Updates: MBLY - Will The Downturn Be Short-Lived?

Summary

- Mobileye stands as a pivotal player in the Advanced Driver Assistance Systems (ADAS) sector, specializing in Level 0 to Level 2 solutions.

- Mobileye faces intensifying competition from emerging startups and established corporations enhancing their ADAS offerings with advanced chip and software technologies.

- Analysts' forecasts are still optimistic, however, the risk-reward has vastly improved since the share price plummet.

https://twitter.com/convequity/status/1743564025261334856

In our previous report on INTC, we previously mentioned Mobileye (MBLY), then a distinct business division within INTC. Remarkably, even during that period, MBLY exhibited preliminary indications of operational challenges, contrary to the overwhelmingly positive outlook shared by most market participants, which we found to be unsubstantiated.

https://twitter.com/convequity/status/1588405430182498305

Last year, at the height of its market valuation, our stance on MBLY was clear: it represented an overvalued entity, with significant potential gains already factored into its price, while long-term risks were largely overlooked or underestimated by analysts. These analysts often based their optimistic forecasts on selective information from management discussions and superficial channel checks.

https://twitter.com/convequity/status/1588140145185681408

In this brief update, we aim to revisit MBLY's current position, analyzing why we anticipate a continuation of its challenges, albeit with a somewhat improved risk-reward profile. Furthermore, we will explore how Qualcomm (QCOM) has executed a strategic masterstroke in the automotive sector, positioning itself strongly against leading competitors and established industry giants like Nvidia (NVDA) and MBLY.

MBLY: Pioneering Autonomous Driving Technology

Mobileye (MBLY), a front-runner in autonomous driving technology, specializes in chip and software solutions primarily serving as a Tier 1 supplier for Original Equipment Manufacturers (OEMs). MBLY established itself as a trailblazer in the category by leading the development of vision-based Advanced Driver-Assistance Systems (ADAS), gaining substantial initial adoption in high-end Internal Combustion Engine (ICE) vehicles. This was particularly notable prior to 2017, before Tesla (TSLA) catalyzed the trend towards vehicle electrification and digitization.

Key Success Factors

The cornerstone of MBLY's success has been its tight integration of software and hardware (SW+HW), coupled with its control over data and a focus on cost-effective solutions. These elements have been instrumental in solidifying MBLY's position in the market.

MBLY is known for offering a white-glove service to automakers, many of which have traditionally been slow adopters of new technologies. For instance, it was surprising to see high-end vehicles like the 2022 Bentley or Maybach equipped with Samsung tablets that were eight years old. This tablet, the 2014 Samsung sm-t230nz, was born in the era where the annual rapid performance gain in mobile was prevalent, and each year's new product is 2x+ better than in the previous year. The tablet is essentially an unusable deprecated tablet for the consumer market that is worth <$50, but because automakers are so slow to adapt and deploy new technologies, even high-end car owners have to tolerate a lousy digital experience. In many cases, customers need to pay $10k+ to get these lousy optional items while they could simply buy a $1000 iPad that has 10x+ better performance and UX. This highlights the technological lag in comparison to the rapidly evolving consumer electronics sector. And while this is absurd for technologists, apparently most car OEMs, other than some next-gen startups, are comfortable and happy with it.

Shift in OEM Priorities and MBLY’s Growing Importance

The landscape began to shift around 2017. TSLA’s rising popularity and the exponential growth in its sales since 2020 sparked a realization among OEMs about the urgent need to embrace digitization and electrification, often interlinked. Concurrently, the EV sector witnessed a surge in startups, buoyed by significant investments and the validation of EVs as a commercially successful path, further enhancing MBLY's relevance.

Intel’s (INTC) acquisition of MBLY in 2017 for $15.3 billion was a strategic and forward-thinking decision. However, post-acquisition challenges, including execution issues and internal turmoil within INTC, have significantly hindered MBLY’s innovation capacity and its ability to stay at the forefront of the rapidly evolving autonomous driving space.

