Updates: Netskope - Data-Centric Approach To Cybersecurity (Pt.1)

Summary

- In this Part 1 of Updates, we discuss Netskope's data-centric approach to cybersecurity and how it appears to be providing a competitive edge versus other SASE rivals.

- In Part 2, which will be published in two days, we compare Netskope's NewEdge global network and make detailed comparisons to Palo Alto Networks, Zscaler, and Cloudflare.

- Send us an email at service@convequity.com if you have any queries.

Overview

Year founded: Netskope was founded in 2012 by Sanjay Beri (CEO), Krishna Narayanaswamy (CTO), Ravi Ithal, and Lebin Cheng.

Number of employees: ~3,000 employees.

Markets: Netskope was originally a pure-play CASB vendor, but has since expanded into broader cloud security and network security. Now the company serves SASE (including CASB, SWG, ZTNA + SD-WAN) and cloud security niche markets like SSPM and CSPM.

Customers: Most customers are large enterprises – Netskope claim to have 30% of the Fortune 100 as customers. Overall, the company states to have ~3,400 customers.

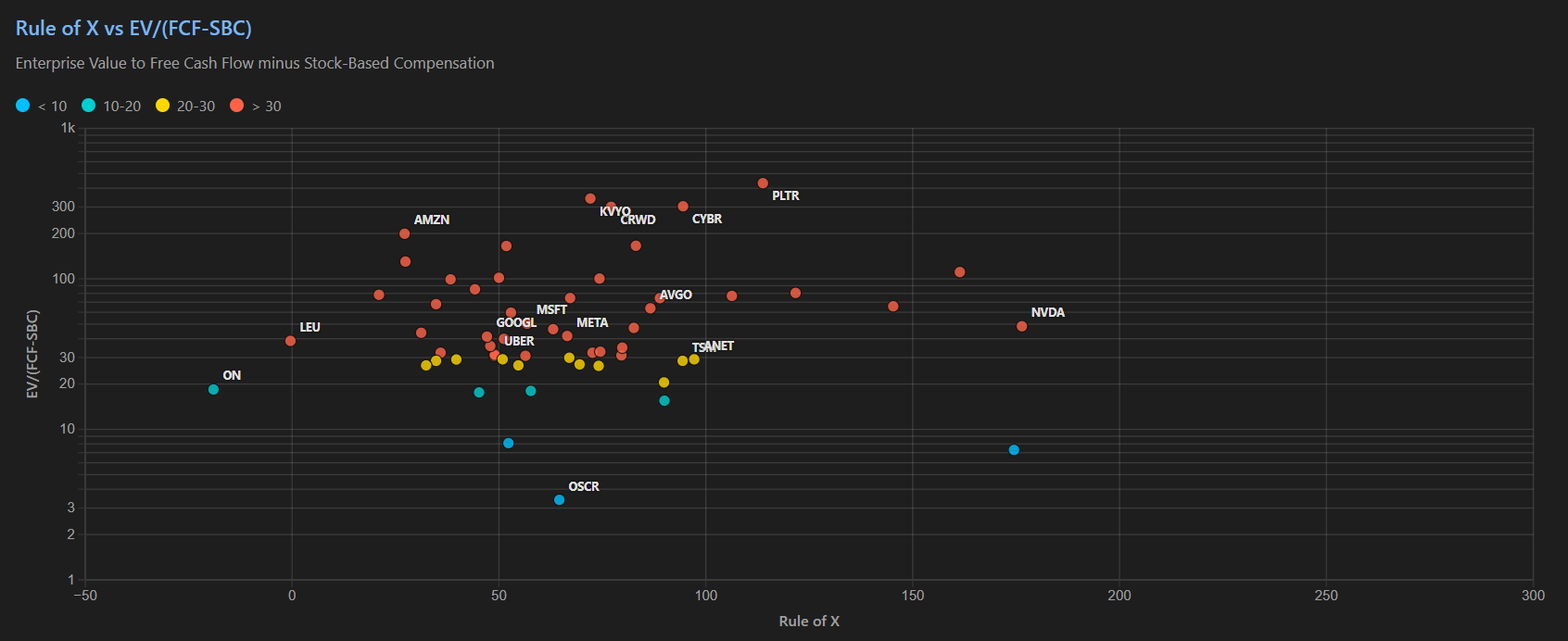

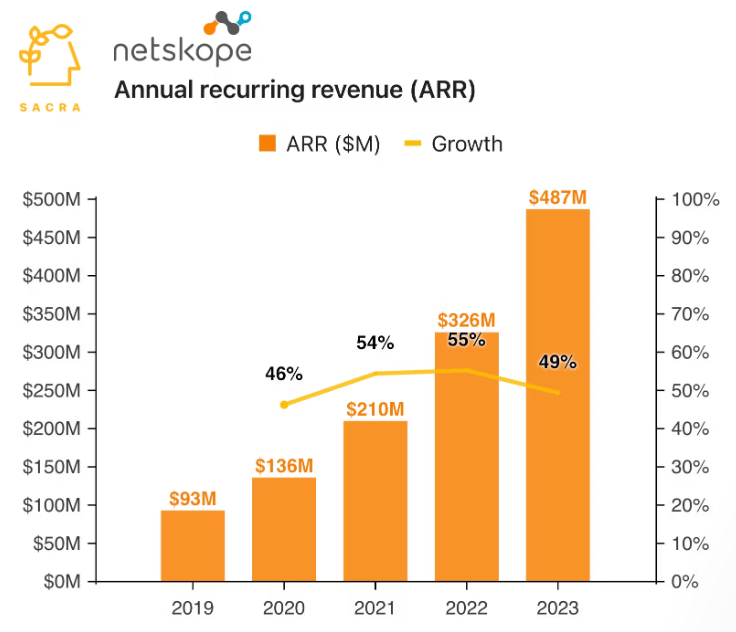

Revenue: Earlier in the year Netskope unveiled that they had surpassed $500m in ARR. Here are historical ARR estimates by Sacra.

Competitors: Main SASE competition is Zscaler and Palo Alto Networks. In the space of cloud security there is some overlap competition with Zscaler, Palo Alto Networks, and Wiz on the CASB, SSPM and CSPM side.

Funding: Netskope has raised a total of $1.44bn over 9 rounds. In the July-21 Series H, they received $300m, which was led by ICONIQ Growth with participation from other previous major investors such as Lightspeed Venture Partners, Accel, Sequoia Capital Global Equities, Base Partners, and Sapphire Ventures. In Jan-23 Series I, they raised $400m via a convertible note.

Valuation & Thoughts: The latest secondary price at ~$12 equates to roughly a $4.4bn market cap. This equates to a P/ARR of 8.8x. Obviously, at these levels, Netskope is not hyped like Wiz is at the moment, with the recent Google bid of $23bn indicating a ~60x P/ARR or EV/ARR. It seems the cybersecurity names with higher (sales) multiples at present or the ones who investors believe have the strongest cloud security future. For instance, PANW, CRWD (even after its recent turmoil), and ZS have EV/S