Note: Supermicro - Improving Fundamentals But Worsening Delisting Risks

Summary

- Supermicro (SMCI) faces severe accounting issues, potential SEC lawsuits, and delisting risks, yet its business fundamentals and market leadership in AI data centers remain strong.

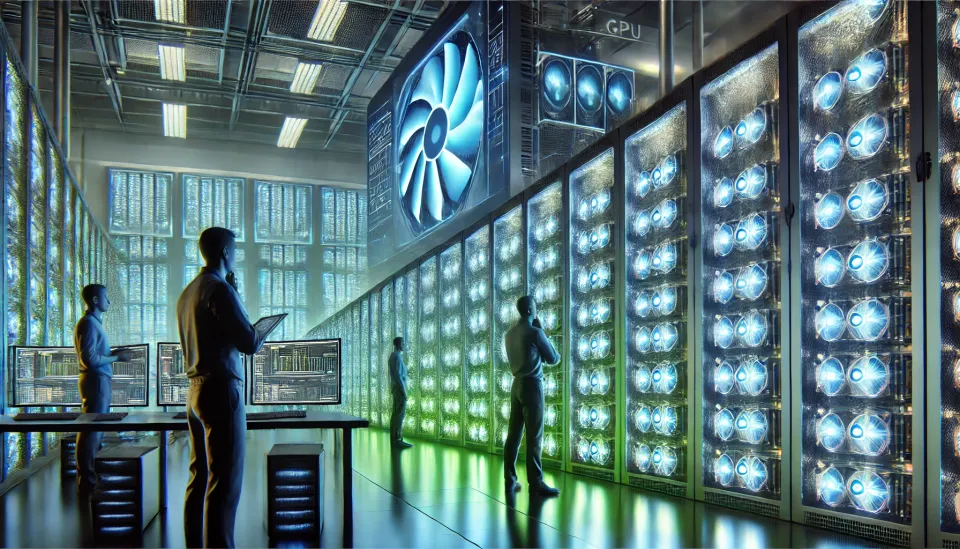

- SMCI's innovative Direct Liquid Cooling (DLC) technology and high-density GPU racks position it as a leader in AI training clusters, exemplified by X.ai's Colossus data center.

- Despite the DoJ investigation and EY's resignation as auditor, SMCI's underlying business remains robust, with significant growth prospects in the AI and data center markets.

- If delisted, SMCI could follow a recovery path similar to Luckin Coffee in the OTC market, with potential for strong performance once financial clarity and business continuity are demonstrated.

The situation surrounding Supermicro (SMCI) continues to unfold, with its share price caught in a persistent downward spiral. This decline follows the DoJ's decision to deepen its investigation and EY removing themselves as the company's auditor. The likelihood of SMCI facing significant accounting and internal control issues, along with a potential SEC lawsuit and even delisting, appears increasingly priced in by the market with near-total certainty.

However, our latest analysis of SMCI’s fundamentals reveals a contrasting narrative: the business itself is becoming more attractive. SMCI’s dominance and leadership in cutting-edge AI training clusters are further cemented, with the first Direct Liquid Systems (DLC) system now operational — not only in production but within the largest AI training cluster ever deployed. Amid delays in Blackwell chip deliveries and a growing push for high-density, high-reliability, liquid-cooled data centers, SMCI is poised to capture additional market share as the only ODM+OEM with a U.S.-based factory and headquarters in Silicon Valley.

In this article, we will briefly address two key topics:

- SMCI’s upward-trending fundamental business prospects

- SMCI’s accounting woes and the possibility of being delisted

Fundamental - DLC, Speed, Density, and Customizability

For technical buyers rather than financial investors, SMCI's appeal is likely growing as it solidifies its leadership with projects like X.ai’s Memphis data center, now aptly named "Colossus."

This is a significant development, as X.ai has constructed the world’s largest AI training cluster, boasting 100,000 H100 GPUs. To put this into perspective, Meta’s previous state-of-the-art cluster with 24,000 H100 GPUs is dwarfed by more than 4x. Elon Musk’s vision to swiftly achieve AI leadership hinges on attaining a multi-fold advantage in compute power, and X.ai is executing on this belief.

In just 19 days, X.ai transformed an Electrolux plant—formerly used to manufacture home appliances—into the largest AI data center featuring 32,000 H100 GPUs. Within three months, the facility was scaled to 100,000 H100 GPUs and over 150 MW of power consumption. Looking ahead, X.ai plans to deploy a 300,500 GPU B200 cluster starting next summer.

The rapid pace of this buildout is unprecedented, leaving local regulators with little time to impose delays, unlike the years-long regulatory hurdles faced by SpaceX for its Starship launches. X.ai also tackled several technical challenges that have traditionally hindered other hyperscalers in constructing massive AI data centers, leveraging smarter engineering and strategic technical partnerships to overcome these obstacles.

To address the power constraints of the local grid only being able to supply 8 MW, X.ai chose to install natural gas combustion turbines on-site. Each mobile natural gas generator, sourced from Voltagrid, provides 2.5 MW of power. By using natural gas generators, X.ai not only resolved the immediate power supply issue — bypassing the need for lengthy partnerships with local utility providers to build additional power plant capacity — but also eliminated the need for traditional uninterruptible power supply (UPS) systems. These systems are currently in massive undersupply, with lead times exceeding one year — longer than even Nvidia GPUs.