Notes: Fortinet - Striving For SASE Success

Summary

- Fortinet impressed investors with its 3Q24 performance and updated FY24 guidance, and set an optimistic tone for the upcoming Investor Day on the 18th November.

- Key growth drivers include Unified SASE and Security Operations, with significant contributions from cross-selling within the Secure Networking installed base.

- Upcoming product refresh cycle in 2025/26 could drive a substantial turnaround in product growth.

- Fortinet's strategic acquisitions and focus on data-centric security, custom ASICs, and PoP strategy, enhance its competitive edge and long-term growth prospects.

3Q24 Overview

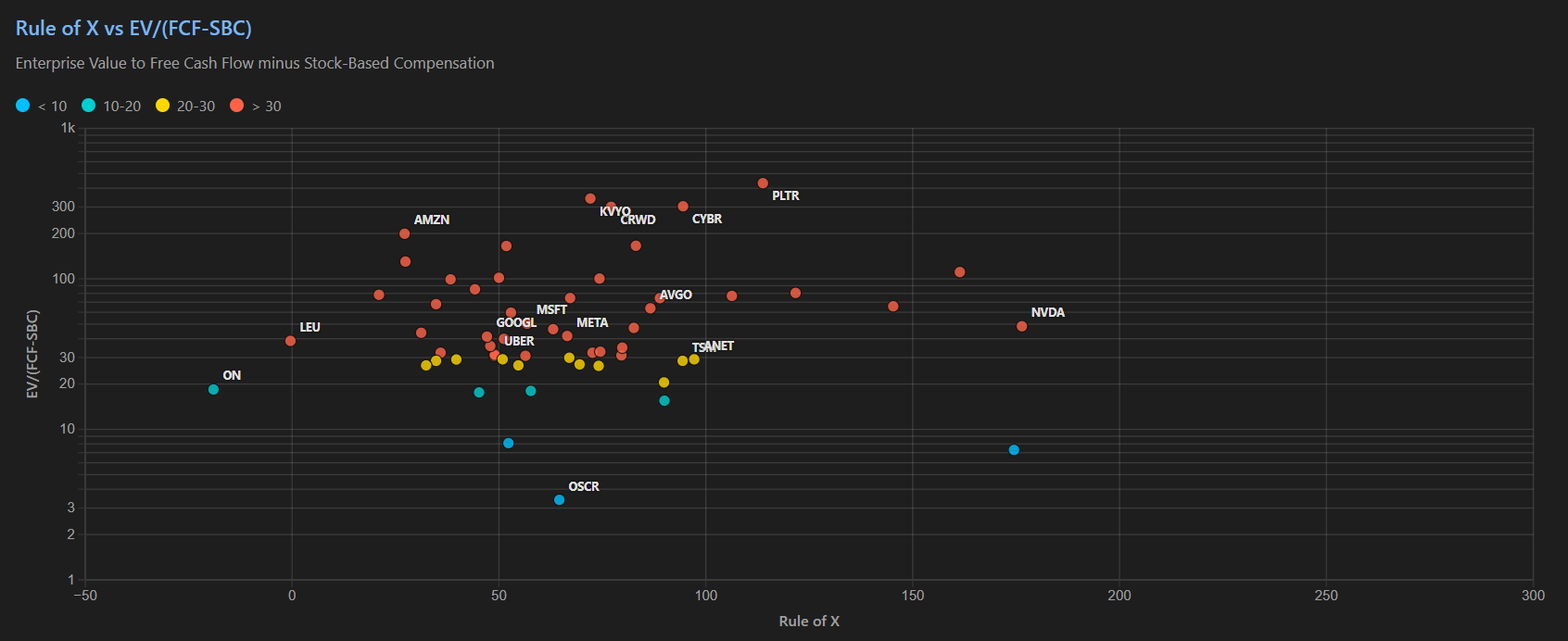

Fortinet (FTNT) delivered a strong performance in 3Q24, surpassing the top end of its guidance on both revenue and non-GAAP EBIT. The company reported $1.51bn in revenue, representing 13% YoY growth, and achieved $545m in non-GAAP EBIT, with a 36.1% margin compared to guidance of 30.5% to 31.5%. Reflecting this momentum, management raised FY24 guidance, increasing the midpoint revenue target from $5.85bn to $5.89bn (a $40m uplift), and improving the non-GAAP EBIT margin forecast from 30.75% to 33.4%, equating to an incremental $168m in EBIT.

Investors responding positively to the ER, boosting the share price by ~10% to $92 at the close of play on Friday 8th November. At this current level, the stock is at the low end of our fair value range of $90-$110 (the link to access the updated DCF valuation model is in the Valuation section at the end of this research note).

The 13% YoY growth in 3Q24 versus 10.9% YoY growth in 2Q24 is a sign that FTNT has moved past the trough in growth, resulting from the inventory build up after the firewall market normalized from 2022 to 2023. The main contributors to FTNT's reacceleration are the Unified SASE and Security Operations divisions, which generated 14% and 32% YoY growth in billings, respectively.

FTNT's cross selling to establish itself as a prominent name in SASE and SecOps is proving to be highly effective, as CFO Keith Jensen stated that 50% of Unified SASE and Security Operations billings came from the Secure Networking installed base. On the whole, it seems that FTNT is finally gaining serious momentum in non-FortiGate business, such as SASE and SecOps and SaaS in general. An interesting comment from Jensen was that FTNT's organic SaaS ARR growth was 76% in 3Q24 - including Lacework and Next DLP would lift this ARR growth much higher.