of ~12-15x, while players perceived with less of a cloud security foothold are trading around 7-8x, such as FTNT and S. Netskope appears to be in the latter bucket, which is interesting and potentially contains a bunch of alpha for when they eventually become a public company, because they actually have tons of native cloud security knowhow. It is just that they have evidently made the decision to market themselves primarily as a SASE provider, somewhat putting their cloud security repertoire on the backburner.

When Netskope does submit its S-1 ready for its IPO, we think high gross margins will be revealed, similar to ZS, at the high 70s level. Like ZS, all of Netskope's networking infrastructure is dedicated for SASE and other enterprise networking traffic, meaning gross margins should be higher than NET's (around 75%), which is mostly lower margin CDN traffic. When you consider terminal cash flow and profitability potential derived from such gross margin combined with the current 30%+ growth, the current multiples look attractive, even offering some post-IPO exit profit for VC investors before becoming expensive for public investors. What may drag on the valuation post IPO is the possibly high S&M expenses, as after all, Netskope is operating in SASE which is a replacement market, necessitating the need for aggressive GTM. This is different to Wiz who is operating in primarily a greenfield market, and hence may have the luxury of reducing S&M expenses relative to revenue sooner than what Netskope will be able to do.

Netskope is trailing PANW and ZS in SASE market share but the company has significant advantages against both of them, as we'll discuss in this Updates report. And if it can solidify market leadership in such a high entry barrier market, the vendor will be a good investment for long-term investors.

Intro

Netskope, founded in 2012, emerged as a category-defining vendor in the Cloud Access Security Broker (CASB) market. As SaaS adoption surged in the 2010s, Netskope's CASB solution addressed the critical need for governing application access and user actions within SaaS environments, with a particular focus on preventing unauthorized downloading of sensitive data. The company distinguished itself through comprehensive capabilities, a market-leading DLP (Data Loss Prevention) solution, and broad coverage of SaaS applications.