Okta Deep Dive Refresh (Pt.3) & 1Q24 Update

Click the link to access the Google sheet supporting this report's analysis.

1Q24 Update

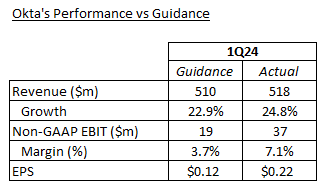

Positives from the 1Q24 ER are the beats on revenue, non-GAAP EBIT, and EPS guidance. Additionally, management raised FY24 revenue guidance by $18m, equating to a growth increase of 100 bps. However, investors have not reacted positively to the quarterly results. In the following day, the stock gapped down 20% to open at $74, and continued falling until it made a recovery slightly above the opening price but still down ~18%.

The market reaction was excessive because there were no surprises. Part of the reaction is due to the general excessive rebound of the broader market, whereby investors are pricing in expectations with little room for disappointment. But we also surmise that perhaps investors are noticing what we have, which is Okta’s non-current RPO (Remaining Performance Obligations), and its components non-current deferred revenue and non-current backlog (value of outstanding orders not yet invoiced) have entered negative growth territory. In other words, these balances are in decline, and this started in 4Q23 (one quarter after our last Okta ER update) as indicated in the following analysis (negative growth is in red).

The cause for the declining balances of non-current deferred revenue and backlog is partly attributed to Okta’s shortening average contract duration. Management do not disclose the average contract duration in every earnings call, but a few quarters ago it was ~3 years and in 1Q24 it was unveiled that it is now 2.5 years. Though, this is a small change in comparison to the growing divergence between current and non-current RPO, which makes one question the 2.5-year duration shared in the earnings call. Just by looking at the current RPO’s proportion of total RPO (about 60%), we can see that Okta’s obligations are skewed more toward those of 12 months or less, which would suggest the number should be much lower than 2.5 years. The counter to this suspicion is that the non-current RPO might include lots of extra-long duration (perhaps 3+ years) contracts; however, if this was the case you would expect the value to be higher to reflect this.

PANW’s and FTNT’s average contract duration has been consistently around 2.2 to 2.7 years and they have maintained RPO growth over 30%+. Given Okta’s sharp decline in RPO growth down to 9%, especially the non-current, for us it is hard to reconcile that with management’s submission of a 2.5-year average contract duration. All in all, this analysis makes us somewhat suspicious. While we appreciate Todd McKinnon’s leadership, he and his team have attempted to cover things up in the past (e.g., the misleading disclosures regarding the progress of Auth0 integration; the breach involving the Lapsus$ hacker incident). This is a risk investors ought to factor into their position in Okta.

As Okta has very small and declining non-current deferred revenue, and a backlog that is in decline, the company’s visibility beyond 12 months is limited. Right now, it is not in a position to provide longer-term guidance like it was doing before 2Q23. It had to scrap the longer-term guidance for FY26 in large part because they have radically less revenue beyond 12 months lined up than they did before.

To counter this, Okta needs to land larger deals spread across a longer period like PANW and FTNT are doing. If they do this, they will increase backlog and non-current deferred revenue >>> which increases non-current RPO >>> which provides longer-term revenue visibility >>> which helps management provide better guidance and avoid disgruntling investors with sharp downward revisions to growth.