Updates: Monday - Tons Of Alpha, 3Q24 Review & Platform Deep Dive

Summary

- Monday continues to deliver solid performance at both the top and bottom lines.

- In this update, we revisit MNDY's core competitive edge, progress in its four product categories and discuss its AI development.

- We also discuss the prospect of MNDY becoming a system of record, or SOR, and how mondayDB will play a key role in realizing this vision.

- We also speculate on MNDY's role in a future of agentic AI. This combined with the prospect of MNDY becoming a SOR offers substantial potential alpha for long-term investors.

- Lastly, we discuss MNDY's valuation and share an updated DCF model.

3Q24 Update

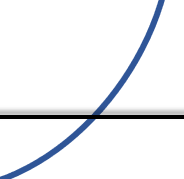

monday.com (MNDY) delivered solid 3Q24 results, reporting revenue of $251m (+33% YoY), exceeding expectations, as management's guidance was $245m (+29.5% YoY). The company achieved a 90% non-GAAP gross margin and $82m in FCF, representing 33% of revenue. Non-GAAP EBIT of $32.2m (12.8% margin) came in considerably higher than guidance of $21m (8.5% margin), and grew 33.6% YoY.

Notably, enterprise traction continues to strengthen, with a 40% YoY increase in $50k+ ARR customers (to 2,907) and a 44% YoY increase in $100k+ ARR customers (to 1,080). Enterprise penetration is really the key for MNDY's future growth, as it is with pretty much all SaaS companies that surpass $1bn in revenue, so this progress is positive for long-term investors. NDR for $50k+ ARR customers reached 115%, up from 114% in prior quarters, supported by the price increase implemented earlier in the year, which has thus far contributed $30m in incremental revenue and is expected to deliver $80m by FY26. Apparently, the price increase has filtered out lower-quality customers (small teams with small budgets), which should result in more efficiency in MNDY's efforts to expand sales with existing customers.

MNDY guided for FY24 revenue of $966m, reflecting 32% growth at the midpoint, and maintained its expectation of a 12.5% non-GAAP EBIT margin and 30% FCF margin for the full year. However, the company anticipates 4Q24 growth of 28.5%, signaling a slight deceleration. Management cited stable demand but noted some “choppiness” in specific market segments.

Leadership changes at MNDY should add a degree of uncertainty for investors. MNDY has recruited Adi Dar to fulfill the new COO role, and is also in a global search for a candidate to replace CRO Yoni Osherov, who has decided to depart after eight years at the company and two years as CRO. Despite the Co-CEO's (Roy Mann and Eran Zinman) confidence in their ability to manage the transition effectively, the mix of leadership changes and an influx of new personnel, as MNDY plans to ramp up its sales force in 4Q24 and FY25, could cause some instability, in our opinion.

Generally, investors should always be cautious when a company's management shows too much confidence in such a leadership-level upheaval. We've seen this play out previously with Okta after they acquired Auth0. Todd McKinnon was too optimistic with the sales org integration of the two entities and didn't fully appreciate the challenges of combining Okta, a top-down GTM vendor, with Auth0, a bottom-up GTM vendor. As a result of McKinnon's limited understanding of the sales integration challenges, Okta experienced a sharp growth deceleration. Indeed, MNDY doesn't have the M&A complication right now, but nonetheless, the outcomes of such leadership and sales org disruptions can be hard to envisage and lead to disappointment, at least in the interim.

While we’ve outlined our concerns about the leadership revamp, an alternative perspective is that the risks might be mitigated by MNDY's current transition from a product-led, bottom-up GTM approach to incorporating a more enterprise-focused, high-touch, top-down GTM strategy. If MNDY were already an entrenched enterprise staple, like Zscaler, the leadership changes would likely pose a greater risk.

Why Work Management Platforms Are Popular

The rise of work management platforms like MNDY represents the next phase of organizational coordination. In the 1900s, the companies adding the most incremental value to society were manufacturers and industrial businesses, and hence they relied on Scientific Management, which emphasized predefined processes, as every job was expected to be carried out in a specific way (e.g., the assembly line). However, as industries shifted toward knowledge work, services, and software, flexibility and adaptability became crucial. As a knowledge worker, you are likely to encounter different projects which require a different approach, and hence you need a large degree of discretion for deciding the optimal way to conduct a series of tasks. Following a narrowly defined series of steps will be too stifling and ineffective for most knowledge workers.

