Updates: MNDY 2Q23 - Finding Great Operating Leverage

Summary

- MNDY continues to delight investors by delivering excellent operating leverage while not letting.

- We review MNDY's new products, such as monday CRM, monday Dev,.

- Specifically, mondayDB, MNDY's new backend architecture, could be a significant catalyst for CRM and its efforts in GenAI.

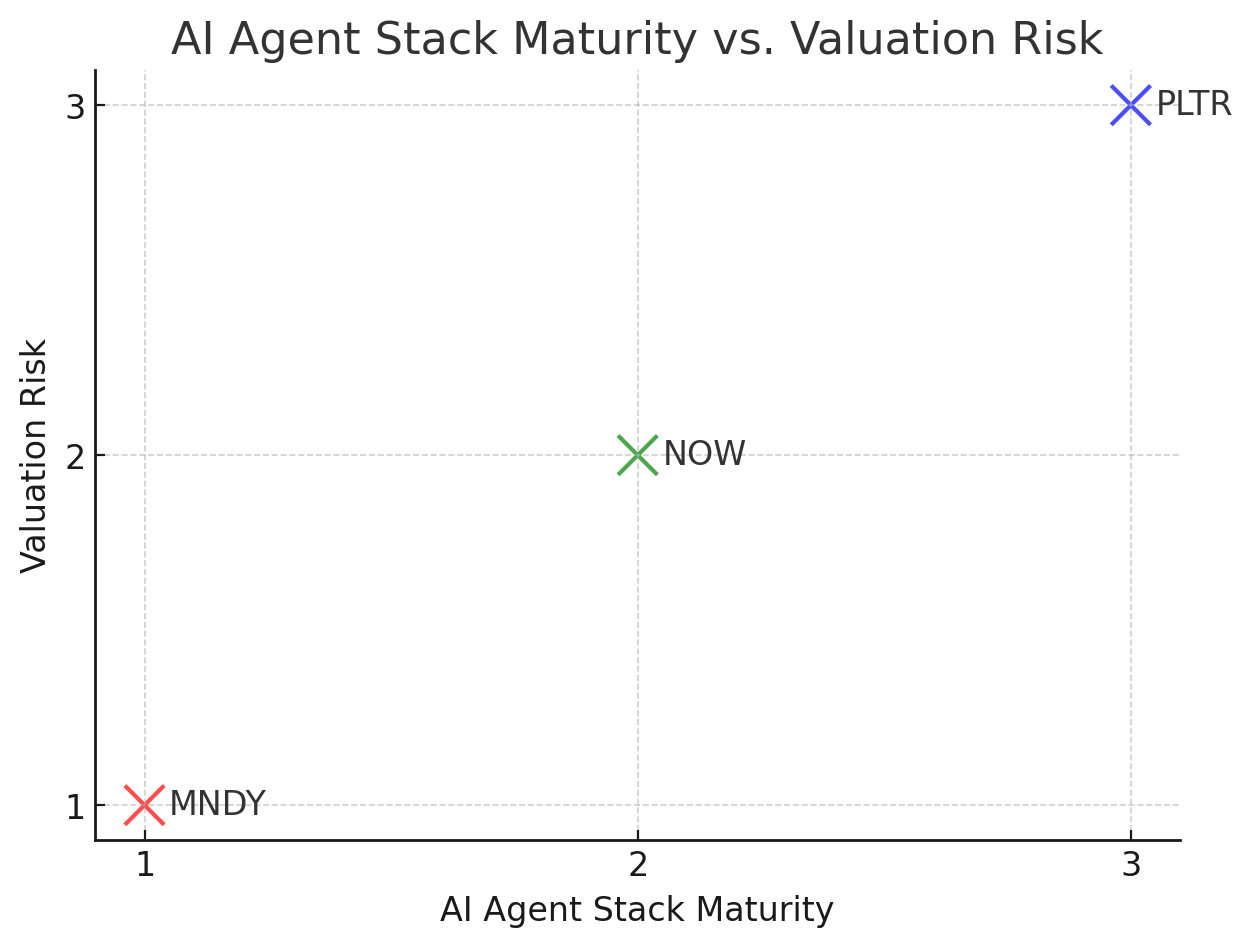

- We discuss a number of factors in MNDY's valuation. The general takeaway is that it seems the market is pricing in a steep-ish growth deceleration to the high-teens over the next couple of years.

