Updates: GTLB 2Q24 - Strong Product Fundamentals & Market Opportunity But Priced In

Summary

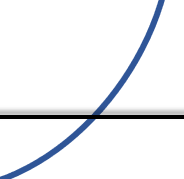

- GTLB's slower growth decay compared to others is attributed to the company's resilient NDR. Price increases, AI monetization, and more enterprise-grade services will further support this.

- GTLB is trading at high multiples while not having yet achieved notable operating efficiency. This suggests investors view GTLB's product fundamentals and market opportunity as particularly strong.

- GTLB continues to make rapid progress in its DevOps platform development. There is ample competition across various aspects of DevOps, though it is clear GTLB has the most end-to-end platform.

- We view GTLB as a hold as there seems to be growth reacceleration already priced in. Currently, GTLB is either a wait-for-the-dip stock or buy/add now in anticipation of larger operating efficiency improvements.

Note: the GTLB update has been delayed due to the original decision to include an in-depth competitor analysis of the DevOps platform market. Since then, we have decided to keep this update shorter and publish the competitor analysis in a separate upcoming report, titled Preliminary DevOps Landscape Assessment. This will be published later in the week.

2Q24 Overview

GTLB delivered a solid 2Q24, growing revenue YoY by 38% to reach $140m, which beat guidance by $10m. This equates to an impressive compounded annualized QoQ growth rate of 46%, signalling that GTLB is performing better than most in the tough economic climate. Non-GAAP EBIT also beat expectations, equating to a margin of -3% versus the -8% guidance.