OKR (Objectives & Key Results), introduced by Intel in the 1970s, became a more suitable management philosophy that replaced Scientific Management. The broad idea of OKR is that clear objectives are set for projects, and there are predefined metrics to measure the progress toward such objectives, though the means and paths to achieve the objectives are at the discretion of the employees. However, as a company, if you are giving freedom to employees on how to progress toward an objective, you need to give them means to coordinate. Otherwise, each employee will be moving along their own path and not be in harmony with others working on the project. Hence, the success of OKR hinges on the use of effective coordination tools.

Since the 2000s, big tech names like Google and Meta have been highly successful with their implementations of OKR, in large part, because they have the skills to create internal software for project coordination. However, most other enterprises have struggled with Outlook, Word, Excel, and Sharepoint for task and project management, knowledge sharing, creating Gantt charts, calendar visualizations, etc., and other forms of coordination. You can create some pretty sophisticated workflows within and among these Microsoft tools for helping groups of workers coordinate, but the learning curve is very steep and not intuitive most of the time.

Companies like MNDY, ASAN, and Airtable have emerged to replace these legacy modes of coordination, driving the next wave of digitization by creating substantial incremental value. If Word marked the 1.0 era of digitization by transitioning paper-based workflows to digital text, and Excel represented the 2.0 era with its advanced data manipulation and automation capabilities, then platforms like MNDY, ASAN, and Airtable are pioneering the 3.0 digitization era. This era is defined by intuitive, customizable tools that empower both technical and non-technical users to streamline workflows, build applications, and manage complex processes without requiring coding expertise.

MNDY, in particular, stands out, not only by addressing high-level coordination, but also low-level process automation. This is one of MNDY's key differentiators and has laid the foundation for the vendor to create distinct SKUs within its broad-based work management platform (e.g., monday CRM, monday Dev, etc.). Interestingly, this low-level process focus circles back to Scientific Management in some regards, because while knowledge workers need freedom, ultimately there are still many commodtized tasks that can benefit from a specific series of steps that get repeated. The key difference is that MNDY empowers workers to create these narrowly defined processes themselves, to suit theirs and their teams' workflows.

Revisiting MNDY’s Edge

MNDY’s competitive advantage lies in its ability to balance simplicity with flexibility. Most players in the work management space are positioned as a simple but rigid off-the-shelf solution (suitable for SMBs), or as a highly customizable but complex solution (suitable for enterprises). MNDY has positioned itself in a sweet spot, making its platform both simple/off-the-shelf and highly customizable, in large part thanks to its no-code/low-code functionality.

Additionally, MNDY’s strategy of targeting low-level processes has created opportunities to develop tailored SKUs, such as monday CRM, monday Dev, and the upcoming monday Service (currently in beta and scheduled for GA end of the year or Jan-25). These SKUs enable MNDY to enter new markets and create multiple touch points in the marketing funnel. In contrast, MNDY's competitors, such as ASAN and ClickUp, offer just a single generic work management platform, which appears to be a suboptimal approach for maximizing market engagement.

MNDY’s Products: Breadth, Depth, and Enterprise Appeal

MNDY’s product suite and key competitors:

- monday Work Management: The core platform for collaboration and coordination, featuring Gantt charts, Kanban boards, and robust automation tools. Key rivals include Asana (ASAN), Smartsheet (SMAR), ClickUp, and Airtable.

- monday CRM: Built to support sales and marketing teams, with integrations like Gmail and Zoom, and plans to add native phone call capabilities. Key rivals include HubSpot (HUBS) and Salesforce (CRM).

- monday Dev: A tool for aligning DevOps with business functions, emphasizing high-level coordination over direct competition with CI/CD platforms. Key rivals include Atlassian (TEAM) and to a lesser extent GitLab (GTLB).

- monday Service (launching late 2024 or early 2025): Targeting ITSM, this product will integrate seamlessly with other MNDY offerings, bridging IT with other departments. Key rivals include TEAM and ServiceNow (NOW).