Updates - Palo Alto Networks 1Q23

Summary

- Despite marginal signs of macro headwinds, PANW remains resilient, delivering a great balance of growth and cash flow.

- Management have acknowledged toughening conditions but have increased their guidance – signaling they feel confident competing in a deteriorating economic climate.

- We do a usual strategy recap – breaking down the business and analysing the areas in which PANW is positioned to prosper.

- We believe the upside for PANW’s stock is substantial – a view we’ve maintained one year now.

Audio Preview:

1Q23 Review & Financial Trends

In 1Q23, PANW has produced yet another solid quarterly performance, beating the guidance for revenue, billings, and non-GAAP EPS, and generating a very high amount of FCF. The company has continued to gain market share in its older, hardware-based, firewall market, while also growing its NGS (Next-Gen Security) division by 67% to reach $2.1bn in ARR.

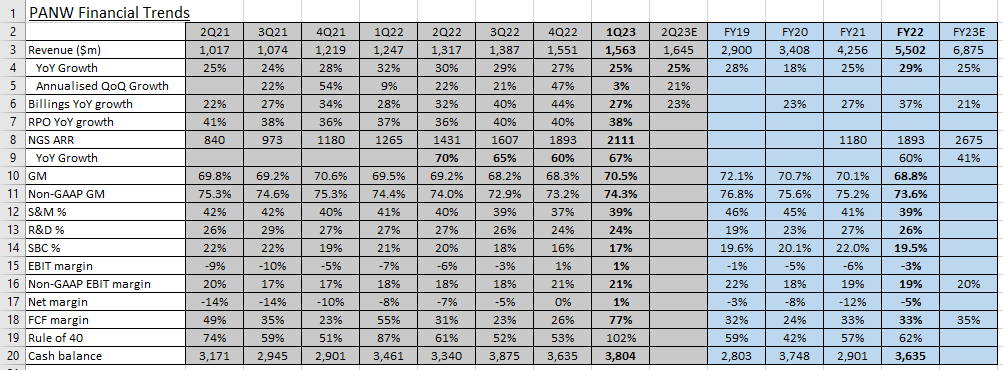

Though, as can be seen on row 5 in the table below, the annualised QoQ revenue growth dipping to just 3% is indicative that even PANW is now feeling a tougher business climate. Investors should note, however, that 4Q22 was quite a spectacular quarter for PANW, so on a QoQ basis, 1Q23 was going to be tough regardless.

This was very much echoed in Nikesh Arora’s remarks and answers to questions during the 1Q23 earnings call. Arora commented that while cybersecurity is showing the most resilience within the tech sector, there are ‘marginal signs of impact’, whereby deals are receiving more scrutiny leading to longer reviews and sales cycles. Furthermore, customers are opening up conversations regarding more lenient payment terms, further elongating the sales cycle. On the whole, however, factors like PANW's longer contract durations and geography and industry diversification (financials and energy sectors are holding up much better), are helping PANW counter many of the macro headwinds that others are struggling with.

In 1Q23, PANW actually increased its hiring of sales reps - adding 550 in the quarter – in order to add more activity around existing accounts and around the sales pipeline. This is the type of leadership we’ve come to expect from Arora – making risky (but calculated) moves against the grain in the quest to outcompete the competition.

He’s astute enough to know that the cybersecurity demands one or two quarters ago haven’t evaporated, it’s just that there are now deeper and elongated reviews before customers decide to buy. Hence, in his view, front-loading the sales force to give these customers more attention ought to help overcome any reservations and expedite the sales process. Indeed, it’s a risky move and might not be highly successful in an absolute sense, but as key competitors are actually slowing down their hiring, relatively speaking it should benefit PANW as they increase mindshare across the enterprise market. And with a healthy FCF margin and cash balance, they are positioned to take on such competitive risks.

NGS ARR has surpassed the $2bn mark, still growing YoY between 60% and 70% - which is spectacular growth for that level of ARR. NGS includes the Prisma (SASE and Cloud) and Cortex (XDR, XSOAR, Xpanse, XSIAM) offerings, and could easily be standalone business commanding a $15bn-$25bn valuation. We think XSIAM is going to be the next lever of secular growth for PANW, powering both its Prisma and Cortex portfolios with best-in-class data management specialised for cybersecurity. For more information on XSIAM, check out our Prisma Cloud report published in mid-November.

Gross margin increased over 200 bps QoQ in 1Q23, indicating that supply chain issues might be somewhat easing for PANW; however, the cause for the spike wasn’t discussed in the call so we’re not going to pay too much attention on this.

On a YoY basis, both GAAP and non-GAAP EBIT margin have improved, assisted by declines in S&M, R&D, and SBC percentages. Management reiterated their intent to continue increasing GAAP profitability, with a particular mention about bringing down SBC %.

