IPO: Rubrik - Last Line Of Defense (Pt.1)

Summary

- Rubrik's IPO marks the first cybersecurity vendor to go public in two years.

- The way Rubrik approaches cybersecurity, while not a game-changer, is a much needed layer of defense that promises to prevent ransomware attacks on its customers.

- Rubrik has become a differentiated category definer of the burgeoning data security market. We review how significant this market could be and Rubrik's future role in it.

- In Part 1 we discuss why existing tools are failing to stop ransomware, why Rubrik can deliver tremendous value, and explain how data security has evolved in large part from the backup data market.

- In Part 1 we also discuss Rubrik's expansion from backup to DSPM, DDR, and DLP.

- In Part 2 we'll cover Rubrik's GTM approach, its competition, and its valuation.

Rubrik Company Overview

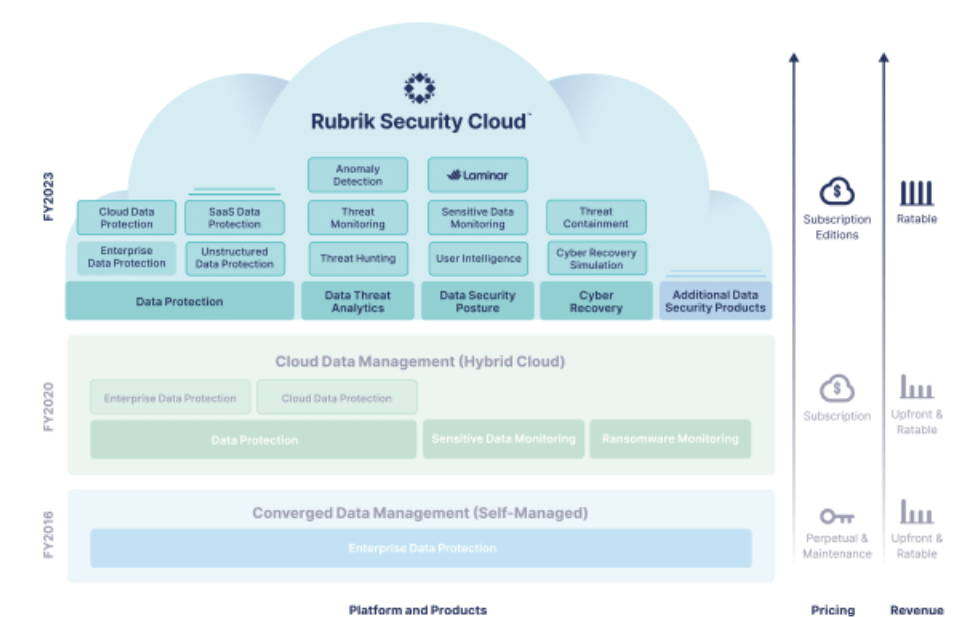

History/evolution: Rubrik was founded in 2014 by Bipul Sinha (CEO), Arvind Nithrakashyap (CTO), Arvind Jain, and Soham Mazumdar. These entrepreneurial engineers saw a market opportunity to offer more secure, cost-effective, and user-friendly data backup and recovery solutions to enterprises. The company's initial offering, Converged Data Management, was sold as an appliance for on-premises environments.

Rubrik's platform evolved into Cloud Data Management, expanding its capabilities to cover hybrid and multi-cloud environments. Recently, the platform was rebranded as Rubrik Security Cloud, reflecting the company's broader focus on security and integration with cloud-based systems.

In its early stages, Rubrik experienced remarkable growth, generating $50m, $170m, and $350m in revenue in its first three years. This growth attracted significant interest from stellar VCs. Bipul Sinha, having been a partner at Lightspeed Venture Partners before founding Rubrik, secured Lightspeed as the lead investor in the company's Series A round. Greylock Partners then led the Series B round, raising a total of $51 million between the two rounds. Both Lightspeed and Greylock continued to invest in subsequent rounds, supporting Rubrik's ongoing development and attracting more capital from other VCs. In May 2017, after completing the Series D round, Rubrik had raised a total of $292m.

Rubrik's Series E funding round, completed in 2019, was the final official fundraising round before its recent IPO. This round raised $261 million and brought Rubrik's valuation to approximately $3.3bn. In 2021, Microsoft made an undisclosed investment in Rubrik following a collaboration between the two companies. This strategic investment marked an important step in strengthening Rubrik's offerings and integrating its solutions more deeply with Microsoft's cloud products, particularly Azure, solidifying Rubrik's position in the enterprise data management and security market. This was the last investment before Rubrik’s IPO on the 25th April 2024.