Competitors

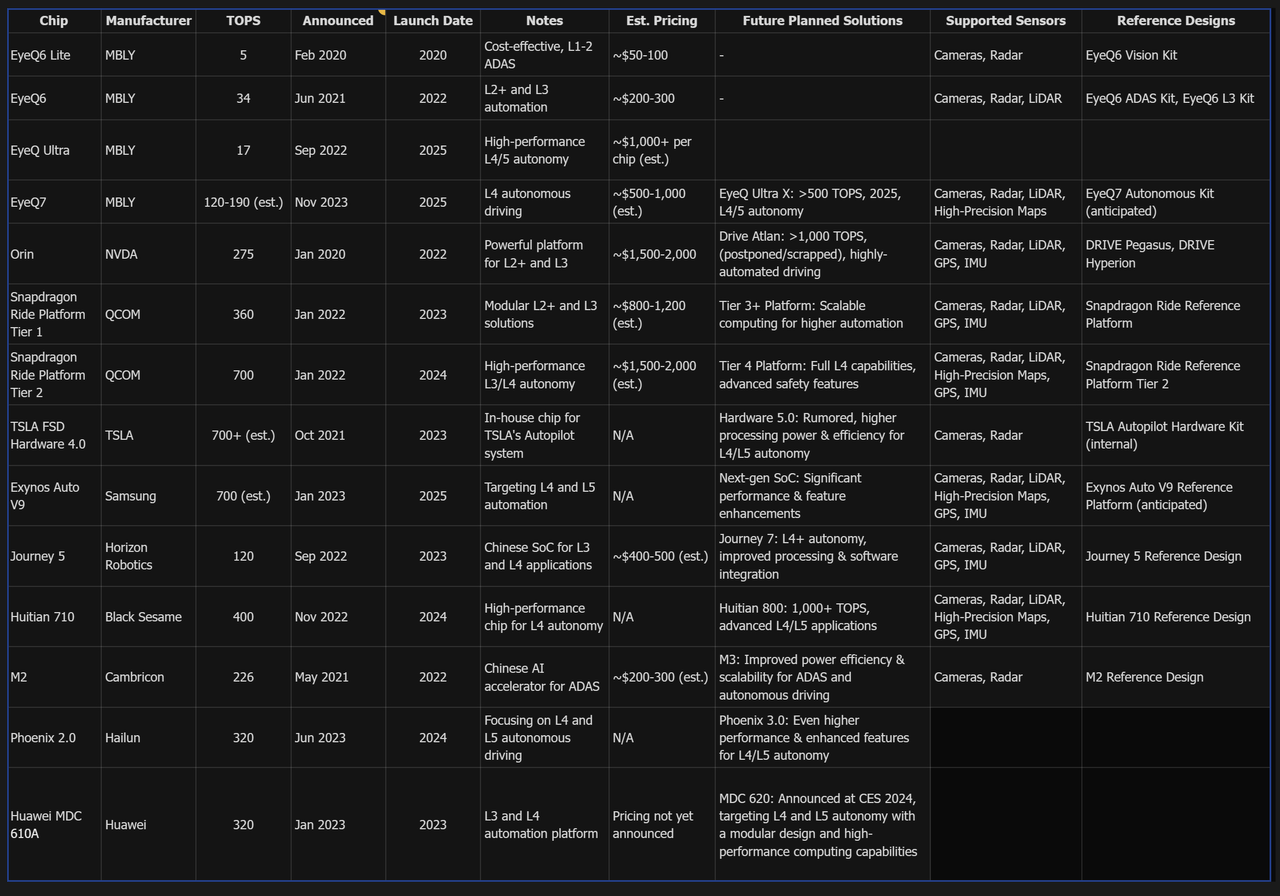

From a chip manufacturing perspective, MBLY's main competitors include NVDA and QCOM. The Chinese market, known for its rapid growth and intense competition, has seen the emergence of promising contenders, including startups and tech heavyweights like Huawei, further diversifying the competitive landscape.

