Notes: The Only Way Not to Be Replaced by AI is to Invest in AI

Summary

- AI democratizes software creation, but capitalism rewards scale, risking economic dilution rather than widespread prosperity.

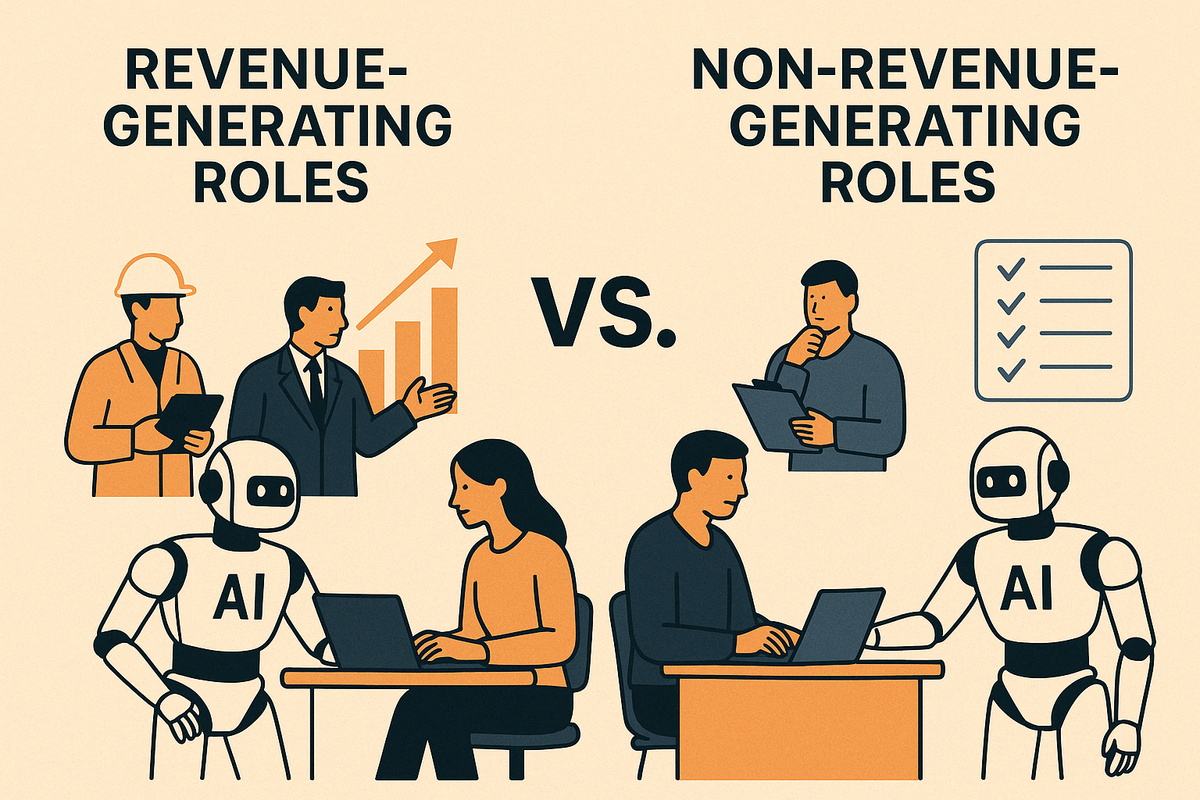

- Non-revenue-generating roles face significant AI displacement; revenue-generating roles will expand until marginal returns diminish.

- Platforms like GitLab, Klaviyo, and Salesforce should benefit as they leverage AI to empower productivity and scale effectively.

- Investing in AI and enabling broader early-stage AI investment would help mitigate widening economic disparity.

Jensen Huang recently claimed on the a16z podcast that AI will create jobs, not destroy them, emphasizing the democratization of software creation through AI tools like ChatGPT. His core point — that anyone, not just professional coders, can now build applications — is undoubtedly valid. Yet, does democratizing software creation necessarily lead to job creation?

We've seen this democratization before with platforms like YouTube, which empowered millions of new creators. But crucially, this didn’t translate into millions of stable, high-income jobs. Most creators make minimal earnings, with only a select few benefiting economically. Why? Because capitalism inherently rewards scale — creation alone doesn’t guarantee compensation.

But the AI-driven disruption we face today differs substantially from YouTube’s optional side-hustles. GenAI and, eventually, AGI, threaten core, full-time knowledge-worker roles — especially in non-revenue-generating corporate departments.

Take IT departments: their ultimate objective is a defined, stable state — networks provisioned, secured, and reliable tech support established. Achieving and maintaining this state increasingly depends less on humans and more on automated AI agents.

Similarly, HR and finance roles focused on onboarding, compliance, payroll, and reporting face significant displacement, as AI efficiently maintains these clearly defined end states with minimal human intervention.

Consider cybersecurity, an area we closely follow. With AI agents enhancing efficiency, enterprises will likely need fewer security analysts to achieve and maintain their desired security posture for networks, endpoints, and data.

