Updates: Palo Alto Networks 1Q25 - Reacceleration Continues (Pt.2)

Summary

- PANW's strategic acquisitions and innovative product launches, especially in SASE and cloud security, position it as a leader in the cybersecurity market.

- The IBM Qradar acquisition and partnership is a smart deal that enhances PANW's market reach, leveraging IBM's consulting arm to drive adoption of PANW's products.

- PANW's focus on AI security and real-time threat mitigation, coupled with its strong S&M execution, reinforces its competitive edge and market leadership.

- Valuation suggests PANW is in the fair value range, with significant upside potential if Arora's platformization strategy continues to progress.

Product Fundamentals

Network Security - Strata & Prisma SASE

In the 1Q25 earnings call, Nikesh Arora said: "We're clearly leaders in the network traffic part. As we talked about, 70% of our use case is now public-facing cloud service provider traffic. We are still one of the leaders in the CNAPP space from our early start in Prisma Cloud. But what I think is going to happen in the next few years, this market is going to shift more and more towards the real-time security side on cloud, which is where CDR, cloud SOC, XSIAM become more and more important. So almost every one of our XSIAM deals, there is a portion of that, that is deployed toward cloud security now. And having that data together allows us to prioritize all the configuration issues and separate again signal from noise."

Across its three major playing fields, Palo Alto Networks (PANW) has executed exceptionally well, leveraging the momentum of several successful product launches.

