Updates: Confluent - Investors Are Betting On Agentic AI Too Early

Summary

- Confluent's 3Q24 results exceeded expectations, with 26% annualized QoQ growth, improved EBIT and FCF margins, and raised full-year guidance, signaling potential growth reacceleration.

- Management's strategic acquisitions of Immerock and Warpstream highlight CFLT's agility and vision, positioning it to compete effectively in the real-time data space.

- Despite competitive pressures from Redpanda, CFLT's pivot to BYOC and focus on stream processing and analytics could expand its addressable market significantly by FY25.

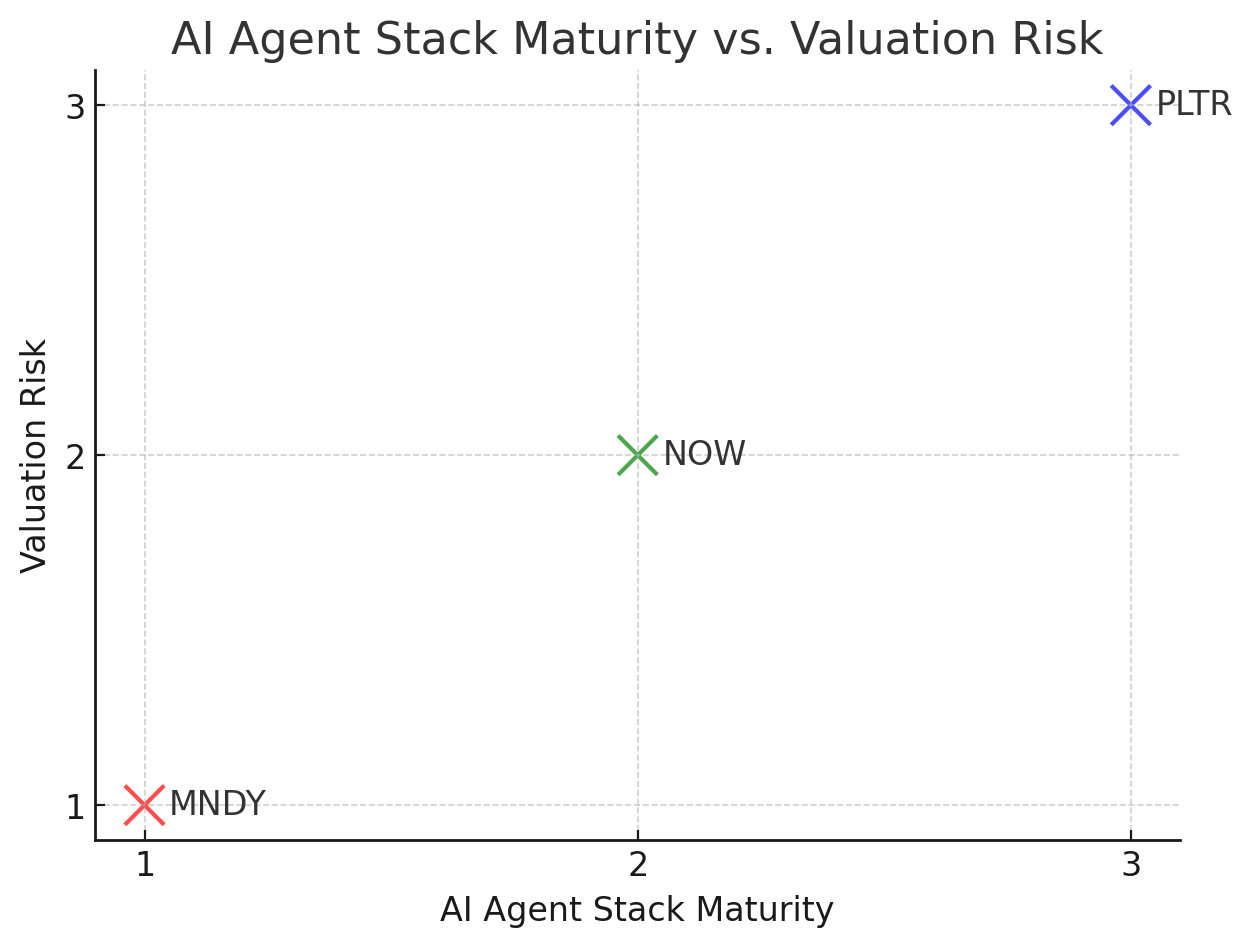

- While CFLT's GenAI potential is promising, immediate growth will depend on traditional applications, with long-term gains tied to the maturation of AI agent technology.

Confluent's (CFLT) 3Q24 results positively surprised investors. Annualized QoQ growth stands at 26%, largely driven by one-off large deals, including significant DSP agreements. Non-GAAP EBIT margin improved by 1,200bps to 6.3%, while the FCF margin rose by 1,070bps to 6%. However, the standout was management’s tone and the raised full-year guidance. They indicated that most cloud optimization efforts have concluded, positioning CFLT to reaccelerate growth, following a recovery trajectory similar to that of the hyperscalers in the coming quarters. This aligns with the longer time customers typically require to optimize spending on the upper tech stack compared to underlying IaaS.

Management also expressed optimism about CFLT's GenAI potential, emphasizing stream processing as a critical enabler for real-time GenAI applications and retrieval-augmented generation (RAG). Additionally, sentiment has been buoyed by expectations of a strong FY25, as major product releases from the past 1.5 years are set to reach GA and drive monetization next year.

Impressive Vision and Day-1 DNA of Leadership

What stands out most to us is CFLT management's ability to craft a robust roadmap with a clear and compelling vision. They consistently stay ahead of the curve, competing effectively with the brightest and most innovative startups in the field — an uncommon feat within the SaaS cohort. In our view, only a select few, like PANW, exhibit a comparable level of 'Day 1' DNA.