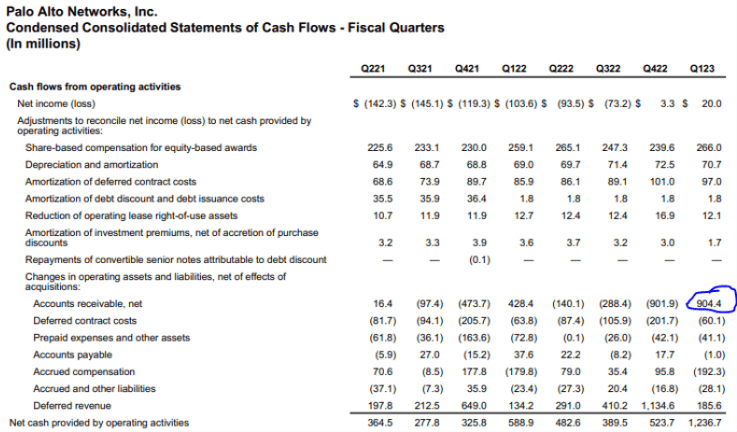

Due to effective collection following highly successful bookings and billings in 4Q22, PANW managed to reduce its accounts receivable by c. $900m in 1Q23. This represents the majority of the $1.24bn of CFO and the 77% of FCF margin. As a result, PANW’s Rule of 40 for 1Q23 surged to 102%.

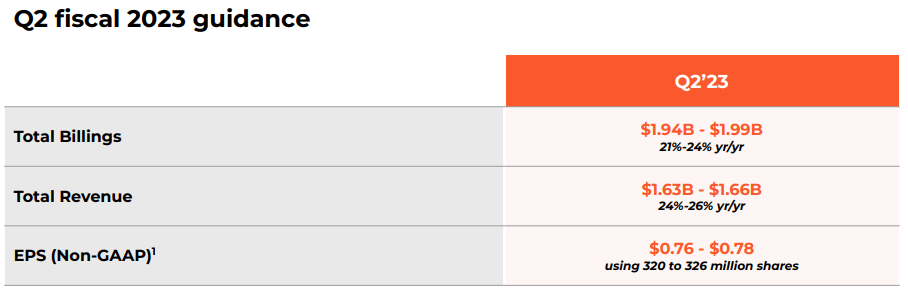

2Q23 and FY23 Guidance

2Q23 guidance indicates that management believe in the strength of the business going forward, despite the mounting economic challenges. For 2Q23, it is expected that PANW will generate 21%-24% of billings growth, 24%-26% of revenue growth, and $0.76-$0.78 of non-GAAP EPS. On a QoQ basis, the revenue guidance indicates an annualised QoQ growth rate of 21%, which shows that the low 3% QoQ growth in 1Q23 was largely a result of the strong 4Q22.

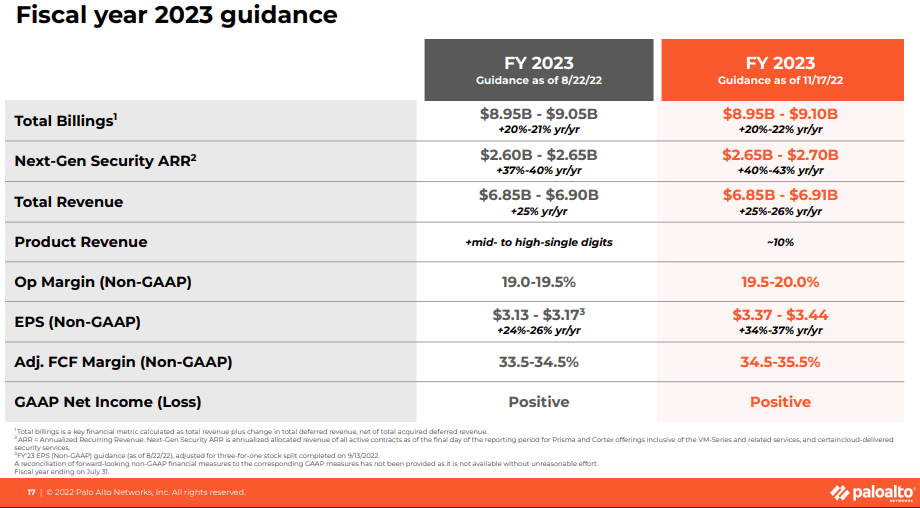

In the investor presentation, PANW showed how they’ve increased, albeit only slightly, their guidance for FY23, since the last guidance offered back in August 2022. Again, this exudes a lot of confidence in the execution ability of the business, because on one hand management are acknowledging the toughening economic climate, but on the other hand are increasing the guidance. Clearly, Arora and the leadership team believe that - with the balance of growth, cash flow, cash in the bank, and the PANW brand - the company can outcompete rivals amid an economic downturn.

The increase in expected product revenue growth is particularly insightful. It indicates that enterprises are becoming customers of PANW to embark on major transformations, led by their NGS portfolio, but because such customers have hybrid requirements, choosing PANW for appliance-based firewalls where needed also makes sense, especially for those that want to consolidate vendors. So, in essence, the success of the NGS division appears to be having positive knock-on effects for the product division.