Convequity MSU: Unity - Dec 2023

Summary

- Unity is a game engine used by game developers for creating and rendering real-time 3D graphics. It generates revenue from game creation and advertising.

- Unity's new pricing structure has caused discontent among game developers and raised concerns about its future growth and profitability.

- We apply the MSU framework to discern whether or not there is upside potential in Unity's stock.

Unity - Quick Intro

What is Unity?

Unity is the creator of the Unity game engine. A game engine is the foundational building block for creating a game or rendering anything in the real-time 3D format. Essentially, it is the OS for real-time 3D graphics rendering. For simpler games, you can build your own or use open-source alternatives, but for complex and commercial games, a sophisticated and standardized game engine like Unity is a must. For old and established game studios, they may have their own engine and evolve it along the way. Also, they need invest heavily and upgrade it every year to make sure it is still cutting edge, which is very resource intensive.

Apart from the game creation that generates 1/3 of its revenue, Unity has 2/3 of revenue generated from game and mobile app operation, growth, and monetization. This is a natural extension of its core business as Unity got started as a simple mobile game engine, and most mobile games are freemium instead of traditional pay-to-play. As Unity owns the game engine, it has contextual information about a gamer's activity within the game, so it can provide better statistics for game developers on how to optimize the game and grow user hours and reduce churn rates. In recent years, Unity is also expanding into the adtech business whereby advertisers can better target their audiences with more contextual information while game developers can monetize their freemium games better. To supercharge this in-house development, Unity acquired Ironsource, which was the second largest player in the mobile adtech space, behind AppLovin (APP).

What is Unity's pricing model?

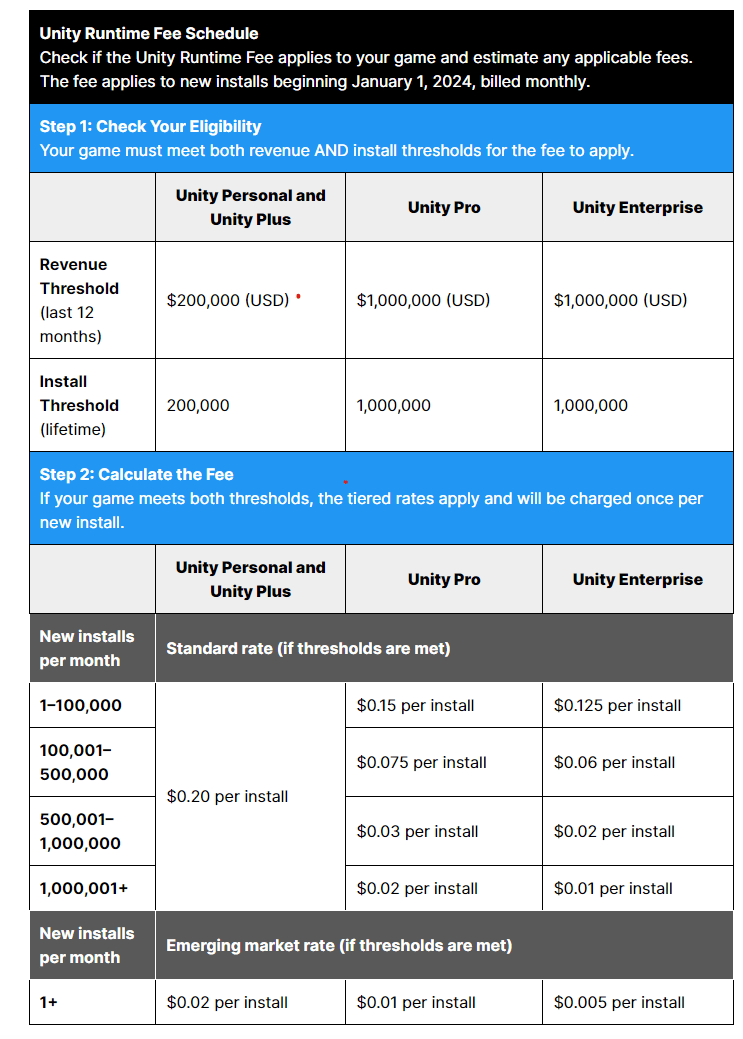

For the core game engine, Unity previously charged game studios based on the number of seats and plans they subscribe to. Starting from 2024, for new games built on Unity 6, Unity will charge an additional runtime fee of 2.5%, which is 2.5% of a game's revenue.

What happened in September?

In September 2023, Unity suddenly announced the new pricing plan without even talkinig to major customers for feedback. In the new pricing structure, Unity adds a new runtime fee structure, and a new fee structure based on the number of installations (i.e., installing the game following the download). The latter caused much discontent and confusion and game developers were infuriated because Unity didn't elaborate on how installation would be counted, and if repeated installation or fake installation is counted too. Unity also charges a punitive 20 cents per installation for personal plans after passing 200k installations, which could potentially increase the cost for small game developers dramatically.