In addition to direct competitors in the chip sector, MBLY faces indirect competition from integrated companies such as TSLA, which develop their own vehicles, chips, and software. This self-sufficient approach by TSLA represents a unique challenge in the ADAS space.

Moreover, MBLY is in competition with specialized software firms that focus on ADAS algorithms and technological expertise. Key players in this arena include Cruise, Zoox, Waymo, among others, each contributing to the dynamic and rapidly evolving field of autonomous driving technology.

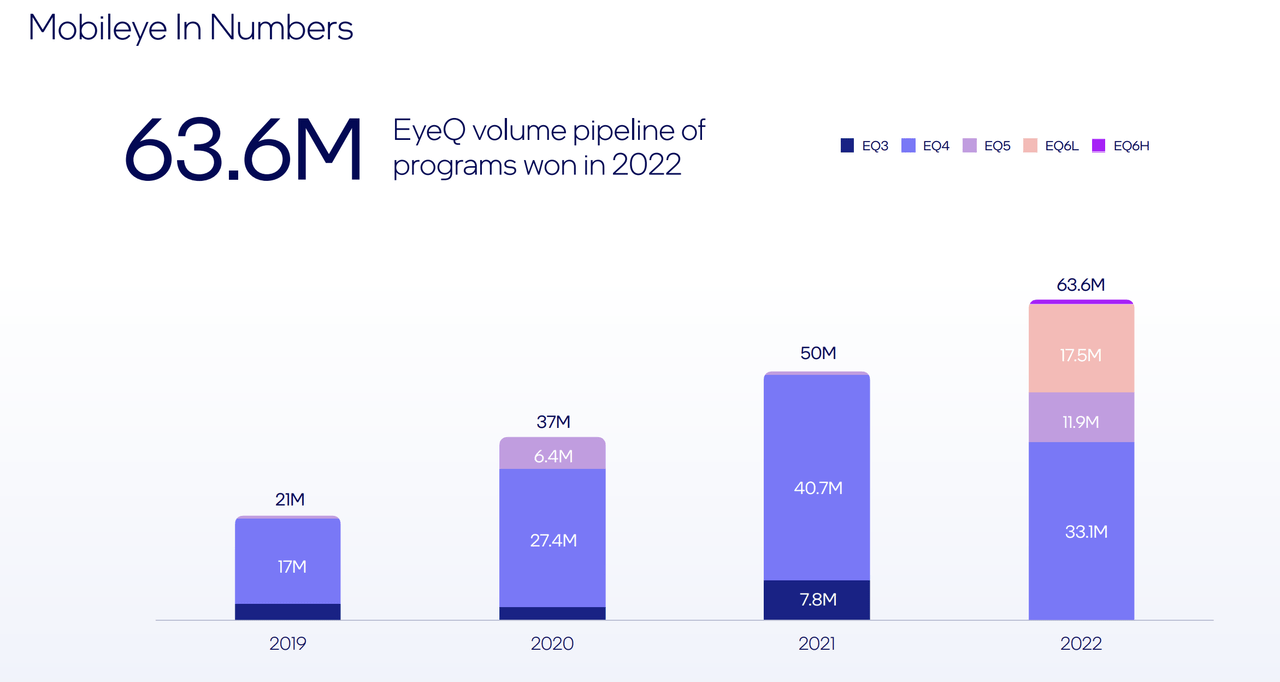

Notable ADAS Chips & Vendor Info by Convequity January 11th 2024

The primary needs of OEMs in the automotive industry have evolved significantly. It's becoming increasingly clear that the focus isn’t just on Tera Operations Per Second (TOPS); instead, OEMs are looking for comprehensive solutions that align with the broader trends in the automotive sector.

In this context, MBLY finds itself in a challenging competitive landscape. Despite an appealing roadmap, MBLY's offerings seem less compelling when compared to dynamic competitors like QCOM. The market's belief in MBLY as a BoB stock might lead to unexpected setbacks, given the company's current positioning in the rapidly advancing field of ADAS.