2Q23 Overview

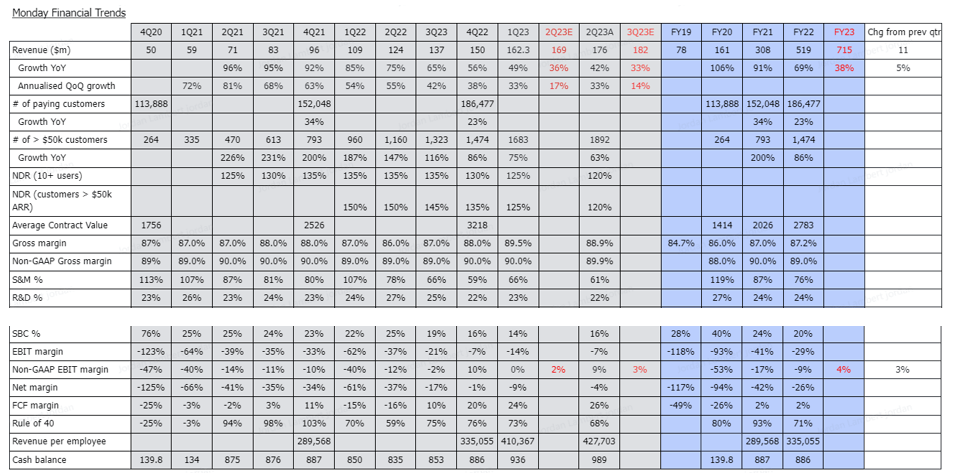

MNDY had a very good quarter, beating both the guidance on revenue and non-GAAP EBIT. The company beat revenue guidance by $7m, or 600 bps in growth terms, and beat non-GAAP EBIT by $13.6m, or 770 bps in margin terms. Growing 42% YoY and 33% in annualized QoQ terms - considering the TTM revenue base of $600m+, the dense competition, and the macro-induced budget restraints – is highly impressive and underscores MNDY’s excellent execution.

Click the link to access the table and see the DCF valuation.

The guidance for 3Q23 follows the same narrative for pretty much every other software firm right now – which is a continued deceleration in growth. MNDY expects to generate $182m of revenue in 3Q23, which equates to a 33% YoY growth and a 14% annualized QoQ. This is a steep drop compared to prior decrements in quarterly growth. However, MNDY has delighted investors with the $11m increase in revenue (500 bps in growth terms) guidance for FY23, taking the expected full year revenue to $715m. From the earnings call, it seems as though management are fairly confident that the NDR, which has been slipping during the past few quarters, has stabilized and will begin to creep back up in the second half of FY23, which appears to be supporting the full-year revenue guidance revision. This would align with ours and probably many others who sense that the tech layoffs have reduced considerably since the lows of of 2022. If this is the case, then MNDY's seat-driven NDR should indeed stabilize.

The falling NDR has been largely offset by strong new logo wins, which has supported MNDY’s top line and enabled the guidance beat. The growth in the number of customers spending over $50k also continues to be very strong. As of 2Q23, MNDY has 1892 > $50k customers, which is a 63% YoY growth rate and an annualized QoQ growth rate (not shown in table) of 50%, which is great momentum considering the macro headwinds.

It would be insightful to know the Average Contract Value (ACV) right now, but unfortunately MNDY appears to only be disclosing the total number of customers in the fourth quarter. From 4Q21 to 4Q22, the ACV grew a very strong 27%, and based on the > $50k customer momentum, we suspect the ACV will continue on the rise.

Along with impressive top-line performance, over the past quarters MNDY has made good progress in improving its margins (GAAP and non-GAAP EBIT/NET and FCF). This has been achieved via broad-based operating efficiency gains, from lower COGS %, lower S&M %, lower G&A %, and lower SBC %, which in turn has been achieved by growing the number of products (such as monday CRM and monday Dev) and features on its platform. And they've achieved this while maintaining R&D %.

The operating efficiencies may have even taken MNDY by surprise, as the company beat non-GAAP EBIT margin by 760 bps (coming in at 9.4% vs 1.7% guidance). And management have increased FY23 non-GAAP EBIT guidance by ~$22m, to $29m, representing a 300-bps revision bump in non-GAAP EBIT margin, suggesting that further operating leverage will be achieved quite rapidly.

FCF margin has also ramped up in the past few quarters. After seeing second quarterly FCF margin above 20% for 2Q23, our initial reaction was ‘perhaps it is a quarterly deviation from the longer-term trend’. However, in the 2Q23 earnings call, management revealed that they expect a high-teen FCF margin in 3Q23 and low-20s FCF margin for the full year of FY23. This is a massive increase from FY22 of ~2000 bps, and is very supportive for the valuation. It is interesting, because SentinelOne (S) has improved non-GAAP EBIT by a larger delta than MNDY during the last 4 quarters, and the delta change in FCF margin for both has been about the same; however, S' share price performance has suffered whilst MNDY's has been solid. From this we infer that investors are not just placing great emphasis on EBIT/FCF improvements, but placing emphasis on crossing the breakeven point. It seems EBIT/FCF improvements don't mean much if they are still in negative territory - improvement plus crossing breakeven appears to be the catalyst to steady returns for high growth stocks at present.

Over the 18 months we’ve been covering MNDY, the company has transitioned from a hyper-growth + FCF negative/flat business, to a well-balanced growth + FCF positive business, and this transition has been supportive for the share price since the November 2022 low. Many other firms, such as OKTA and NET, have experienced similar growth slowdowns but haven’t offset this with material FCF margin gains, and ultimately this has been reflected in the share price performances. If MNDY can generate a 50%+ Rule of 40 with 30%+ growth and 20%+ FCF margin during the coming quarters, we expect the stock to attract increasingly more investor attention.