Per Unity's plan, the installation fee is very likely to be served as a way to prevent game developers expecting to be successful from choosing the Personal plan and then having a highly successful game that receives a high number of installations. The new pricing is aimed at influencing developers to choose the Pro or Enterprise plan.

The 20 cents per installation is very illusive as most personally developed games don't reach 200k installations, and if so, the developer can easily upgrade to Pro or Enterprise plan to increase the threshold. But many developers are shocked by the 20 cents per installation charge, and with Unity's lousy communication, developers' fear, uncertainty, and doubt are rapidly brewing to the extent that it has started to damage Unity's reputation.

After the news and with only three months before the pricing structure comes into effect, developers were shocked and many signaled they intend to leave Unity and find alternatives. Unity was forced to forfeit the installation fee in a new blog post 10 days later without any further explanation, but the 2.5% runtime fee remains for new games after January 2024. Following this debacle, CEO John Riccitiello, who scaled up Unity from 2014 to 2023, quietly announced his early retirement, and Unity appointed a new chairman of the board and an interim CEO.

What's the Thesis

The long term thesis for Unity still holds, which is that 3D games will continue to penetrate into the broader gaming population, and more and more games will be based on Unity. Other promising growth catalysts are Unity's plans to expand and leverage its gaming engine to serve other markets requiring high-quality and real-time 3D graphics.

High-Level 12-point Overview of the MSU Application on Unity (U)

Following on from our introductory report to the MSU framework, we have amended the scoring system. M, S, and U will be given one of the following scores:

+++, ++, +, /, -, --, ---

The forward slash is a neutral view on the stock. +++ is the most bullish and --- is the most bearish.

For the Unity MSU, we make the following scores to compare and distinguish the three types of views:

M+, S/, U+

Here is a 12-point overview highlighting the key areas where our views (U) differ from the Market View (M) and Street View (S):

- Investor Base Perception:

- M: Notes a diverse investor base with varying levels of industry knowledge, contributing to stock volatility.

- U: Emphasizes strong mainstream investor support, including backing from prominent investment firms.

- Leadership and Management Perspectives:

- M: Perceives former CEO John Riccitiello negatively and is uncertain about new leadership.

- S: Generally aligned with Unity's management perspectives.

- U: Views current leadership (Roelof Botha, Jim Whitehurst) positively, highlighting their industry expertise.

- Unity's Competitive Position:

- M: Sees Unity's game engine as replaceable, with skepticism about its market position.

- S: Regards Unity as a formidable player in the game engine sector.

- U: Asserts a stronger-than-perceived market position, noting its widespread adoption, even among competitors.

- Pricing Structure and Monetization Strategies:

- M: Criticizes Unity's new pricing structure, anticipating backlash and skepticism about revenue growth.

- S: Not much evidence that suggests S has specifically addressed pricing strategies.

- U: Highlights the advantage of Unity's seat-based pricing model over competitors.

- Market Share Estimation:

- M & S: Views Unity as having a strong presence but is uncertain about its overall market share.

- U: Suggests Unity's market share is underestimated, especially in mobile gaming.

- Growth and Innovation:

- M & S: Expresses concerns about Unity's growth potential and strategic direction.

- U: Sees significant growth prospects, particularly in AR/VR, multi-platform gaming, and mobile gaming sectors.

- Challenges in Revenue Growth and Profitability:

- M: Concerned about challenges in growing revenue and improving profitability.

- S: Optimistic about Unity's ability to deliver operational efficiency.

- U: Recognizes challenges but sees potential in emerging technology areas and game engine market dynamics.

- AI Integration and Game Development:

- M & S: Do not specifically address AI's impact on game development.

- U: Highlights Unity's use of AI to democratize game development, making it accessible to less skilled developers.

- Competition from Platforms like Roblox and Fortnite:

- M & S: Do not appear to specifically address competition from these platforms.

- U: Acknowledges competition but emphasizes Unity's unique position and AI integration.

- IronSource Merger and Market Speculation:

- M: Speculates on potential M&A activities, including interest from AppLovin.

- S: Does not appear to specifically address the IronSource merger.

- U: Sees the IronSource merger as a strategic differentiator but acknowledges challenges in realizing synergies.

- Cultural Dynamics and Industry Challenges:

- M & S: Do not delve into the cultural aspects of game development.

- U: Highlights the unique cultural dynamics in game development, emphasizing the need to balance creativity with business considerations.

- John Riccitiello's Role and Perception:

- M: Views Riccitiello's tenure and comments negatively.

- S: Does not specifically address Riccitiello's role.

- U: Acknowledges controversies but emphasizes Riccitiello's passion and experience in gaming.

Now we'll dive into more detail across the MSU application to Unity.

M

Unity's stock price has experienced significant volatility in recent quarters, reflecting the diverse and sometimes conflicting views within the market. This volatility is partly attributable to the broad spectrum of retail investors who entered the market post-COVID. These investors range in sophistication and occasionally drive significant price fluctuations.