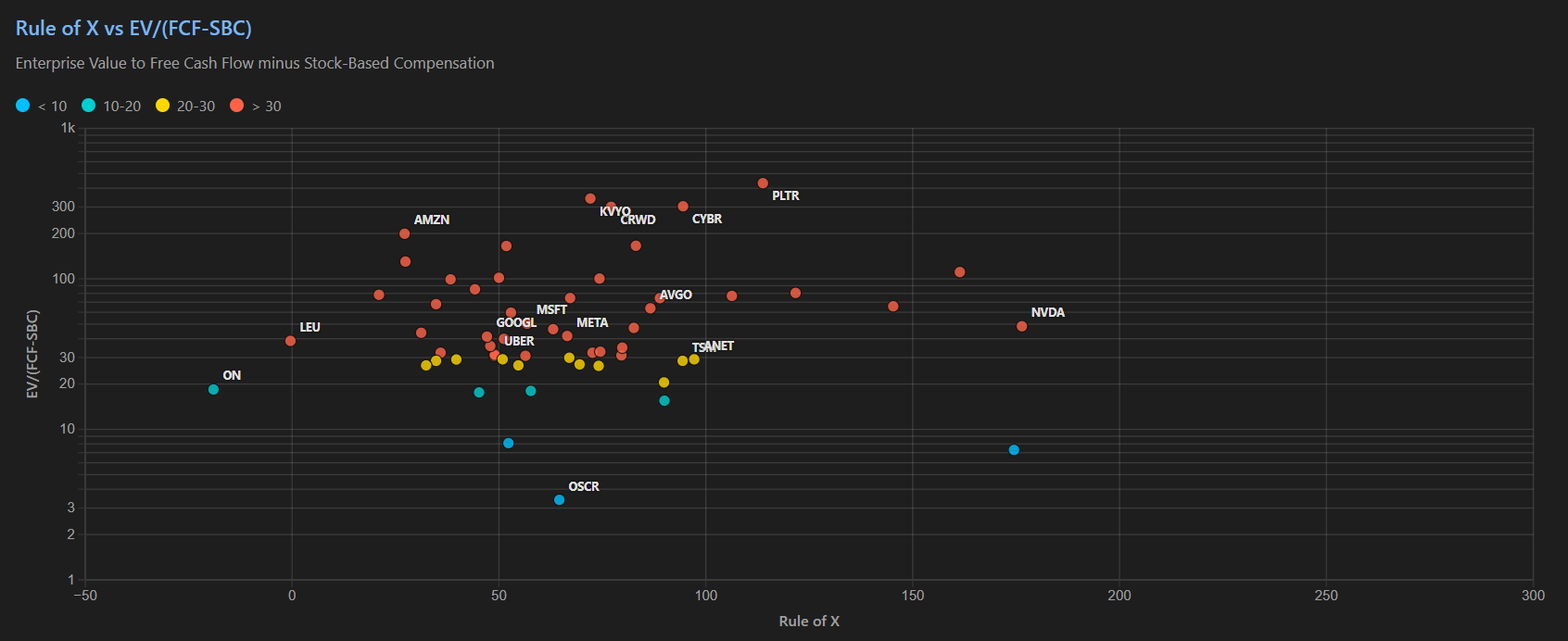

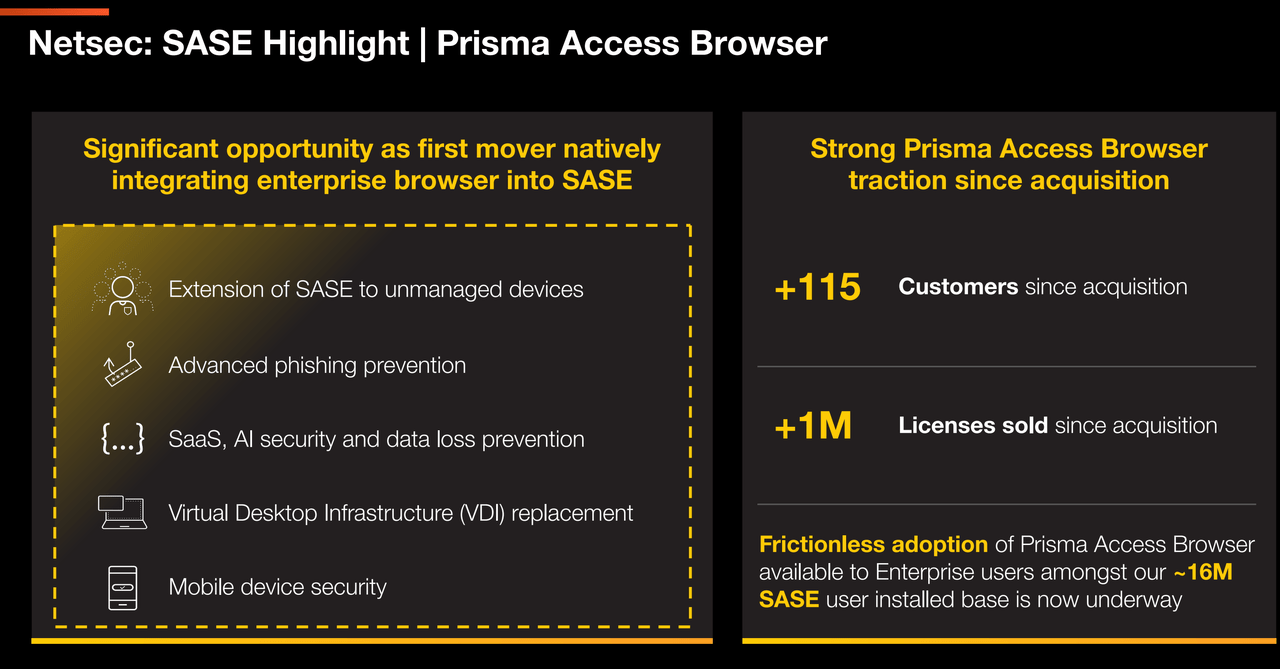

SASE has been the largest growth driver for NGS, now contributing over 60% of the NGS business. PANW has consistently identified key trends ahead of the competition, including secure browser capabilities, data security, and secure AI usage. Notably, 40% of Prisma SASE customers are entirely new to PANW, a significant distinction from its competitors.

This trend is also evident in PANW’s cloud security business, underscoring its strategic focus on capturing new customers rather than solely relying on cross-selling to existing ones. By ensuring that these NGS products attract non-PANW customers, the company demonstrates their competitive edge. Moreover, it signals that the GMs managing these offerings are prioritizing customer feedback and staying attuned to market developments, including competitor moves and emerging startups.

We view this approach as superior to CRWD’s strategy, which often hinges on cross-selling "good enough" products to its existing customer base, rather than driving new customer acquisition through competitive differentiation.

The acquisition of Talon Security, now integrated as Prisma Access Browser, exemplifies PANW’s commitment to leading, not merely competing, in emerging markets. Prisma SASE aims to be the best in class, establishing defensible moats that competitors struggle to replicate, rather than simply catching up to market standards and upselling to PANW’s existing firewall customers. As we’ve highlighted in previous analyses, secured browsers represent a significant growth market. PANW’s foresight in targeting this space early and acquiring one of its top players underscores its strategic acumen.