Trump’s Trade Reset and the Hidden Tailwinds for Tech

Summary

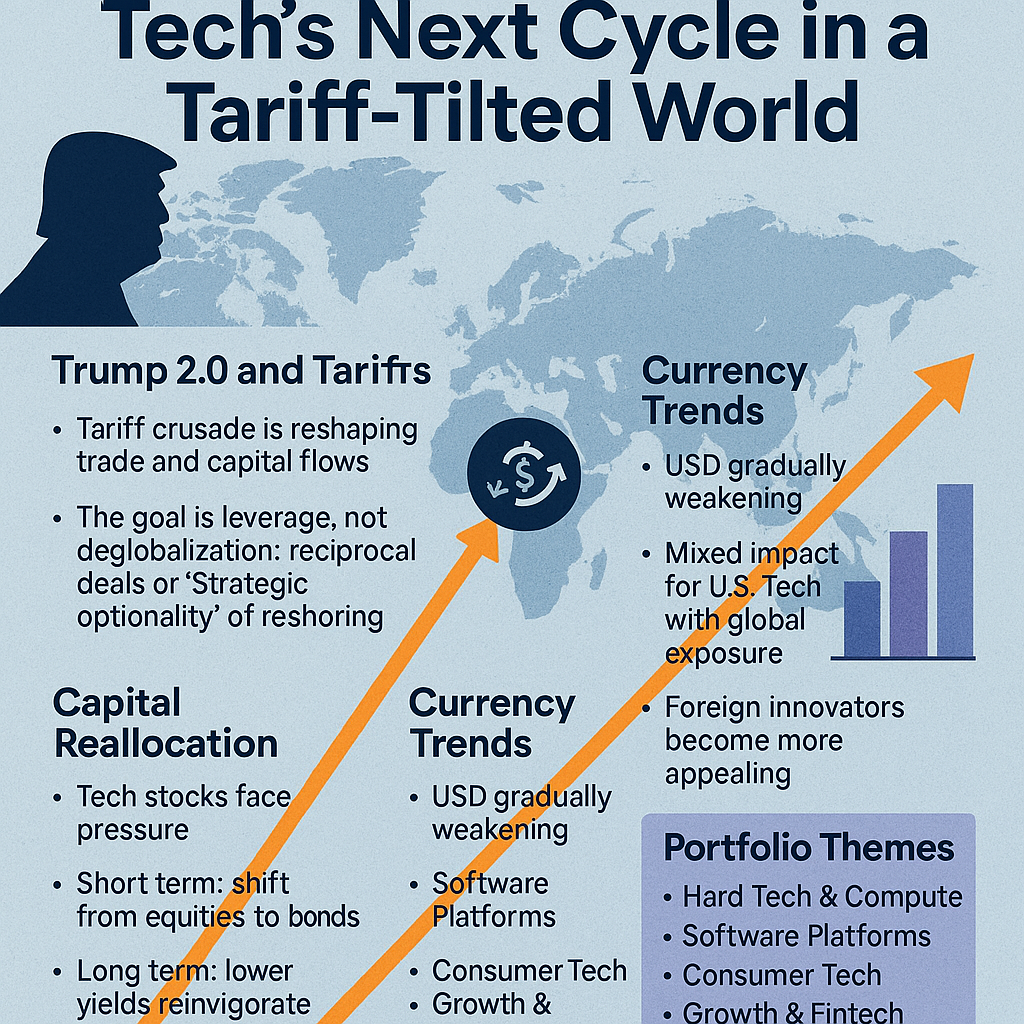

- Trump’s aggressive tariff agenda is creating strategic optionality for the U.S. — leverage for fair trade or a catalyst for reshoring.

- Bessent’s capital shift from equities to bonds may pressure tech in the short term but could lower yields and boost valuations long term.

- U.S. reindustrialization and deregulation are setting the stage for hardware-software convergence, with OT security and defense tech emerging as key themes.

Repricing the Global Order: Tech in the Age of Tariff Retaliation

As Trump 2.0 gains momentum, we’re witnessing the sharpest shift in U.S. trade posture in decades. Long-held grievances are finally being implemented. Trump’s tariff crusade is no longer political theater — it’s a full-scale effort to unwind lopsided trade deals made under the banner of diplomacy and post-war recovery.

For decades, Trump has argued that the US bears an unfair tariff burden. Countries like Kuwait, rebuilt with US protection, still impose steep duties on US exports while enjoying open access to American markets. But it’s not just about visible tariffs. Trump has also pointed to "shadow tariffs" — hidden costs in the form of non-tariff barriers. South Korea, for instance, imposes relatively low formal tariffs on U.S. beef but burdens it with food safety regulations and bureaucracy, effectively making U.S. beef prohibitively expensive for the average Korean household. These indirect measures are designed to protect domestic industries, functioning as de facto tariffs.