Updates - Okta 3Q23

Summary

- Okta is back on track, executing well amid a toughening macro climate.

- The Auth0 sales integration issues appear to have been largely resolved.

- Management’s guidance is very cautious – just 16% growth for the next fiscal year of FY24.

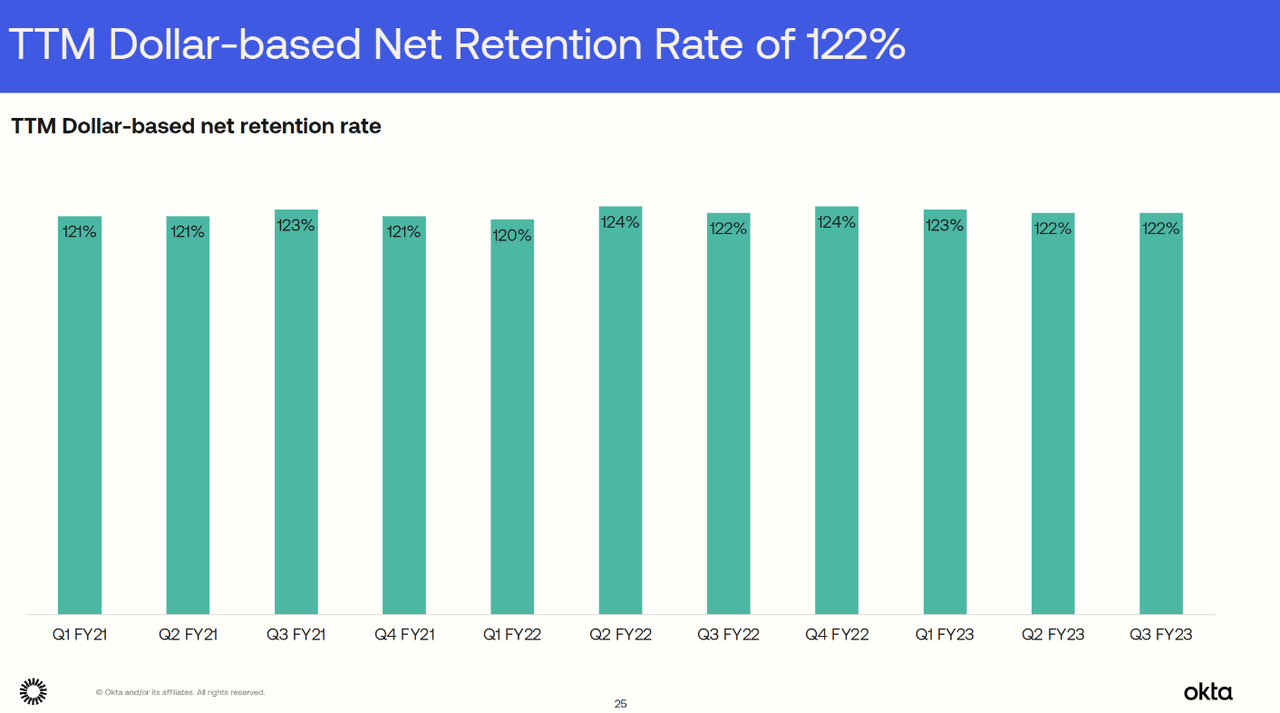

- Given Okta’s current DBNR, this suggests there would need to be no new logos to arrive at this growth rate - which seems very unlikely.

- Given the current price of c. $64, the market believes Okta won't ever reaccelerate growth back above 20%. In essence, our thesis is based on growth reaccelerating post FY24.

Audio Preview:

3Q23 Review & Financial Trends

Okta exceeded analyst expectations for 3Q23 revenue growth and EPS by 3.4% and 6.4%, respectively. This was the primary contributor to the c. 20% gap up following the release of the 3Q23 results. YoY and annualised QoQ growth were 33% and 26%, which is very solid considering the revenue level and the economic climate. Many other leading SaaS firms have experienced their QoQ growth almost flatline, so Okta’s ability to generate such a level of quarterly growth amid the macro headwinds is an indicator that the business is getting back on track with its execution. The stock rally abated, however, as investors digested the annualised QoQ growth for 4Q23 of just 7% and the FY24 (fiscal year ending 31st Jan 2024) revenue growth guidance of just 16%.

Okta has made significant progress in overcoming the Auth0 integration challenges. In the previous 2Q23 earnings call, it was communicated that there had been sales headwinds pertaining to overlap between Okta’s and Auth0’s products. Sales reps had been directed to sell the complete Okta + Auth0 solution and there was confusion as to which decision-makers the sales reps ought to be targeting for the different solutions.

This confusion has now been cleared up thanks to Okta’s new strategy of having two clouds – one for Workforce Identity, and the other for Customer Identity. Okta’s annual Oktane event Oktane event, did a great job at explaining the differences between the Workforce Identity and Customer Identity and how the two will interoperate with one another. The new GTM will help sales reps and customers better understand the value proposition of each platform, and how the value can compound if they are used together.

