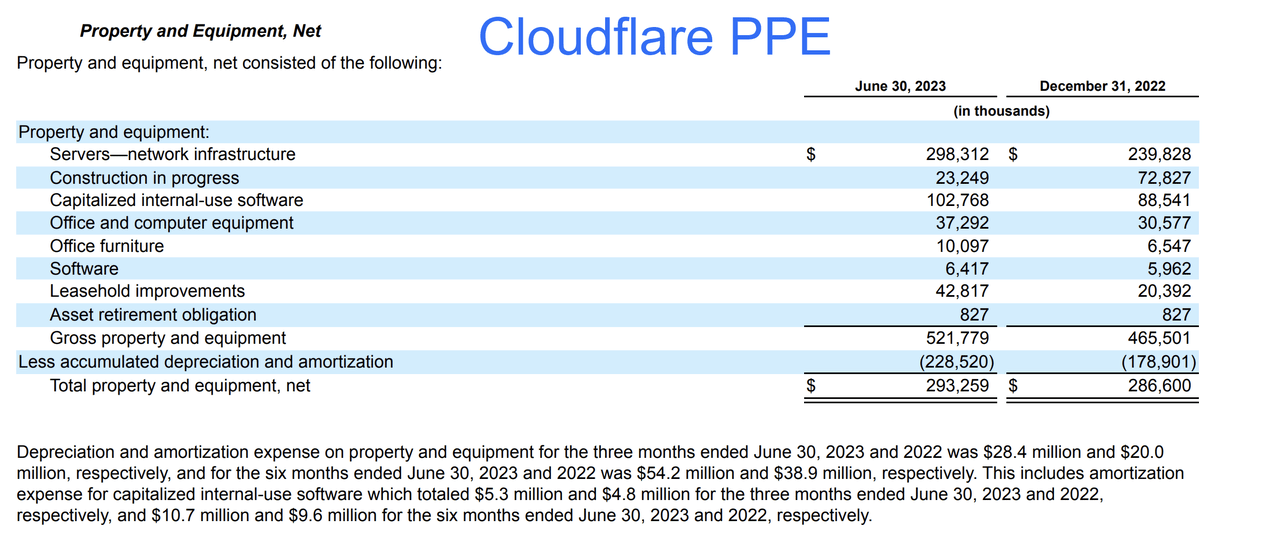

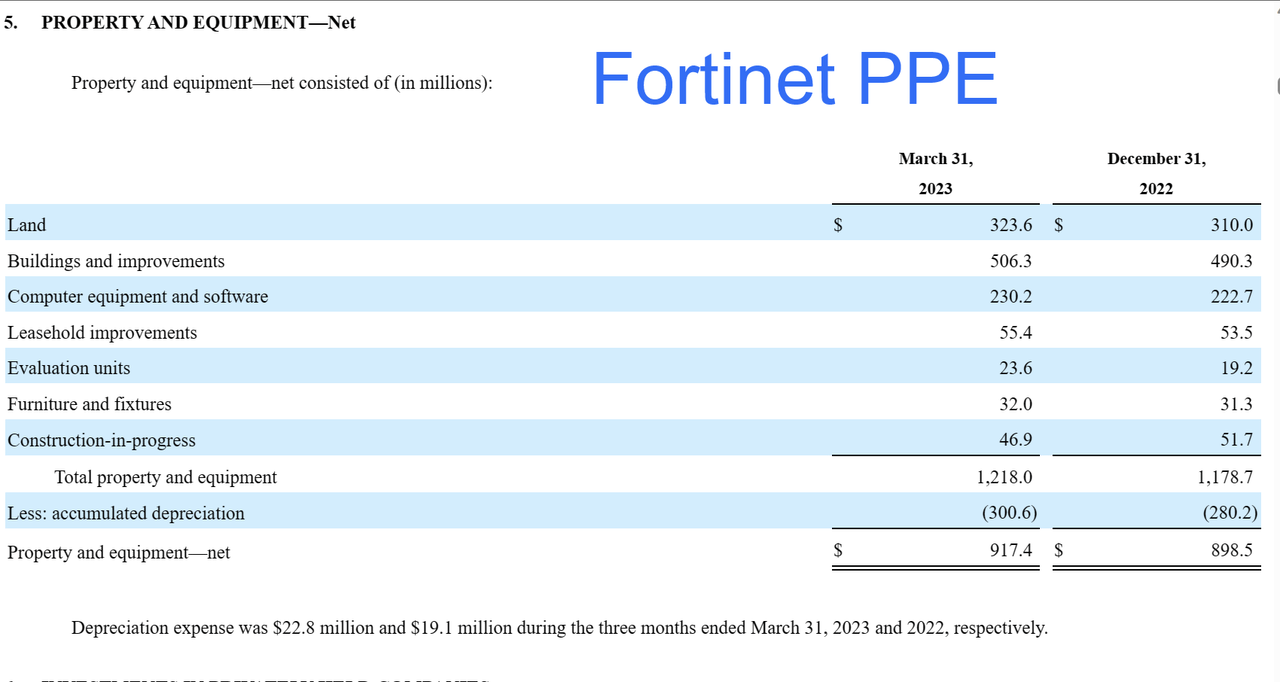

Investment in PPE & NaaS

It is noteworthy that FTNT's projected full-year capital expenditures are approaching $350 million at the midpoint. FTNT is investing significantly in building its own end-to-end cloud service, including the physical facilities, hardware infrastructure, and software.

This "full stack" approach differs from the conventional strategies of NET and ZS, who rent datacenter space and servers from third-party colocation providers like Equinix (EQIX). Building in-house is more reminiscent of hyperscale cloud platforms like AWS, Azure, and GCP.