Revenue-generating departments, however, present a different narrative. Roles in sales, marketing, product development, and R&D may not only survive but potentially expand. AI dramatically boosts productivity, effectively shifting the supply curve outward. For revenue-generating roles, unlike non-revenue-generating roles, there's no clearly defined "final state" or ceiling. Companies continuously seek to increase revenues, meaning the productivity boost from AI incentivizes them to scale up, hiring more employees or deploying more AI agents until marginal returns diminish to zero.

Let’s consider some examples:

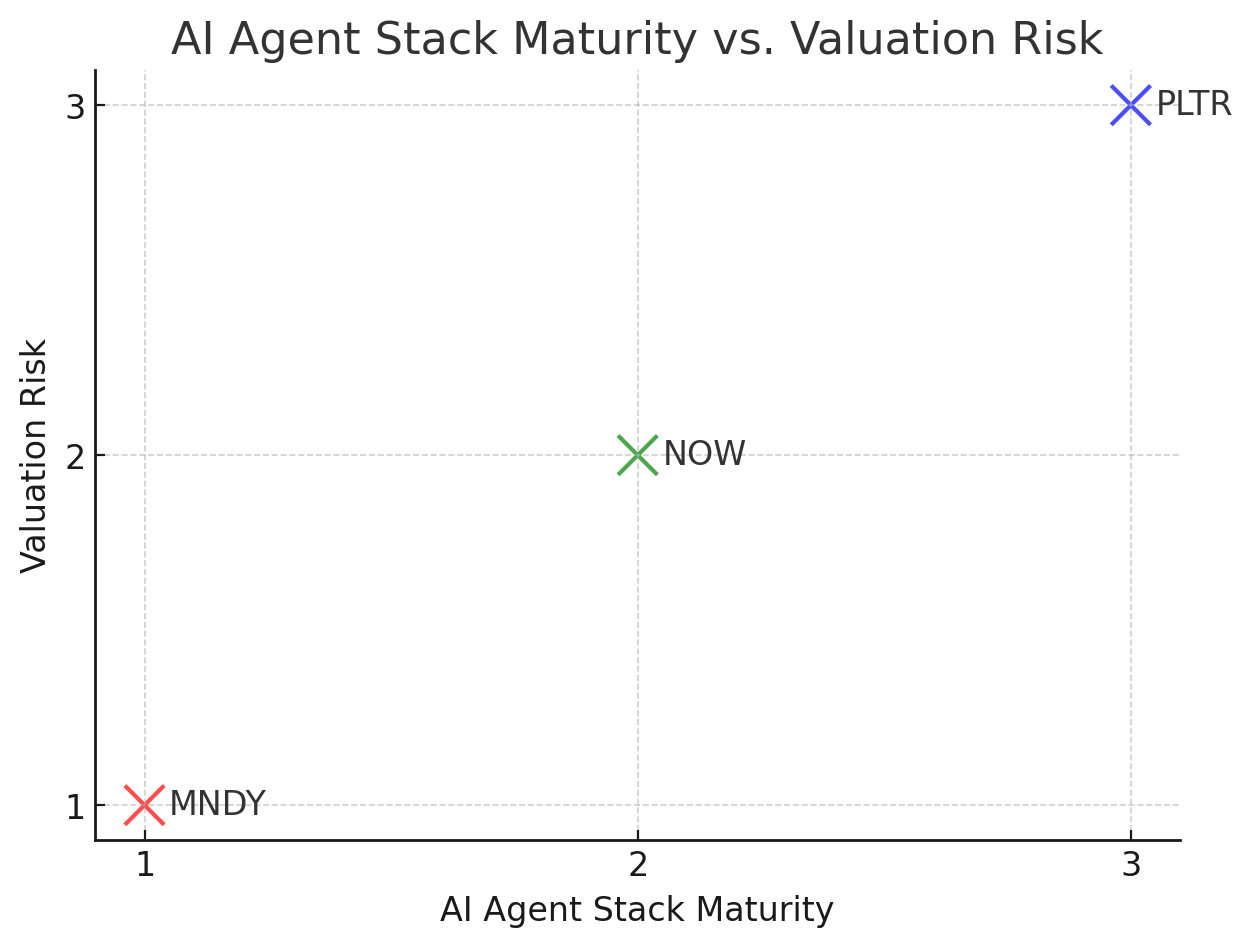

Software Developers: Developers create revenue-generating products, like software and services. AI tools dramatically amplify developers’ productivity. Companies have clear economic incentives to hire more developers, as each incremental hire — supported by AI — continues to deliver attractive marginal returns. For instance, consider GitLab, whose seat-based revenue model directly benefits from increased developer productivity. More productive developers mean companies hire more of them and pushing their supply curve outward, each needing GitLab’s collaborative platform, thus driving GitLab’s revenues upward.

Teachers at Physical Schools: Teachers create educational content — arguably a revenue-generating activity as educational institutions market their offerings. AI can significantly enhance teachers' productivity, allowing each educator to produce higher-quality, personalized content. However, physical constraints like classroom size limit scalability. Nonetheless, AI could facilitate more personalized in-class instruction or support hybrid learning models, potentially improving education quality without requiring substantial increases in headcount.