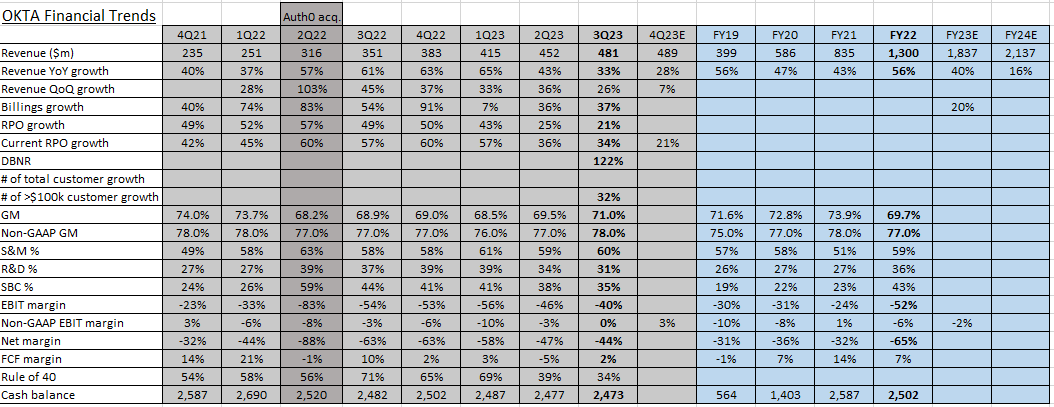

For a closer look at the following table click the link to go to the Google Sheets showing Okta's DCF valuation (discussed in later section) and the financial trends.

Growth for revenue, billings, RPO, and number of customers, have each trended downwards over the past few quarters. Some of this is due to the Auth0 integration issues; some of it is attributed to the deteriorating macro conditions; and some of it is attributed to the natural deceleration of growth as a company surpasses the $1bn revenue mark. However, over the long-term, given the c. $80bn TAM of the identity market along with Okta’s refined strategy, we think Okta can generate a CAGR of 20% to 25% during the next few years.

For the first time, Okta has reached break even from a non-GAAP EBIT perspective. Continued improvements in gross margin and R&D % have contributed to this milestone. Management expects the momentum in profitability to continue and for Okta to increase non-GAAP EBIT to 3% in 4Q23. And indeed, if growth has decelerated to below 30% going forward, investors will be expecting to see evidence of a convincing path to profitability. In the past two quarters, Okta’s Rule of 40 has slipped below the 40% standard for BoB SaaS companies, attributed to the slowdown in growth. Hence, to not lose further interest from investors, we think Okta will need to make up for it with better operating leverage, thus leading to higher FCF margin and EBIT margins.

The expected annualised QoQ growth for 4Q23 of just 7% indicates Okta sees toughening conditions ahead in the intermediate-term. Though, this growth is greater than what was previously factored in to Okta’s FY23 guidance, increasing expected FY23 revenue by $21m. This would take FY23 revenue to $1837m at 40% growth. Management also increased the guidance for non-GAAP EBIT margin for FY23 from -6% to -2%. Management extended their guidance to include a preliminary revenue estimate for FY24. They told analysts they have a conservative estimate of just 16% growth, after taking into account their belief that the economy will get worse before it gets better. It’s not difficult to infer that this is an extremely cautious guidance. With a DBNR of 122% and a gross churn of ~ 95%, to get to 16% growth would mean that Okta does not to win any new logos during FY24 [122% - (100% - 95%) = 17%].

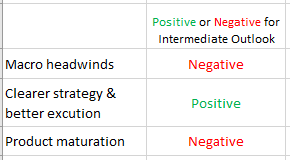

It certainly looks as though the next couple of quarters are going to be challenging to Okta from a macro perspective. But some of the macro headwinds are being offset with a clearer strategy and GTM. Though we surmise that much of management’s intermediate-term cautiousness also comes from Okta’s IGA (Identity, Governance, & Administration) and PAM (Privileged Access Management) solutions within its Workforce Identity Cloud needing a couple more quarters to mature. The same goes for the CIAM solution in the Customer Identity Cloud.

When IGA, PAM, and CIAM fully mature and integrate with the broader Okta platform, Okta is going to significantly extend its leadership in the identity space and its very possible durable growth of 20%+ will prevail over the longer term.

SBC % has been trending downwards, reaching 35% in 3Q23, however, this is still very high and poses as a headwind for investors. You can see in the financial trends table above, in 4Q21 and 1Q22, prior to the Auth0 acquisition, Okta’s SBC % was 24% and 26%. Okta’s $6.5bn acquisition of Auth0 in May 2021, was financed almost entirely with stock, and there is sizeable incentive component whereby more stock will be paid upon certain business performance milestones being met.