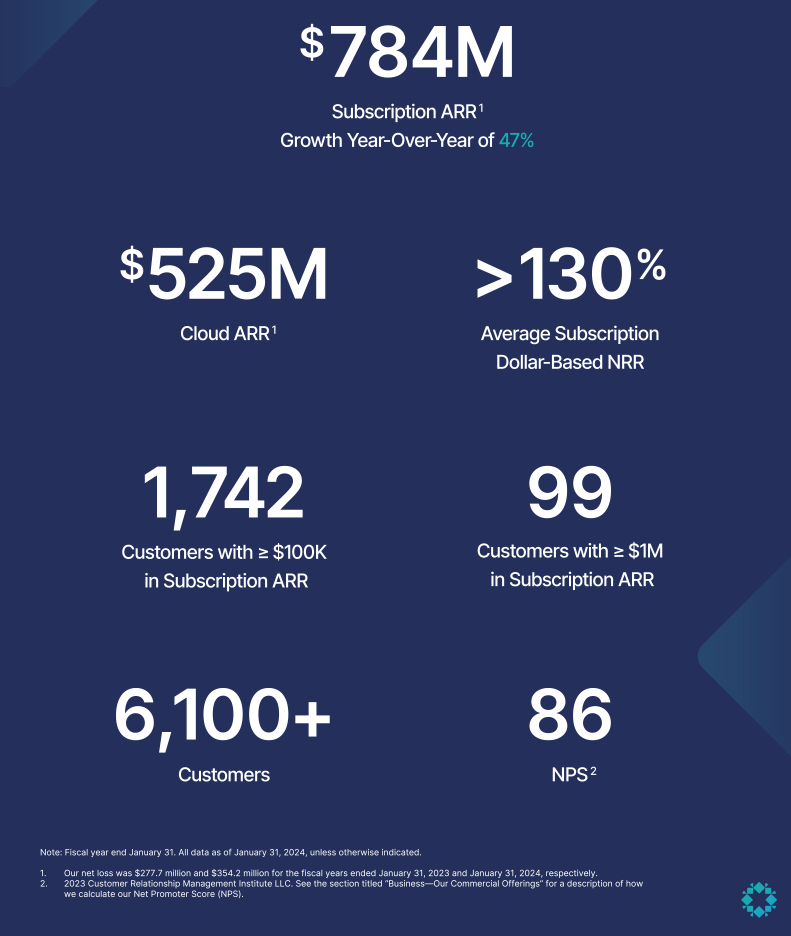

IPO & Valuation: Rubrik went public on 25th April 2024, raising $752m in its IPO. The company offered 23.5 million shares at an initial price of $32 per share, which was above its previous target range of $28 to $31 per share, placing Rubrik's valuation at around $5.6bn. At Friday’s close (26th April) Rubrik’s share price was $38, translating to a valuation of $5.8bn, trading at an EV/S and EV/GP of 10.4x and 13.6x, respectively.

Pre-IPO, Lightspeed (represented by Ravi Mhatre as a director) and Greylock (represented by Asheem Chandna as a director) owned 23.9% and 12.2%, respectively. Sinha owned 7.6% and fellow co-founder Nithrakashyap owned 6.7%.

Financials:

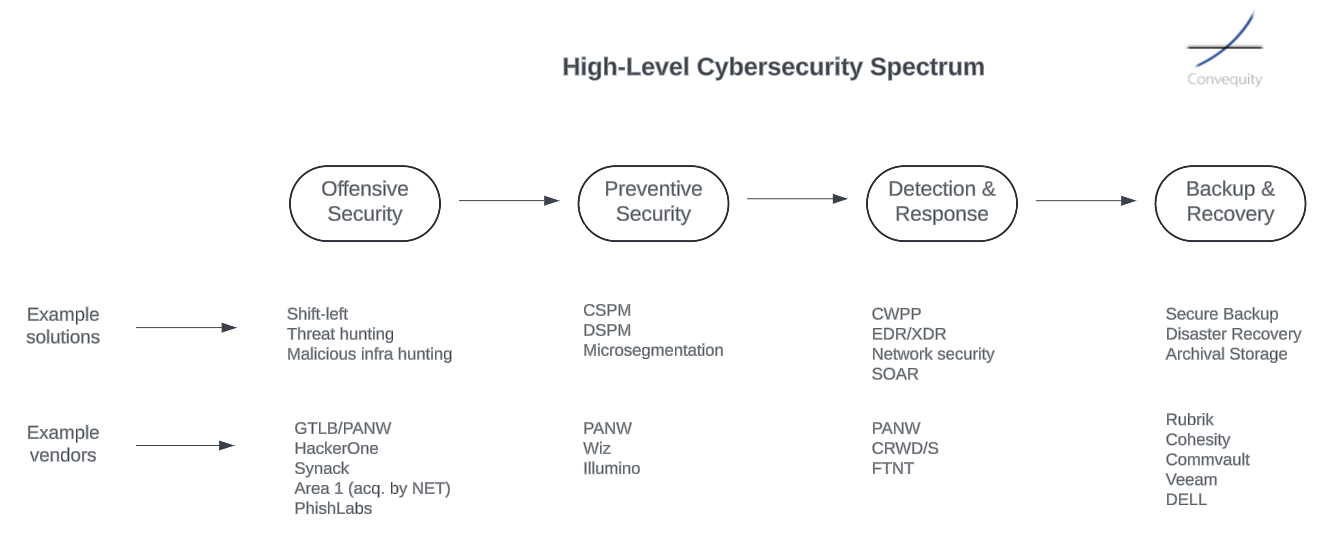

Markets & Products: From its core data backup and recovery domain, Rubrik has expanded into DSPM (Data Security Posture Management), DDR (Data Detection & Response), and DLP (Data Loss Prevention, via a Zscaler integration).

M&A: Rubrik has made three acquisitions over its history, expanding its capabilities and market presence:

- Datos.io (2018): This acquisition enabled Rubrik to enter the NoSQL database backup market, expanding its capabilities to more data types. Datos.io was a cloud data management company specializing in protecting modern, distributed databases such as MongoDB and Cassandra. This deal allowed Rubrik to enhance its backup and recovery capabilities, particularly for next-generation, distributed database technologies.

- Igneous Systems (2020): Rubrik acquired the assets and intellectual property of Igneous Systems, a Seattle-based data management company. This acquisition allowed Rubrik to further its capabilities in managing unstructured data, particularly across hybrid cloud environments.

- Laminar Security (2023): In August 2023, Rubrik acquired Laminar Security, an Israel-headquartered company specializing in DSPM. This acquisition has given Rubrik the technology to help customers identify sensitive data and apply the necessary security controls to keep such data safe from hackers. Sidenote - PANW acquired a DSPM leader named Dig Security in December 2023, in which we shared some thoughts in our recent PANW update (scroll to toward the end of the report).

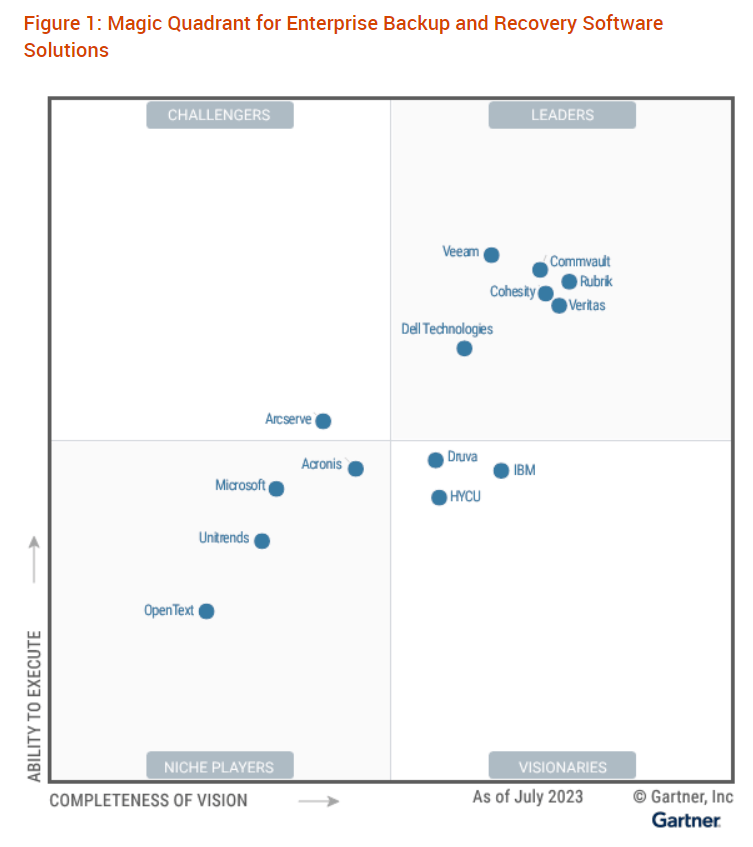

Competitors: Rubrik’s main rivals include legacy vendors such as Commvault, Veeam, and Dell, as well as Cohesity who is Rubrik’s most direct next-gen competitor.

Interesting facts: 1) In its first few months, Rubrik brought in $400k of customer orders before they even had an operational product. 2) Rubrik made waves in the data security industry when it introduced the first ransomware warranty in 2021. This first-of-its-kind warranty provides coverage of up to $10 million for qualifying customers who experience losses due to ransomware attacks, highlighting Rubrik's confidence in its data security solutions and its commitment to customer protection.