Notes: Stocks To Monitor For A Future World Of Agentic AI - Palantir, Monday, ServiceNow

Summary

- Unlike brittle RPA tools, AI agents will adapt to workflows, integrate across enterprise data, and operate autonomously, making their TAM far larger.

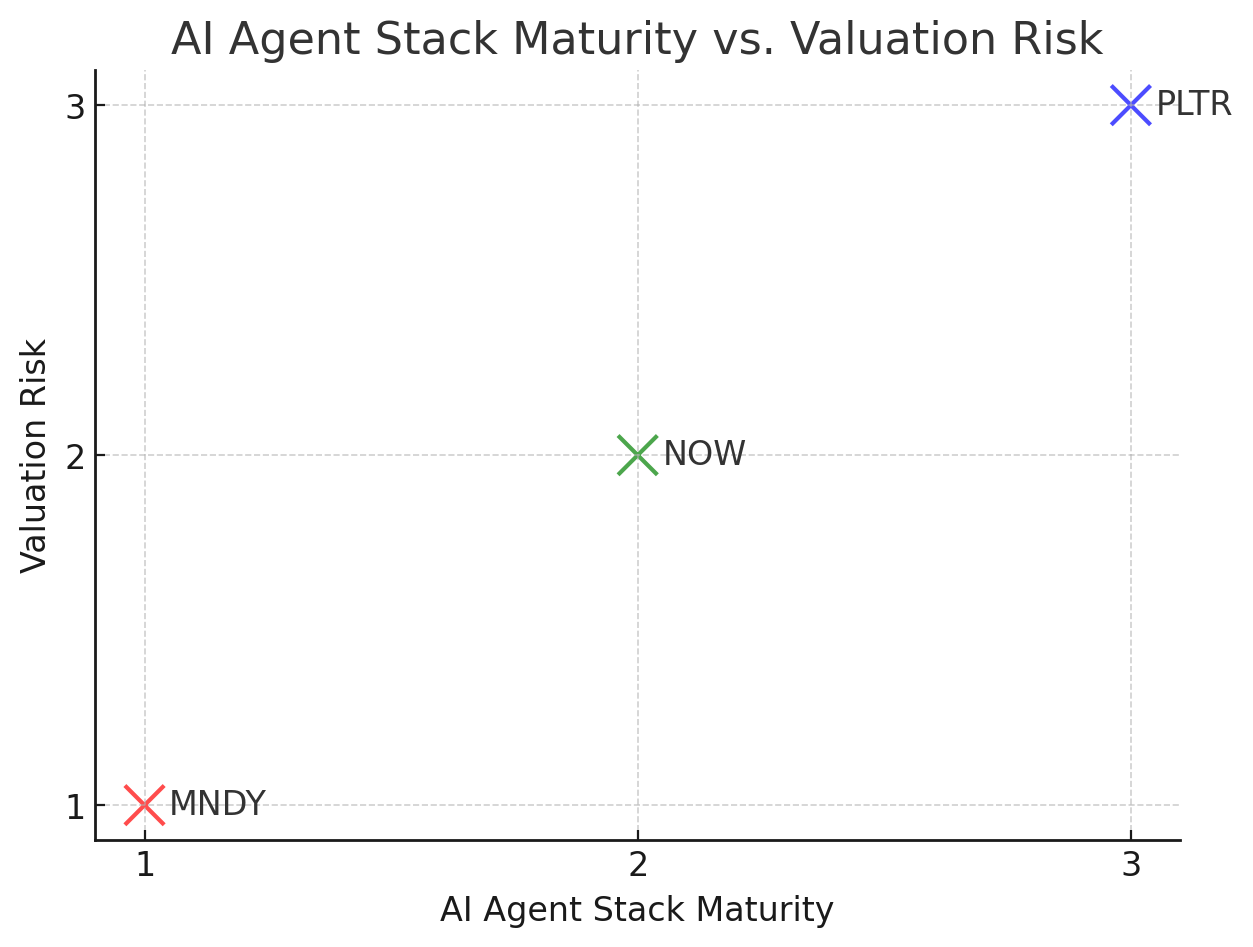

- ServiceNow (NOW) has a strong AI agent roadmap, bolstered by its Raytion acquisition for advanced enterprise search and data integration capabilities.

- Palantir (PLTR) excels in workflow understanding, data integration, and security, but its high valuation poses a risk despite its leading AI capabilities.

- monday (MNDY) offers high alpha potential as it transitions from SMB to enterprise, aiming to become a System of Record (SOR) and an AI agent leader.

Discussions around AI have evolved rapidly. When the GenAI wave kickstarted in November 2022 with the release of ChatGPT, LLMs were mostly text assistants. Then their capabilities quickly expanded to copiloting to augment workflows. Now, the industry is progressing toward AI “agents” that can execute tasks autonomously, and in the future they will be able to coordinate among themselves. In this new era of agentic AI, several enterprise software providers stand out. Our research has focused on three in particular: Palantir (PLTR), monday (MNDY), and ServiceNow (NOW).

From RPA to Agents, TAM Estimates, & SOR

Robotic process automation (RPA) could be viewed as the earliest incarnation of a digital enterprise agent. Although these tools helped automate repetitive tasks, often for manual data entry, but they were often brittle. Even a minor shift in a login box could break an RPA script. What’s more, they required costly professional services for implementation, which only heightened the frustration when the script failed.

The difference with AI agents is that they will have contextual awareness: they will be able to navigate slight variations in a workflow without falling apart. They'll be able to adapt and will be connected to the entire data estate of the enterprise. They'll have the generalizability of LLMs and will also be scripted to complete a series of tasks but with adaptability.

Applying RPA market size estimates - such as Forrester's $22bn TAM estimate in February 2022 - to assess the AI agent TAM, feels like a huge underestimation. Whereas RPA is for narrowly defined workflows and inapplicable for many processes, AI agents will be connected to an enterprise's entire data fabric, capable of completing workflows across diverse applications. Furthermore, AI agents' connectedness will enable them to be leveraged to different workflow use cases across the enterprise with far more ease, without requiring arduous implementations. This makes us think the TAM should be orders of magnitude larger than RPA, and a top-down approach, beginning with the size of the whole software industry, would be a better way to think about the value generation.