The investor base comprises various groups with differing levels of industry knowledge and interest:

- Gamers and General Retail Investors: This segment has a basic understanding of gaming as a leisure activity but limited insight into the gaming industry's intricacies. Their investment decisions may be more influenced by personal experiences with games rather than a deep understanding of the business aspects.

- Game Developers and Studio Employees: These individuals possess extensive knowledge about Unity's technology and its applications but may lack a comprehensive grasp of business management and financial aspects. Their perspective is often rooted in technical and user experience considerations.

- Pure Financial Investors: This group engages minimally with gaming as a pastime but possesses a broad, high-level understanding of the industry. However, their knowledge may lack depth in the nuances and technicalities that drive game development and the gaming market.

This diverse investor base contributes to the complexity of Unity's market performance, with each group bringing its unique set of priorities and understanding to investment decisions.

- Perceptions of Former CEO John Riccitiello: Many in the industry view former CEO, John Riccitiello's tenure, both at Unity and previously at Electronic Arts (EA), negatively. His leadership was marked by controversial decisions and comments, such as his harsh characterization of game developers, that alienated many gamers and developers. This sentiment toward Riccitiell is perceived as detrimental to Unity's success.

- Unity's New Pricing Structure: There's a widespread belief among stakeholders that the pricing structure Unity introduced in September was poorly conceived and likely to be unsuccessful. Concerns include potential backlash from the developer community and the structure's effectiveness in meeting Unity's strategic goals.

- Replaceability of Unity's Game Engine: A significant portion of the market perceives Unity's game engine as easily replaceable, despite a lack of strong alternatives currently available. This perception suggests a potential shift of users towards other engines like Unreal Engine (UE) by Epic Games or the open-source Godot engine.

- Future Challenges for Unity: The consensus is that Unity is likely to face considerable challenges in upcoming quarters. This outlook is influenced by recent corporate decisions and market trends.

- Recovery from Recent Setbacks: Recent market movements indicate that Unity's stock has recovered most of its losses since the September incident. This suggests that the market may have reassessed the long-term impact of the former CEO's tenure and other recent challenges.

- Views on Unity's Market Position: A minority opinion holds that Unity possesses a strong market position due to the significant investment in know-how and the steep learning curve associated with mastering its game engine. This perspective implies a certain degree of customer loyalty and barriers to switching to alternative platforms.

- Market Recognition of Unity's Strong Presence: Unity is widely recognized for its robust presence in innovative sectors such as mobile and VR/XR. Notably, following Apple's launch of Vision Pro, Unity experienced a significant surge in its stock value. This increase occurred despite Unity's weaker fundamental results, driven by investors anticipating gains from Unity's role as the exclusive engine partner for Vision Pro.

- Perceptions of Leadership Changes: There is a general lack of familiarity among market participants with Unity's new interim CEO, Jim Whitehurst, and Chairman of the Board, Roelof Botha. Despite this, the recent positive trend in Unity's stock price suggests that the market holds considerable confidence in the company's resilience and prospects, even after the challenges it faced internally and externally in September.

- Uncertainty Around Future Strategy and Product Roadmap: There is a widespread uncertainty regarding Unity's strategic direction and future product developments. However, the market's response indicates an optimistic view. Many investors seem to believe that the new management team will deliver improved performance and strategies in the upcoming quarters.

- Speculation on Potential M&A: A notable segment of investors speculates that Unity's new management might increase the likelihood of the company being involved in M&A activities. This speculation is partly influenced by Jim Whitehurst's recent advisory role with Silver Lake, a significant investment firm. As a result, the market appears to be valuing Unity not just on its current operations but also considering its potential attractiveness to strategic buyers.

- Acquisition Speculation with AppLovin (APP): There is ongoing speculation in the market that AppLovin might consider acquiring Unity. This speculation has been fueled by Unity's previous decision to decline an offer from APP in favor of pursuing the Ironsource acquisition. This situation highlights the strategic interest and potential synergies perceived by some in the industry between Unity and APP.

- Challenges in Unity's Revenue Growth: Aside the M&A considerations, many investors express concerns about Unity's potential to grow its revenue. Proposals to enhance monetization, such as implementing installation fees or runtime fees, are believed to risk alienating developers. This could lead to a significant departure of developers from Unity, thereby shrinking the customer base and increasing the dependency on a smaller pool of high-revenue clients. The proposed 2.5% runtime fee or revenue sharing model is also met with skepticism, with doubts about its ability to substantially boost revenue growth.

- Unity's Profitability Struggles and Management Change: The general sentiment is that Unity faces ongoing challenges in improving profitability. However, the introduction of new management has sparked optimism among a segment of investors. This change at the helm is seen as a possible catalyst for strategic and operational improvements that could enhance Unity's financial performance in the future.