Updates: Palo Alto Networks 1Q25 - Reacceleration Continues (Pt.1)

Summary

- Palo Alto Networks (PANW) faced volatility in 2024 but showcased resilience and strong growth potential through its bold platformization strategy, led by CEO Nikesh Arora.

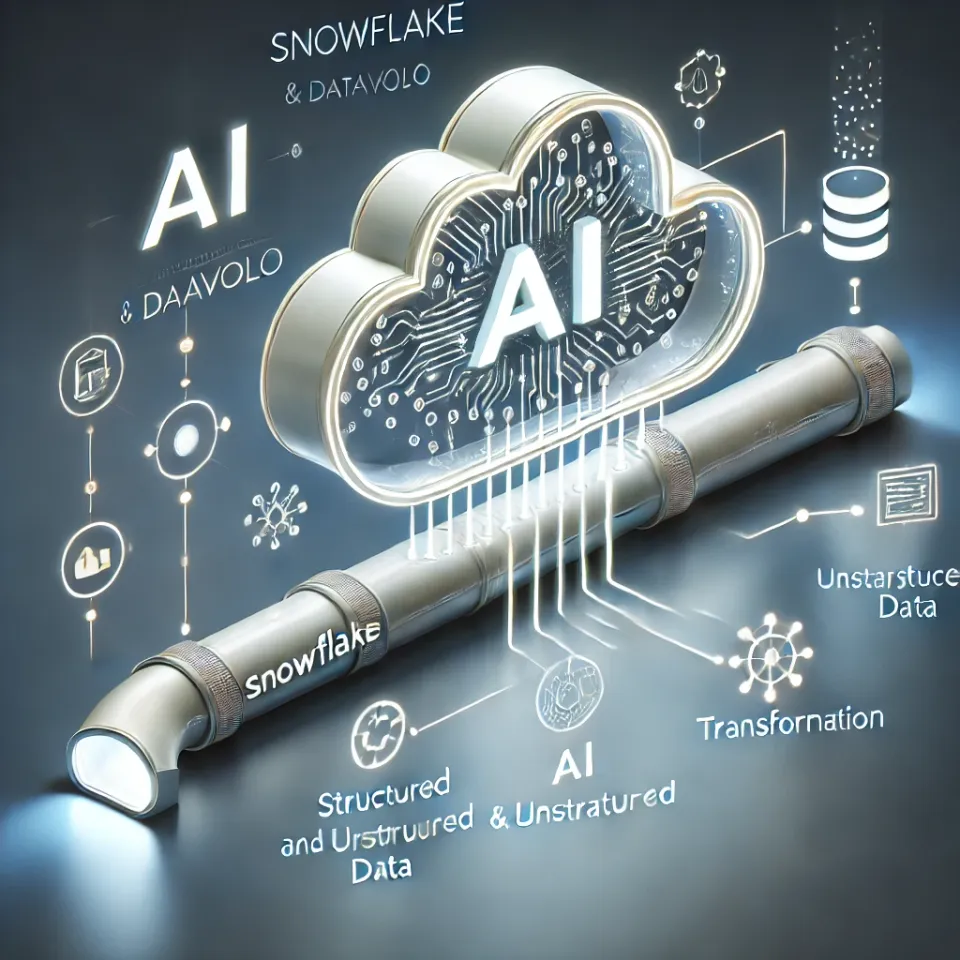

- Despite initial investor concerns, PANW's focus on its platformization strategy and substantial growth in NGS ARR and service revenue positions it for long-term success.

- PANW's strategic shift towards in-house innovation and reduced M&A activity, combined with strong financial metrics, indicates a promising future with potential for high shareholder returns.

- With significant strides in platform deals and enterprise contracts, PANW is poised to dominate the cybersecurity market, mirroring the growth trajectory of tech giants like ServiceNow.

- Part 1 discusses the 1Q25 results and general thoughts. In Part 2 we shall dive into a deeper discussion on each of PANW's divisions.

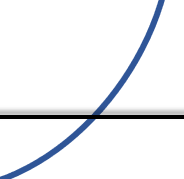

Palo Alto Networks (PANW) experienced a tumultuous journey in 2024. At the start of the year, we viewed PANW's valuation as somewhat stretched. The company had delivered strong execution over several quarters, and the market had gradually come to recognize its potential, as we had anticipated. This led to PANW receiving increased attention in mainstream financial discussions. As a result, a broader set of less knowledgeable investors became familiar with the stock, fueling a strong rally in 2023 that transitioned into a more gradual "melt-up." However, by early 2024, the potential for significant alpha generation seemed to be waning, leaving most future returns closely aligned with broader market trends.

The 2Q24 earnings report (ER) was a wake-up call for investors who had priced PANW as a mature, large-cap cybersecurity play entering a phase of stable growth and margin expansion — much like the trajectory of other tech giants in recent years. Instead, CEO Nikesh Arora charted a bolder course, doubling down on platformization, signaling that PANW still had substantial growth opportunities ahead.

For long-term PANW investors familiar with Arora's strategy since 2018, this ambition was unsurprising. However, for a newer cohort of investors seeking stability and wary of risks, this shift was unsettling. Fundamentally, though, we believe Arora's vision is both sound and exceptional. The resulting dip in PANW’s share price presented a prime opportunity for intelligent investors to capitalize on the market’s overreaction.

As anticipated, after a brief period of consolidation, PANW shares resumed their upward trajectory. Subsequent earnings calls highlighted early indicators of progress in platformization, providing greater visibility and boosting investor confidence. By the 4Q24 ER, PANW had almost fully recovered from the losses incurred after 2Q24, demonstrating the resilience of its strategy.

Now, with the recent turbulence fading into hindsight, the key question is: What’s next for PANW?