Online Education Providers: Online education platforms, such as Coursera and Udemy, currently face significant headwinds due to the rise of GenAI. In theory, online tutors should benefit similarly to software developers, who leverage AI tools to enhance productivity, allowing organizations to scale their supply curves. Universities and educational organizations could similarly hire online tutors in greater numbers, significantly scaling content production and learner reach with the aid of AI.

However, unlike software developers who have platforms like GitLab to amplify their productivity, online tutors are dependent on providers like Coursera, which primarily partners with universities and large organizations. Historically, universities are slow adopters of transformative technologies like AI, making Coursera's swift integration of AI-driven content creation challenging. This positions Coursera poorly against personalized, AI-curated learning experiences now easily accessible through GenAI tools. Personally, I've experienced this shift firsthand—recently opting to create a Python learning course directly via ChatGPT, whereas previously platforms like Coursera or Udemy would have been my default choices.

Udemy, conversely, primarily serves independent educators who create and sell courses directly through its platform. While facing similar growth challenges, Udemy could theoretically be better positioned to thrive by empowering its independent tutors with AI-assisted tools to create faster, higher-quality educational content. Such a strategic pivot towards AI-enhanced content generation could mitigate competitive pressures from direct-to-consumer GenAI offerings, revitalizing Udemy's growth and market position. Yet, with no current signs of such adaptation, Udemy's prospects also remain uncertain in an increasingly AI-driven educational landscape.

Marketing Professionals: Marketing directly generates revenue by acquiring and retaining customers. AI-driven personalization, targeted messaging, and data analytics significantly boost marketers’ productivity, incentivizing companies to expand marketing efforts. Klaviyo, for instance, thrives by empowering marketers with AI-driven tools for personalized marketing at scale. As marketers become more productive with AI, companies invest further in platforms like Klaviyo, expanding their marketing teams and driving greater revenue for Klaviyo.

Sales Professionals: Similarly, sales roles benefit immensely from AI productivity enhancements. Salesforce, with its AI-driven tools, enables sales representatives to manage and convert leads more efficiently. This productivity boost encourages companies to expand their sales teams until marginal productivity diminishes, directly increasing Salesforce’s revenue.

Yet, even revenue-generating roles face challenges. Physical and computational constraints (like compute resource limitations affecting AI agent deployment) and market saturation eventually cap scalability. Currently, hyperscalers like AWS and Azure already struggle to support widespread AI agent workloads at scale. Additionally, market saturation limits endlessly expanding sales or developer teams — no market supports infinite growth.

While revenue-generating roles might be okay, we do worry about non-revenue-generating jobs due to the reasons outlined above. Historically, disruptive technologies led to job upgrades rather than permanent unemployment. Agricultural machinery displaced physical labor, yet society transitioned successfully to intellectual roles. But GenAI and especially AGI threaten intellectual roles themselves, prompting an unprecedented economic dilemma.

If intellectual labor is automated, what's the next "upgrade" for displaced workers? Advanced STEM roles, creative professions, frontier scientific research? Realistically, the majority cannot rapidly transition into elite intellectual jobs.

What happens when billions — not just millions — begin creating apps, digital services, courses, and automation tools not out of passion but necessity? Unlike casual YouTube creators, these billions will be forced into a hyper-competitive ecosystem that rewards scale above all else. In capitalism, scale equals value: CEOs earn millions because their decisions impact vast numbers of customers; software developers earn substantial salaries because their products serve thousands or millions. But if billions can produce similar digital products, market overlap and saturation inevitably occur. The average product or app may only reach 100 users, causing the economic value of each creator’s output to diminish dramatically. That's not job creation — it's economic dilution.

Ultimately, capitalism itself might need reevaluation when AGI surpasses human intellect. Alternative economic models, including universal basic income or various socialist structures, could become necessary to maintain social stability.

In conclusion, Jensen Huang is right about democratization — AI has made creation more accessible than ever. But he may be overly optimistic about net job creation unless our economic structures evolve meaningfully.

Roles in non-revenue-generating functions face serious displacement risk, as AI efficiently achieves and maintains their defined end states. Revenue-generating roles, by contrast, may multiply — but only to the extent that market demand, compute availability, and marginal productivity allow.

And if capitalism continues to reward scale above all else, billions may find themselves participating in creation, but excluded from compensation.

One practical solution remains: investing in AI itself. Today, everyday investors have limited access, typically only able to invest in mature, publicly traded AI-focused companies. Expanding opportunities for early-stage AI investment to the general public, as advocated by figures like Jason Calacanis, could help mitigate the emerging economic disparity driven by AI.

Policymakers should explore avenues allowing broader participation in early AI investment, potentially transforming AI's impact from economic displacement into widespread prosperity.

And it seems likely that Trump 2.0 will encourage the SEC to further explore options for enabling less sophisticated investors to invest in companies before they reach their IPO.

That’s how we close the AI wealth gap before it explodes and societal chaos ensues.